Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

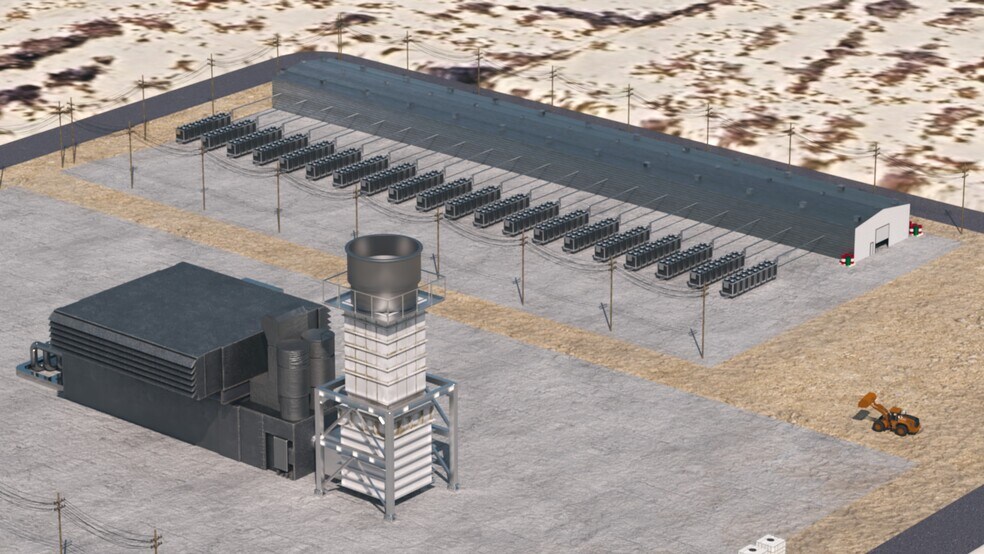

2.4-Gigawatt Energy Campus Highway 17 Lot | Terrain industriel | 311,61 ha | À vendre | 103 671 958 € | Pecos, TX 79772

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Land is lasered, and all the pieces are in place for large-scale technology, AI, and data center development to begin in Q1 2026.

- Impeccable positioning atop the Alpine High Gas zone, a 5,000-foot thick natural gas zone, ranked by Britannica as a global Supergiant field.

- Gas transport company will sign a contract for 10+ years, with firm transport, and the gas capacity will be ready after the 6-month meter built out.

- Averaging $2.00 or less per MMBTU (= under $0.02 per kWh), WAHA index gas is among the cheapest in the United States.

- Emissions are covered with SCR systems in place to reduce NOx to under 9 PPM, qualifying for Texas's expedited TCEQ permitting (60 to 90 days).

- Area is poised to become a global energy capital and is expected to be one of the largest energy sectors in the world within the next five years.

RÉSUMÉ ANALYTIQUE

Rare, 2.4-gigawatt energy campus that is development-ready, offering immediate access to gas turbines and genset packages. The seller's family business, a global power generation firm, provides direct access to aeroderivative genset packages and over a gigawatt of used and new turbines for immediate sale, with Phase 1 (240 MW) deployable by Q4 2026. Installation, operations support, and maintenance can be provided for all genset packages.

Two 36-inch natural gas pipelines (Kinetic & OneOk) cross the parcel, each with a capacity of 1.7 BCF. After nearly a year, the seller has a gas term sheet in hand stating the WAHA index plus a 40-cent transport fee for up to 400,000 MMBTU of gas. Two gas meters will be installed, each with a 200,000 MMBTU capacity, or approximately 1,200 MW of electrical capacity each (2.4 gigawatts total). The seller will wire $4,000,000 on November 12, 2026, to construct the first gas meter, which is expected to take 140 to 170 days to complete and be ready for gas turbine hook-up.

The seller's family-owned enterprise operates power plants and turbine generation facilities in over 37 countries, with nearly 1,000 people employed globally. The average cost to operate turbines ranges from 0.5 to 1.5 cents per kw/h, depending on the O&M tier package the owner desires, and can also be handled by the family business if the buyer chooses. The enterprise's headquarters is in Corpus Christi, Texas, making operations on this Pecos, Texas, site even more ideal, as it is only hours away. With six 50-ton overhead cranes at their Corpus Christi headquarters, the family business also handles all aspects of turbine and engine refurbishment, except for a 50,000-hour major overhaul, typically only performed by the OEM.

Relationships with SCR manufacturing companies are in place so that all turbines purchased and deployed will have proper SCR exhaust add-ons to reduce the NOX PPM down from 25 PPM to 5-8PPM. This allows for an expedited fast-track permitting process with the TCEQ, which is nearly automatic, and enables buyers to start construction within a matter of a few months. Four commercial water wells (two active) on-site produce 3,000 gallons per minute, and a long-haul fiber line with dark fiber available lies 4.5 miles north.

Grid interconnect is underway via Vega. Buyer may opt for a grid-tied or private Behind-the-Meter setup. A 765-kV transmission line, known as the Big Hill to Sand Lake 765-kV Transmission Line Project, is expected to be approved early in 2026, with completion anticipated between 2029 and 2030. Additionally, Microsoft's $14 billion energy campus with Nscale is just 15 minutes East.

Few companies have begun drilling in the Alpine High zone because there is already an abundance of excess gas coming from other major zones in the Permian Basin. Again, just another example of why this area is positioned to be a superior location for AI and other hyperscale companies.

The seller has agreed to pay a 7% commission to the buyer's broker/agent, a $1,140,000 commission check payable to the broker/agent at the full asking price. The family's global enterprise is willing to consider an exclusive agreement with the buyer of this deal for all turbines in the pipeline, provided the logistics are feasible. The sellers are not interested in selling turbines alone. The family enterprise can guarantee 2,400 MW of turbine capacity by 2029 with ramp-up phases between now and then.

