Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

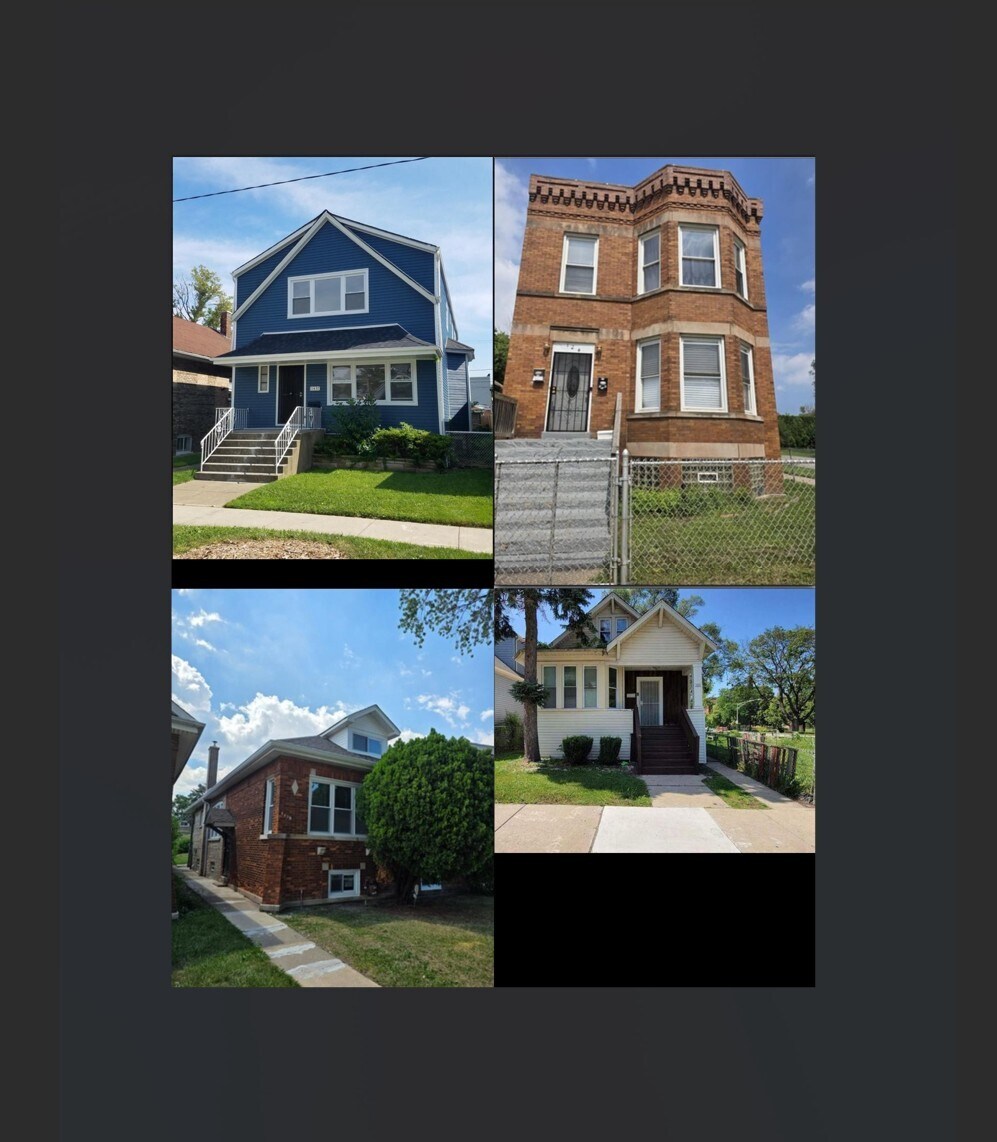

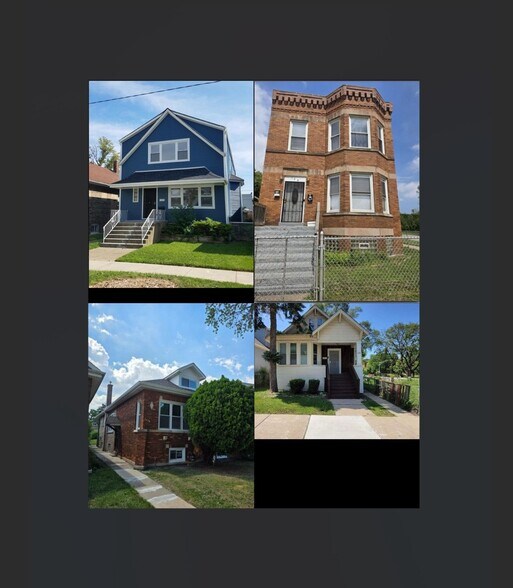

91 SFR/Multi Portfolio | 24% CoC 2 biens | Immeuble residentiel | À vendre | 12 559 506 € | Chicago, IL

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Institutional scale, sensible mix 91 properties across Chicago: 63 SFRs, 21 two-flats, two 3-flats, one 4-unit, one 6-unit, one 8-unit, and two condos

RÉSUMÉ ANALYTIQUE

Offering Overview:

Institutional-scale, scattered-site 91-property Chicago portfolio delivering durable in-place cash flow and multiple exit paths. Asset mix: 63 Single-Family Homes, 21 Two-Flats, two 3-flats, one 4-unit, one 6-unit, one 8-unit, and two condos. Properties are located across established working-class neighborhoods, offering both diversification and operational efficiencies at scale.

