Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

Turnkey Preschool | 122-Lic | Biz & Real Esta ___ Local commercial 602 m² À vendre Ontario, CA 91761 2 493 665 € (4 142,22 €/m²)

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- 122-Child Licensed Preschool with Real Estate Included

- Located in High-Growth Ontario Market Surrounded by Families

- Value-Add Play via Subsidy Optimization and Tuition Alignment Expand into CSPP, CCTR, and CACFP programs to increase revenue per child

- Turnkey Facility with Upside – Only 50 Currently Enrolled

- Established Childcare Facility with Growth Potential: Operating since 1990, this 6,480 sq ft daycare is licensed for 122 children

- ***PLEASE: Do not go to the property directly, talk to clientele, nor employees about the sale per the request of the seller. Thank you.***

RÉSUMÉ ANALYTIQUE

The facility is licensed for 122 children and currently has 50 enrolled, leaving ample room for enrollment expansion and revenue growth. This is a prime value-add acquisition for owner-operators, preschool chains, or investors looking to grow within the child care sector.

PROPERTY OVERVIEW

Building Size: 6,480 SF

Lot Size: 0.69 Acres

License Capacity: 122 Children

Current Enrollment: 50

Zoning: Educational / Daycare Use

Parking: On-site parking lot

Improvements: Multiple classrooms, administrative office, playground, ADA-accessible restrooms, kitchen setup

LOAN STRUCTURES (example)

SBA 7(a) Loan (15% Down)

DSCR: 1.88x

Debt Yield: 9.5%

Leveraged IRR (5-Year Hold): 29.6%

DSCR: 1.39x

Debt Yield: 9.5%

Leveraged IRR (5-Year Hold): 17.7%

VALUE-ADD STRATEGIES

Increase enrollment from 50 to 100+ children (82%+ capacity utilization)

Optimize tuition rates to match local market benchmarks

Expand eligibility and participation in CSPP, CCTR, and CACFP programs

Implement enrichment programming (music, STEM, language) to attract new families

Rebrand and market the center to increase community awareness and drive leads

DEMOGRAPHIC ADVANTAGE

Located in a high-density family community in San Bernardino County, the property benefits from a strong pipeline of working parents, dual-income households, and a high volume of children under age 10. Traffic counts, residential growth, and local school feeder systems reinforce the long-term viability of the center.

EXIT STRATEGIES

Resale to strategic or private operator at full enrollment

Hold and refinance after NOI growth for capital extraction

Sale and leaseback to a child care REIT or investment group

Asset repositioning for alternative educational programming or special use care (e.g., therapy, SPED)

WHY THIS LISTING STANDS OUT

Rare combination of business + real estate in a demand-rich market

SBA financing ready, with clean financials and owner add-backs clearly documented

Underutilized license capacity, allowing an investor to more than double gross revenue

Modern facility, fully code-compliant, ADA-ready, and capable of full-day programming

California’s public investment in early learning through CSPP, CCTR, Prop 98, and infrastructure funding offers lasting financial tailwinds

INFORMATIONS SUR L’IMMEUBLE

À PROPOS ___ , ONTARIO, CA 91761

Childcare Facility | 6,480 SF | 122-Child License | Ontario, CA Price: $3,088,888 Property Type: Retail (Daycare Subtype) Building Size: 6,480 SF Lot Size: 0.69 Acres Year Built: 1985 Cap Rate: 7.4%–9.5% (Current); 12%+ (Pro Forma) Location: Ontario, CA Unlock a high-potential childcare investment with this 6,480 sq ft facility on a 0.69-acre lot in Ontario, CA, listed for $3,088,888. Operating since 1990, this established center is licensed for 122 children (Licenses: 18 infants, 52 daycare, 52 school-age), offering significant enrollment upside. Located in a high-traffic corridor (195,918–215,847 daily vehicles), the property benefits from the Inland Empire’s childcare shortage (58% of working parents rely on centers) and strong demographics ($108,300 median income, 24.3% Workday Drive, 16.7% Urban Villages). New 2025 California subsidies (new owner would need to apply for these subsidies), including the Cost of Care Plus Rate (+10%–20% reimbursements) and $58M CCDF grants, fund upgrades (e.g., playgrounds, training), enhancing profitability. SBA 7(a) financing (15% down, 9.75%, 25-year term) offers a 1.4–1.8 DSCR, while conventional loans (25% down, 7.5%) improve DSCR to 1.6–2.0 by 2029. With a 12%–15% leveraged IRR, 1.7x–2.1x equity multiple, and tax benefits (1031 exchange), this investment delivers for operators and investors seeking cash flow, growth, and real estate upside. Exit strategies could include a $4.26M–$5.05M sale (2029, 8% cap rate) or repositioning for alternative uses.

PRINCIPAUX COMMERCES À PROXIMITÉ

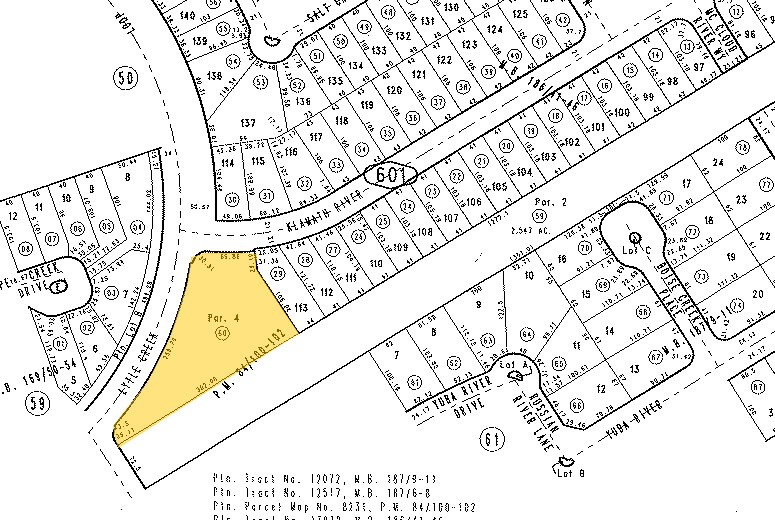

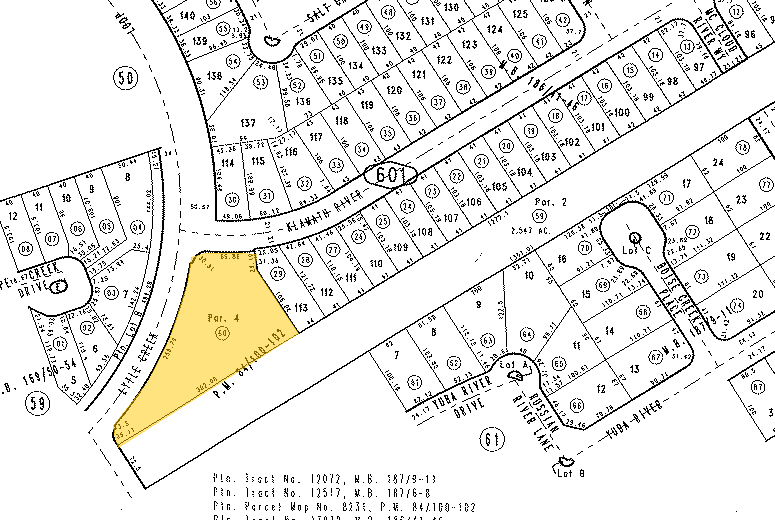

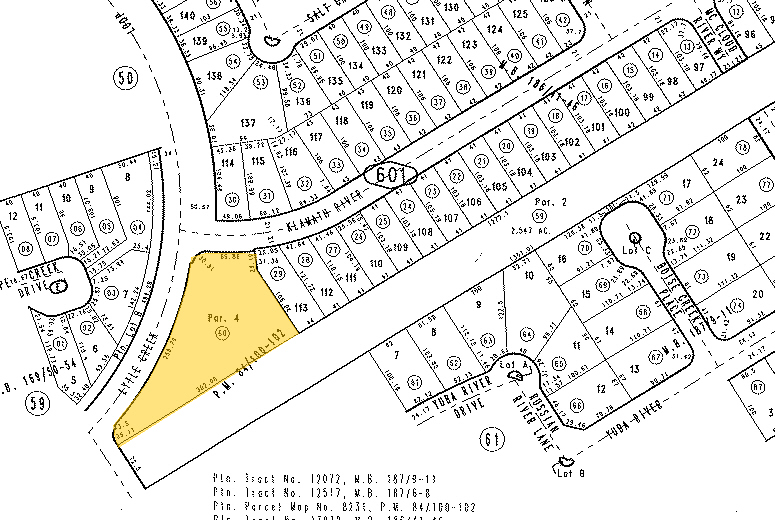

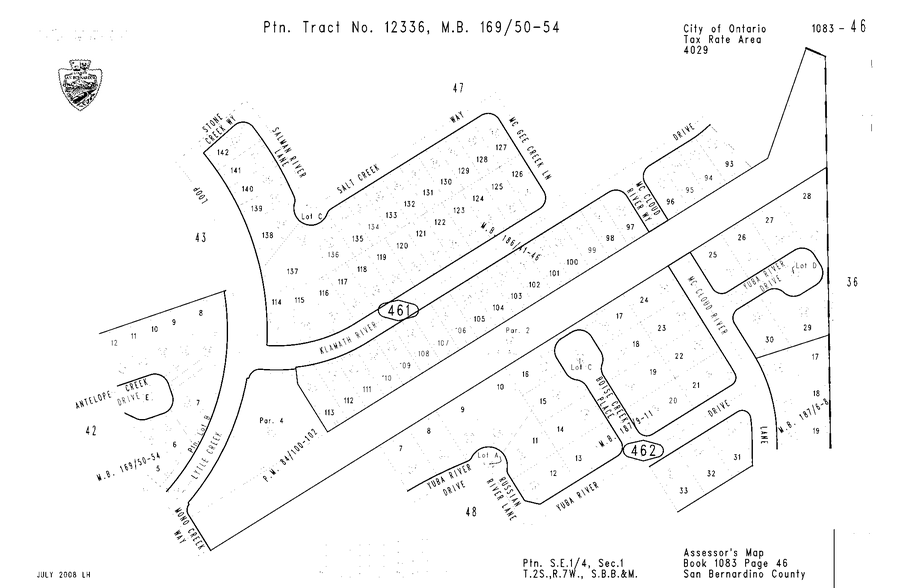

TAXES FONCIÈRES

| Numéro de parcelle | 1083-461-60 | Évaluation des aménagements | 939 460 € |

| Évaluation du terrain | 495 105 € | Évaluation totale | 1 434 565 € |

TAXES FONCIÈRES

Présenté par

Turnkey Preschool | 122-Lic | Biz & Real Esta | ___

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.