Serious inquiries only. No wholesalers. This is a large project with incredible long-term scalability. A 12% non-refundable deposit is required for any contract feasibility period. The seller is willing to accept Cash, Bitcoin, or stock options as payment, depending on the buyer and the structure.

Two 36-inch natural gas pipelines (Kinetic & OneOk) cross the parcel, each with a capacity of 1.7 BCF. After nearly a year, the seller has a gas term sheet in hand stating the WAHA index plus a 40-cent transport fee for up to 400,000 MMBTU of gas. Two gas meters will be installed, each with a 200,000 MMBTU capacity, or approximately 1,200 MW of electrical capacity each (2.4 gigawatts total). The seller will wire $4,000,000 on November 12, 2026, to construct the first gas meter, which is expected to take 140 to 170 days to complete and be ready for gas turbine hook-up.

The seller's family-owned enterprise operates power plants and turbine generation facilities in over 37 countries, with nearly 1,000 people employed globally. The average cost to operate turbines ranges from 0.5 to 1.5 cents per kw/h, depending on the O&M tier package the owner desires, and can also be handled by the family business if the buyer chooses. The enterprise's headquarters is in Corpus Christi, Texas, making operations on this Pecos, Texas, site even more ideal, as it is only hours away. With six 50-ton overhead cranes at their Corpus Christi headquarters, the family business also handles all aspects of turbine and engine refurbishment, except for a 50,000-hour major overhaul, typically only performed by the OEM.

Relationships with SCR manufacturing companies are in place so that all turbines purchased and deployed will have proper SCR exhaust add-ons to reduce the NOX PPM down from 25 PPM to 5-8PPM. This allows for an expedited fast-track permitting process with the TCEQ, which is nearly automatic, and enables buyers to start construction within a matter of a few months. Four commercial water wells (two active) on-site produce 3,000 gallons per minute, and a long-haul fiber line with dark fiber available lies 4.5 miles north.

Grid interconnect is underway via Vega. Buyer may opt for a grid-tied or private Behind-the-Meter setup. A 765-kV transmission line, known as the Big Hill to Sand Lake 765-kV Transmission Line Project, is expected to be approved early in 2026, with completion anticipated between 2029 and 2030. Additionally, Microsoft's $14 billion energy campus with Nscale is just 15 minutes East.

Few companies have begun drilling in the Alpine High zone because there is already an abundance of excess gas coming from other major zones in the Permian Basin. Again, just another example of why this area is positioned to be a superior location for AI and other hyperscale companies.

The seller has agreed to pay a 7% commission to the buyer's broker/agent, a $1,140,000 commission check payable to the broker/agent at the full asking price. The family's global enterprise is willing to consider an exclusive agreement with the buyer of this deal for all turbines in the pipeline, provided the logistics are feasible. The sellers are not interested in selling turbines alone. The family enterprise can guarantee 2,400 MW of turbine capacity by 2029 with ramp-up phases between now and then.

Serious inquiries only. No wholesalers. This is a large project with incredible long-term scalability. A 12% non-refundable deposit is required for any contract feasibility period. The seller is willing to accept Cash, Bitcoin, or stock options as payment, depending on the buyer and the structure.

INFORMATIONS SUR L’IMMEUBLE

1 LOT DISPONIBLE

Lot

| Prix | 103 671 958 € | Surface du lot | 311,61 ha |

| Prix par ha | 332 699,98 € |

| Prix | 103 671 958 € |

| Prix par ha | 332 699,98 € |

| Surface du lot | 311,61 ha |

1 1

DONNÉES DÉMOGRAPHIQUES

ACCESSIBILITÉ RÉGIONALE

VILLE

POPULATION

MILES

TEMPS EN VOITURE

El Paso

682 669

205

3 h 24 m

San Antonio

1 532 233

360

5 h 58 m

Austin

964 254

391

6 h 52 m

Fort Worth

895 008

397

6 h 48 m

Dallas

1 345 047

437

7 h 38 m

Houston

2 325 502

570

9 h 44 m

ACCÈS ET POPULATION ACTIVE

10 MILES

Population totale

13 634

Population active totale

5 640

Taux de chômage

3,19%

Revenu médian du foyer

$56,210

Employés d’entrepôt

1 037

Enseignement secondaire ou supérieur

73,80%

À PROXIMITÉ

RESTAURANTS |

|||

|---|---|---|---|

| Subway | - | - | 8 min. à pied |

| Domino’s | - | - | 12 min. à pied |

LOCAL COMMERCIAL |

||

|---|---|---|

| Tractor Supply Company | Amélioration du logement | 7 min. à pied |

HÔTELS |

|

|---|---|

| Hampton by Hilton |

64 chambres

2 min en voiture

|

| Red Roof Inn |

36 chambres

2 min en voiture

|

| Best Western Plus |

105 chambres

3 min en voiture

|

| Comfort Suites |

58 chambres

4 min en voiture

|

| Fairfield Inn |

87 chambres

4 min en voiture

|

CONSEILLER EN VENTE

Richard Lowrance, Seller Representative

Richard Lowrance est l'un des membres fondateurs de PropertyCashin. Lui et son équipe ont réalisé plus de 700 transactions en 9 ans d'activité dans l'immobilier. L'entreprise est spécialisée dans l'encaissement de vendeurs motivés qui souhaitent liquider leur propriété, puis dans la recommercialisation des actifs auprès du public. Leurs principaux marchés sont Dallas/Fort Worth, Houston, San Antonio et la région de Los Angeles.

1 sur 7

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

2.4-Gigawatt Energy Campus | Highway 17

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.