Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

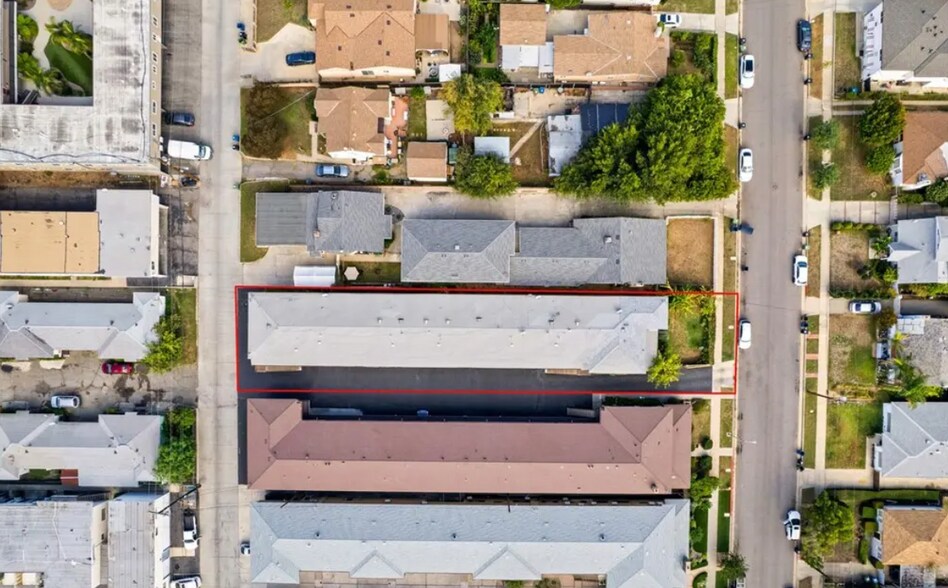

917 S Edith Ave Immeuble residentiel 10 lots 2 505 542 € (250 554 €/Lot) Taux de capitalisation 5,07 % Alhambra, CA 91803

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Upside on rental income

- Laundry Room

- Commuter friendly

- Covered Assigned Parking

RÉSUMÉ ANALYTIQUE

10-Unit Multifamily Investment in Prime Alhambra Location

Strategically positioned in the core of Alhambra, California, this 10-unit multifamily property presents a compelling opportunity for investors seeking a stable and well-located asset within one of Los Angeles County’s most resilient rental submarkets.

Alhambra continues to demonstrate strong rental fundamentals, with consistent occupancy rates, low vacancy levels, and a diversified tenant base driven by proximity to major employment and educational hubs such as Cal State LA, Downtown Los Angeles, and Pasadena. The city’s blend of established neighborhoods, cultural amenities, and robust local services supports steady rent growth and long-term tenant retention.

The property offers 19 total bedrooms and 10 bathrooms across its unit mix, supported by covered carport parking and an on-site laundry facility that provides additional income potential. The asset’s central location—near shopping corridors, public transit, and major freeways—enhances its desirability and accessibility for tenants.

Surrounded by a well-developed residential and commercial environment, this property represents a rare opportunity to acquire a cash-flowing asset in a high-demand market with long-term appreciation potential. Investors can benefit from Alhambra’s strong rental demand, limited multifamily supply pipeline, and proximity to major regional economic centers in the San Gabriel Valley and Greater Los Angeles area.

Why This Property Offers Value

-High occupancy / low vacancy risk – With a reported vacancy rate of ~2.9 % for multifamily in Alhambra, the rental market is demonstrating strong tenant demand.

-Upside potential via ancillary income – Covered carports and on-site laundry present additional revenue streams that enhance overall asset yield.

-Commuter & institutional demand drivers – The location benefits from proximity to Cal State LA, the greater Pasadena and Downtown Los Angeles employment bases, and established transit/freeway connectivity, supporting both resident retention and rental stability.

-Limited new supply – The relatively modest pipeline of new multifamily inventory in the San Gabriel Valley limits competitive pressure, supporting renter-demand fundamentals and potential rental growth.

-Market-led rent levels – With prevailing rents at or above $2,400/month in Alhambra and steady, albeit modest, growth in asking rents, income stability and modest growth potential coexist.

Strategically positioned in the core of Alhambra, California, this 10-unit multifamily property presents a compelling opportunity for investors seeking a stable and well-located asset within one of Los Angeles County’s most resilient rental submarkets.

Alhambra continues to demonstrate strong rental fundamentals, with consistent occupancy rates, low vacancy levels, and a diversified tenant base driven by proximity to major employment and educational hubs such as Cal State LA, Downtown Los Angeles, and Pasadena. The city’s blend of established neighborhoods, cultural amenities, and robust local services supports steady rent growth and long-term tenant retention.

The property offers 19 total bedrooms and 10 bathrooms across its unit mix, supported by covered carport parking and an on-site laundry facility that provides additional income potential. The asset’s central location—near shopping corridors, public transit, and major freeways—enhances its desirability and accessibility for tenants.

Surrounded by a well-developed residential and commercial environment, this property represents a rare opportunity to acquire a cash-flowing asset in a high-demand market with long-term appreciation potential. Investors can benefit from Alhambra’s strong rental demand, limited multifamily supply pipeline, and proximity to major regional economic centers in the San Gabriel Valley and Greater Los Angeles area.

Why This Property Offers Value

-High occupancy / low vacancy risk – With a reported vacancy rate of ~2.9 % for multifamily in Alhambra, the rental market is demonstrating strong tenant demand.

-Upside potential via ancillary income – Covered carports and on-site laundry present additional revenue streams that enhance overall asset yield.

-Commuter & institutional demand drivers – The location benefits from proximity to Cal State LA, the greater Pasadena and Downtown Los Angeles employment bases, and established transit/freeway connectivity, supporting both resident retention and rental stability.

-Limited new supply – The relatively modest pipeline of new multifamily inventory in the San Gabriel Valley limits competitive pressure, supporting renter-demand fundamentals and potential rental growth.

-Market-led rent levels – With prevailing rents at or above $2,400/month in Alhambra and steady, albeit modest, growth in asking rents, income stability and modest growth potential coexist.

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

$99,999

|

$9.99

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

$99,999

|

$9.99

|

| Taxes |

$99,999

|

$9.99

|

| Frais d’exploitation |

$99,999

|

$9.99

|

| Total des frais |

$99,999

|

$9.99

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Frais d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 2 505 542 € | Classe d’immeuble | C |

| Prix par lot | 250 554 € | Surface du lot | 0,11 ha |

| Type de vente | Investissement | Surface de l’immeuble | 731 m² |

| Taux de capitalisation | 5,07 % | Occupation moyenne | 100% |

| Nb de lots | 10 | Nb d’étages | 2 |

| Type de bien | Immeuble residentiel | Année de construction | 1962 |

| Sous-type de bien | Appartement | Ratio de stationnement | 0,09/1 000 m² |

| Style d’appartement | De faible hauteur | ||

| Zonage | RPD, Alhambra | ||

| Prix | 2 505 542 € |

| Prix par lot | 250 554 € |

| Type de vente | Investissement |

| Taux de capitalisation | 5,07 % |

| Nb de lots | 10 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | C |

| Surface du lot | 0,11 ha |

| Surface de l’immeuble | 731 m² |

| Occupation moyenne | 100% |

| Nb d’étages | 2 |

| Année de construction | 1962 |

| Ratio de stationnement | 0,09/1 000 m² |

| Zonage | RPD, Alhambra |

CARACTÉRISTIQUES

CARACTÉRISTIQUES DU LOT

- Climatisation

- Balcon

- Four

- Cuisinière

- Baignoire/Douche

CARACTÉRISTIQUES DU SITE

- Accès 24 h/24

- Laverie

- CVC contrôlé par l’occupant

- Détecteur de fumée

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| Studios | 10 | - | - |

1 1

TAXES FONCIÈRES

| Numéro de parcelle | 5350-021-037 | Évaluation totale | 2 553 461 € (2025) |

| Évaluation du terrain | 766 038 € (2025) | Impôts annuels | -1 € (0,00 €/m²) |

| Évaluation des aménagements | 1 787 423 € (2025) | Année d’imposition | 2024 |

TAXES FONCIÈRES

Numéro de parcelle

5350-021-037

Évaluation du terrain

766 038 € (2025)

Évaluation des aménagements

1 787 423 € (2025)

Évaluation totale

2 553 461 € (2025)

Impôts annuels

-1 € (0,00 €/m²)

Année d’imposition

2024

1 sur 11

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

917 S Edith Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.