Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

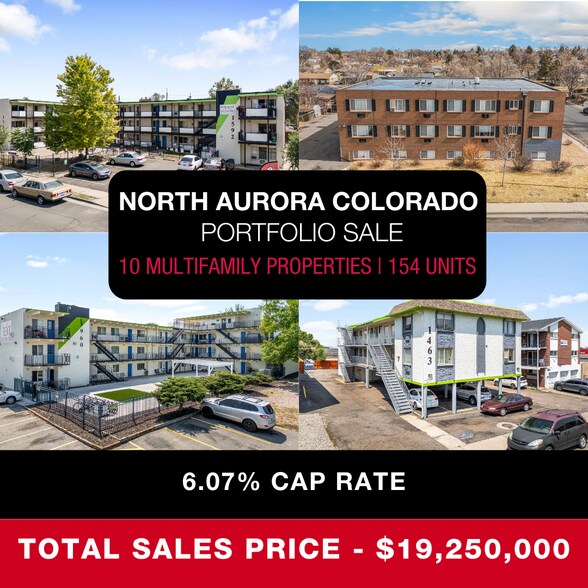

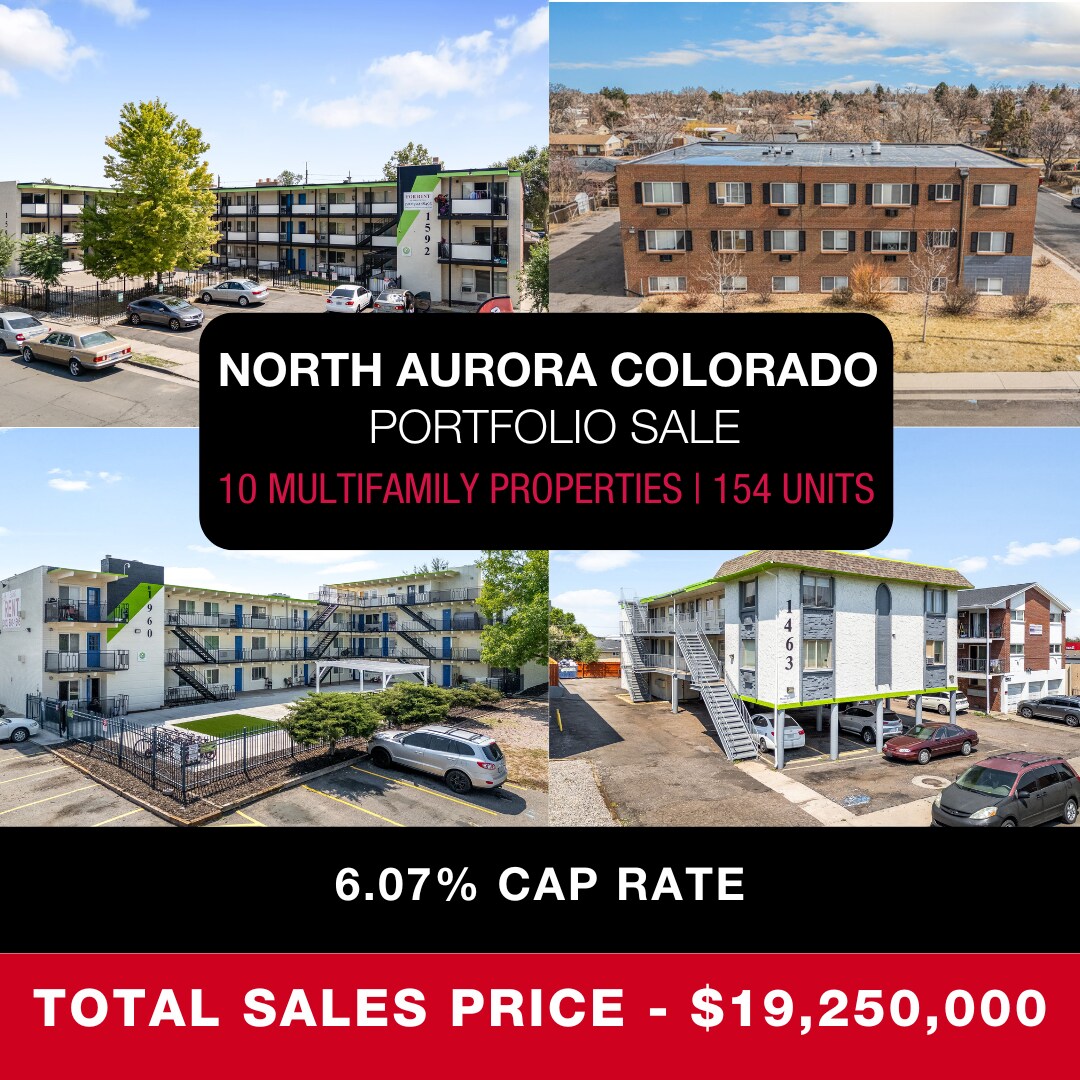

- 154 Total Units Across 10 Separate Properties – All located within a compact 0.25-mile radius in North Aurora, CO.

