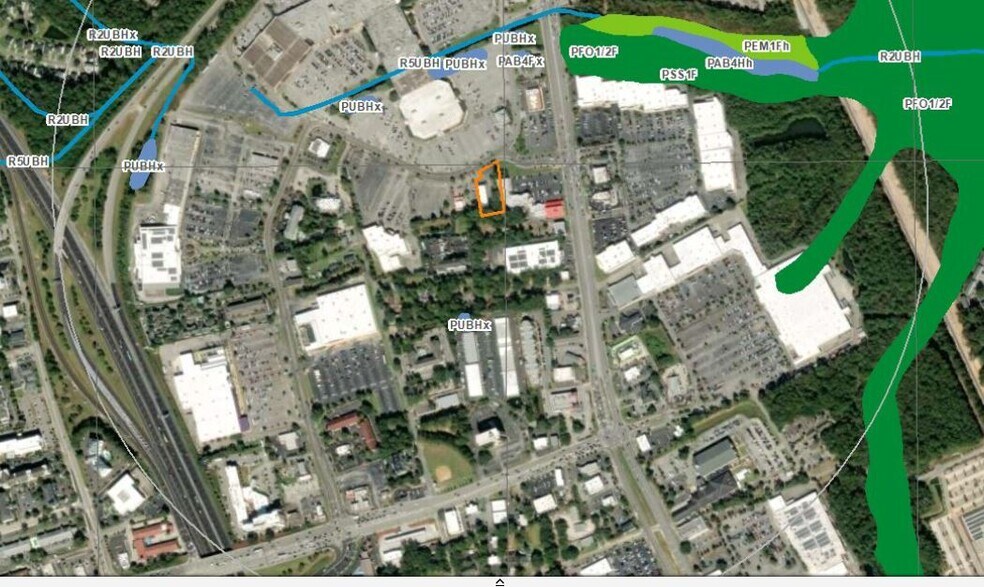

2161 Northwoods Blvd

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

2161 Northwoods Blvd Local commercial | 637 m²

À PROPOS 2161 NORTHWOODS BLVD , NORTH CHARLESTON , SC 29406

| Prix | Pas individuellement en vente | Classe d’immeuble | C |

| Surface de l’immeuble | 637 m² | Surface du lot | 0,39 ha |

| Type de bien | Local commercial | Occupation | Mono |

| Sous-type de bien | Réparation automatique | Ratio de stationnement | 3,94/1 000 m² |

| Prix | Pas individuellement en vente |

| Surface de l’immeuble | 637 m² |

| Type de bien | Local commercial |

| Sous-type de bien | Réparation automatique |

| Classe d’immeuble | C |

| Surface du lot | 0,39 ha |

| Occupation | Mono |

| Ratio de stationnement | 3,94/1 000 m² |

RÉSUMÉ ANALYTIQUE

This portfolio offers investors the opportunity to expand their holdings by purchasing individual locations, select groupings of similar properties, or the entire portfolio. The sale is facilitated by PropertyGroupUSA, a renowned investment firm with an extensive nationwide portfolio. PropertyGroupUSA aims to divest certain key assets to realign its portfolio towards targeted sectors.

The properties in this portfolio range from a 2,575-square-foot former Taco Bell to a former 55,000-square-foot big box Academy Sports, showcasing a diverse array of assets. The primary property types include former CVS Pharmacy and Pep Boys automotive repair buildings, complemented by two big box stores and two restaurants. Each property is freestanding, stand-alone, and vacant and benefits from flexible zoning, not being part of other shopping centers, thus offering maximum versatility. These properties feature unique attributes such as drive-thrus, restaurant equipment, and drive-in doors, which enhance their adaptability for various future uses. In addition, the micro-locational benefits make them attractive to a wide range of buyers, with the corresponding cities and markets performing exceptionally well.

The markets surrounding each property show promising signs for successful investments, supported by multifaceted economies that promote diverse uses. More than half of the properties are located on hard corners, and some are in designated opportunity zones. All but two properties exhibit positive population growth within a 3-mile radius through 2028, with several having average household incomes exceeding six figures within that area. Overall, market indicators are highly favorable for the various locations. Notably, CoStar identified the Phoenix market, which houses two of the portfolio’s properties, as the leading market for retail improvement since the pandemic. The leasing availability rate in Phoenix declined more than any other metro area in the nation from Q4 2019 to Q1 2024. Even the smallest market in this portfolio, Meridian, boasts a very low retail vacancy rate of 3.3%, with rents increasing by more than 5% year-over-year (Q3 2024, CoStar).

For more information, please refer to the attached documents and contact Randall Perry at 727-755-3249.

The properties in this portfolio range from a 2,575-square-foot former Taco Bell to a former 55,000-square-foot big box Academy Sports, showcasing a diverse array of assets. The primary property types include former CVS Pharmacy and Pep Boys automotive repair buildings, complemented by two big box stores and two restaurants. Each property is freestanding, stand-alone, and vacant and benefits from flexible zoning, not being part of other shopping centers, thus offering maximum versatility. These properties feature unique attributes such as drive-thrus, restaurant equipment, and drive-in doors, which enhance their adaptability for various future uses. In addition, the micro-locational benefits make them attractive to a wide range of buyers, with the corresponding cities and markets performing exceptionally well.

The markets surrounding each property show promising signs for successful investments, supported by multifaceted economies that promote diverse uses. More than half of the properties are located on hard corners, and some are in designated opportunity zones. All but two properties exhibit positive population growth within a 3-mile radius through 2028, with several having average household incomes exceeding six figures within that area. Overall, market indicators are highly favorable for the various locations. Notably, CoStar identified the Phoenix market, which houses two of the portfolio’s properties, as the leading market for retail improvement since the pandemic. The leasing availability rate in Phoenix declined more than any other metro area in the nation from Q4 2019 to Q1 2024. Even the smallest market in this portfolio, Meridian, boasts a very low retail vacancy rate of 3.3%, with rents increasing by more than 5% year-over-year (Q3 2024, CoStar).

For more information, please refer to the attached documents and contact Randall Perry at 727-755-3249.

1 de 5

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE