Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

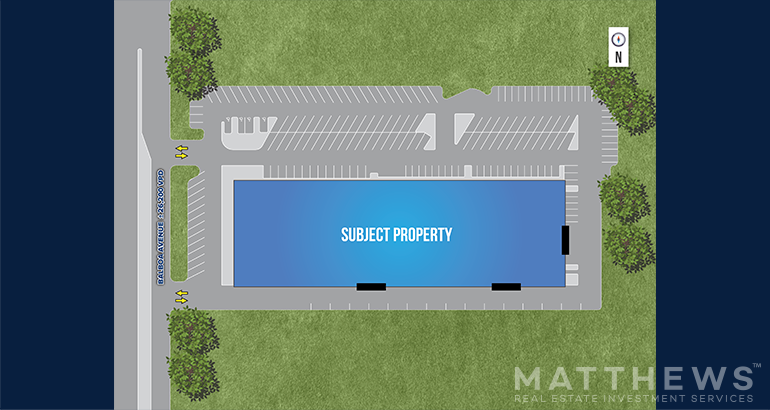

9244 Balboa Ave Local d'activités 4 236 m² À vendre San Diego, CA 92123 13 208 943 € (3 117,98 €/m²)

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- HIGH-IMAGE INDUSTRIAL OWNER-USER OPPORTUNITY IN CORPORATE LOCATION

- KEARNY MESA HAS THE HIGHEST PERCENTAGE OF ITS BASE BUILDINGS OWNED BY OWNER/USERS

- SAN DIEGO’S LEADING MARKET FUNDAMENTALS

RÉSUMÉ ANALYTIQUE

HIGH-IMAGE INDUSTRIAL OWNER-USER OPPORTUNITY IN CORPORATE LOCATION

* Attractive freestanding Corporate HQ/Office/R&D/Industrial Flex in a business park environment with abundant nearby amenities.

* Adjacency to workforce housing and easy access to executive housing.

* Walking distance to public transit and excellent access to SR-163, SR-52, I-15, I-805, I-8 Freeways.

* New "Cool" roof installed Dec. 2020 with a 15 year warranty.

* OWNER-USER ADVANTAGE: This is an ideal corporate headquarter investment that provides an attractive lease-saving trade-off. As opposed to leasing space, a purchase provides protection against future rental market uncertainty and rate hikes. It further offers occupancy control, certain tax benefits and after-tax equity accumulation.

* BONUS DEPRECIATION ADVANTAGE: Given the new tax legislation passed July 2025, a buyer would not have any occupancy cost in the first year given the estimated depreciation benefits providing an approximate $77,011 monthly tax savings or loss carry forwards. (See Lease vs. Own Analysis on page 29 of OM)

SAN DIEGO’S LEADING MARKET FUNDAMENTALS

* Kearny Mesa has the highest percentage of its base buildings owned by owner/users, currently sitting at 79%. Therefore, these types of buildings rarely trade hands which offers an owner/user a unique opportunity to enter the Kearny Mesa submarket.

* Kearny Mesa has long been the real estate backbone for San Diego, providing the region with more than 23 million square feet of office and industrial space. Its central location is a magnet for commercial activity and jobs, leading to one of the region’s lowest vacancies and best absorption through every business cycle.

* Attractive freestanding Corporate HQ/Office/R&D/Industrial Flex in a business park environment with abundant nearby amenities.

* Adjacency to workforce housing and easy access to executive housing.

* Walking distance to public transit and excellent access to SR-163, SR-52, I-15, I-805, I-8 Freeways.

* New "Cool" roof installed Dec. 2020 with a 15 year warranty.

* OWNER-USER ADVANTAGE: This is an ideal corporate headquarter investment that provides an attractive lease-saving trade-off. As opposed to leasing space, a purchase provides protection against future rental market uncertainty and rate hikes. It further offers occupancy control, certain tax benefits and after-tax equity accumulation.

* BONUS DEPRECIATION ADVANTAGE: Given the new tax legislation passed July 2025, a buyer would not have any occupancy cost in the first year given the estimated depreciation benefits providing an approximate $77,011 monthly tax savings or loss carry forwards. (See Lease vs. Own Analysis on page 29 of OM)

SAN DIEGO’S LEADING MARKET FUNDAMENTALS

* Kearny Mesa has the highest percentage of its base buildings owned by owner/users, currently sitting at 79%. Therefore, these types of buildings rarely trade hands which offers an owner/user a unique opportunity to enter the Kearny Mesa submarket.

* Kearny Mesa has long been the real estate backbone for San Diego, providing the region with more than 23 million square feet of office and industrial space. Its central location is a magnet for commercial activity and jobs, leading to one of the region’s lowest vacancies and best absorption through every business cycle.

TAXES ET FRAIS D’EXPLOITATION (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Taxes |

-

|

-

|

| Frais d’exploitation |

-

|

-

|

| Total des frais |

$99,999

|

$9.99

|

TAXES ET FRAIS D’EXPLOITATION (RÉEL - 2025) Cliquez ici pour accéder à

| Taxes | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Frais d’exploitation | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 13 208 943 € | Surface utile brute | 4 236 m² |

| Prix par m² | 3 117,98 € | Nb d’étages | 1 |

| Type de vente | Propriétaire occupant | Année de construction/rénovation | 1980/2000 |

| Type de bien | Local d'activités | Occupation | Mono |

| Sous-type de bien | Manufacture légère | Ratio de stationnement | 0,39/1 000 m² |

| Classe d’immeuble | B | Hauteur libre du plafond | 5,33 m |

| Surface du lot | 1,19 ha | Nb d’accès plain-pied/portes niveau du sol | 3 |

| Zonage | M-1b - Manufacturing and Industrial Uses | ||

| Prix | 13 208 943 € |

| Prix par m² | 3 117,98 € |

| Type de vente | Propriétaire occupant |

| Type de bien | Local d'activités |

| Sous-type de bien | Manufacture légère |

| Classe d’immeuble | B |

| Surface du lot | 1,19 ha |

| Surface utile brute | 4 236 m² |

| Nb d’étages | 1 |

| Année de construction/rénovation | 1980/2000 |

| Occupation | Mono |

| Ratio de stationnement | 0,39/1 000 m² |

| Hauteur libre du plafond | 5,33 m |

| Nb d’accès plain-pied/portes niveau du sol | 3 |

| Zonage | M-1b - Manufacturing and Industrial Uses |

CARACTÉRISTIQUES

- Biotech/Laboratoire

SERVICES PUBLICS

- Gaz - Naturel

- Eau - Ville

- Égout - Ville

1 1

TAXES FONCIÈRES

| Numéro de parcelle | 369-161-11 | Évaluation des aménagements | 2 715 296 € |

| Évaluation du terrain | 1 472 437 € | Évaluation totale | 4 187 734 € |

TAXES FONCIÈRES

Numéro de parcelle

369-161-11

Évaluation du terrain

1 472 437 €

Évaluation des aménagements

2 715 296 €

Évaluation totale

4 187 734 €

1 sur 17

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

9244 Balboa Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.