- Strong Value-Add Opportunity – Current 12% vacancy presents immediate upside due to prior tenant vetting issues; leasing velocity is improving rapidly

- In-House Management Team Available – Seller will convey the existing team: 2 leasing agents/property managers, 1 bookkeeper, 2 maintenance staff

- Significant Capital Improvements Completed – Seller has invested in extensive CapEx across the entire portfolio, with all units remodeled to C-class

- Efficient Operational Scale – Dense cluster allows for economies of scale in management, maintenance, and leasing operations.

- Affordable Housing in High-Demand Location – Strategically positioned near University of Colorado Anschutz Medical Campus

RÉSUMÉ ANALYTIQUE

Introducing a rare opportunity to acquire a 154-unit multifamily portfolio made up of 10 separate buildings at a 6% cap, all situated within a quarter-mile radius in the rapidly transforming North Aurora submarket. This portfolio has undergone extensive renovations, with every unit upgraded to C-class standards, and benefits from affordable rental rates in a high-demand corridor adjacent to the University of Colorado Anschutz Medical Campus. The area’s workforce housing demand remains robust, supported by nearby major hospitals, retail, and public transit.

A new operator can capitalize on:

-Immediate upside through lease-up of current vacancies caused by previous management issues, now being stabilized.

-Operational efficiency via consolidated geographic footprint.

-Optional in-house property management team, allowing for hands-on control or seamless transition to third-party management.

This portfolio is ideally positioned to deliver both steady cash flow and long-term appreciation with the opportunity to push rents, reduce vacancy, and implement a RUBS utility reimbursement program if desired.

A new operator can capitalize on:

-Immediate upside through lease-up of current vacancies caused by previous management issues, now being stabilized.

-Operational efficiency via consolidated geographic footprint.

-Optional in-house property management team, allowing for hands-on control or seamless transition to third-party management.

This portfolio is ideally positioned to deliver both steady cash flow and long-term appreciation with the opportunity to push rents, reduce vacancy, and implement a RUBS utility reimbursement program if desired.

TAXES ET FRAIS D’EXPLOITATION (PRO FORMA - 2025) Cliquez ici pour accéder à |

ANNUEL |

|---|---|

| Revenu de location brut |

$99,999

|

| Autres revenus |

$99,999

|

| Perte due à la vacance |

$99,999

|

| Revenu brut effectif |

$99,999

|

| Taxes |

$99,999

|

| Frais d’exploitation |

$99,999

|

| Total des frais |

$99,999

|

| Résultat net d’exploitation |

$99,999

|

TAXES ET FRAIS D’EXPLOITATION (PRO FORMA - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Autres revenus | |

|---|---|

| Annuel | $99,999 |

| Perte due à la vacance | |

|---|---|

| Annuel | $99,999 |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Frais d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 16 549 610 € | Nb de biens | 10 |

| Prix/m² | 1 693 € / m² | Individuellement en vente | 3 |

| Taux de capitalisation | 6,07 % | Surface totale de l’immeuble | 9 773 m² |

| Type de vente | Investissement | Surface totale du terrain | 1,29 ha |

| Statut | Actif |

| Prix | 16 549 610 € |

| Prix/m² | 1 693 € / m² |

| Taux de capitalisation | 6,07 % |

| Type de vente | Investissement |

| Statut | Actif |

| Nb de biens | 10 |

| Individuellement en vente | 3 |

| Surface totale de l’immeuble | 9 773 m² |

| Surface totale du terrain | 1,29 ha |

Biens

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

|

The Bostonian Apartments

1592 Boston St, Aurora, CO 80010 |

Immeuble residentiel | 2 270 m² | 1962 | 3 438 880 € |

|

Dallas Landing Apartments

1960 Dallas St, Aurora, CO 80010 |

Immeuble residentiel | 2 044 m² | 1967 | 3 438 880 € |

|

Chateau Elan

500 Dayton St, Aurora, CO 80010 |

Immeuble residentiel | 1 263 m² | 1962 | - |

| 1463 Macon St, Aurora, CO 80010 | Immeuble residentiel | 791 m² | 1971 | - |

| 1350 Macon St, Aurora, CO 80010 | Immeuble residentiel | 783 m² | 1972 | - |

| 1342 Macon St, Aurora, CO 80010 | Immeuble residentiel | 783 m² | 1972 | - |

| 1451 Macon St, Aurora, CO 80010 | Immeuble residentiel | 685 m² | 1963 | - |

|

Macon Flats

1433 Macon St, Aurora, CO 80010 |

Immeuble residentiel | 412 m² | 1962 | - |

| 2070 Chambers Rd, Aurora, CO 80011 | Immeuble residentiel | 374 m² | 1965 | - |

| 10201 E Colfax Ave, Aurora, CO 80010 | Local commercial | 369 m² | 1936 | 988 678 € |

1 of 1

1 de 14

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

North Aurora Portfolio Sale

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.