Pricing & Returns (Modeled)

The portfolio is priced to a 12% unlevered cap rate on in-place rents using a conservative 30% operating expense ratio. With standard financing assumptions (80% LTV, 6.5% fixed, 30-yr amortization), underwriting indicates a mid-to-high-20% portfolio-level cash-on-cash return (illustrative; buyer to confirm with lender). Detailed, line-item modeling available; seller provides a dynamic Excel workbook that updates automatically if assumptions or price are adjusted.

Tenant & Revenue Profile

Blend of market-rate and voucher-backed (CHA/HCV) tenancies provides a stable collections base with embedded rent-growth opportunities. Current rent roll and taxes by property are available; buyer can underwrite with the provided 30% OpEx framework or apply a property-level expense view as preferred.

Investment Highlights

• Scale & Diversification: 91 assets spanning SFR and small multis (2–8 units) reduce single-asset volatility and smooth cash flows.

• 12% In-Place Cap (Modeled): Based on current rent roll and a conservative expense load (30%).

• Attractive Leverage Spread: Example financing (80% LTV @ 6.5% / 30 yrs) supports ~mid-/high-20s CoC at the portfolio level.

• Operational Efficiencies: Route-based maintenance, standardized turns, bulk materials, and centralized collections.

• Multiple Exit Paths: Long-term hold for yield, cash-out refinance upon stabilization, or break-up strategy (selective dispositions of higher-performing assets).

• Low Relative Basis: Entry pricing supports resilience, optional capex, and flexibility in strategy across sub-portfolios.

• Transparent Underwriting: Dynamic model shows Annual Rent, NOI, Sale Price, Loan Amount, ADS, CF After Debt, Equity, and CoC per asset and in aggregate; summary totals are filter-aware.

Value-Add Levers

• Rent optimization as leases roll; align below-market units to comps.

• Light CAPEX to improve finishes/curb appeal where warranted to support rent deltas.

• Expense controls: Vendor consolidation, bulk purchasing, and preventive maintenance cadence.

• Utility recapture (where feasible): Implement RUBS or structured passthroughs to reduce owner-paid expenses.

• Tax strategy: Review and appeal opportunities on a rolling basis (tax year and amounts provided per asset).

Underwriting Assumptions (for reference)

• Cap rate shown is unlevered (NOI ÷ Price) and excludes debt service.

• NOI modeled with a 30% expense ratio on collected rents (simple, conservative proxy).

• Illustrative financing example is not a loan commitment; buyer to underwrite with their own rate, fees, and reserve policies.

• Capex, taxes, insurance, and reserves should be underwritten per buyer standards; detailed property-level taxes are included for transparency.

Process & Access

• Portfolio offered as a single package; seller may consider reasonable carve-outs or staged closings subject to pricing/terms.

• Data room access (rent roll, taxes, dynamic underwriting workbook) available upon NDA and proof of funds.

• Drive-by tours and grouped interior access can be scheduled for qualified investors.

• Buyer to verify all information independently; no representations or warranties are made outside of the purchase agreement.

Contact

For the full model, rent roll, and diligence materials, please inquire. Seller can provide the dynamic Excel where you can adjust price, rate, LTV, or expense assumptions and see portfolio return metrics update instantly.

Institutional-scale, scattered-site 91-property Chicago portfolio delivering durable in-place cash flow and multiple exit paths. Asset mix: 63 Single-Family Homes, 21 Two-Flats, two 3-flats, one 4-unit, one 6-unit, one 8-unit, and two condos. Properties are located across established working-class neighborhoods, offering both diversification and operational efficiencies at scale.

Pricing & Returns (Modeled)

The portfolio is priced to a 12% unlevered cap rate on in-place rents using a conservative 30% operating expense ratio. With standard financing assumptions (80% LTV, 6.5% fixed, 30-yr amortization), underwriting indicates a mid-to-high-20% portfolio-level cash-on-cash return (illustrative; buyer to confirm with lender). Detailed, line-item modeling available; seller provides a dynamic Excel workbook that updates automatically if assumptions or price are adjusted.

Tenant & Revenue Profile

Blend of market-rate and voucher-backed (CHA/HCV) tenancies provides a stable collections base with embedded rent-growth opportunities. Current rent roll and taxes by property are available; buyer can underwrite with the provided 30% OpEx framework or apply a property-level expense view as preferred.

Investment Highlights

• Scale & Diversification: 91 assets spanning SFR and small multis (2–8 units) reduce single-asset volatility and smooth cash flows.

• 12% In-Place Cap (Modeled): Based on current rent roll and a conservative expense load (30%).

• Attractive Leverage Spread: Example financing (80% LTV @ 6.5% / 30 yrs) supports ~mid-/high-20s CoC at the portfolio level.

• Operational Efficiencies: Route-based maintenance, standardized turns, bulk materials, and centralized collections.

• Multiple Exit Paths: Long-term hold for yield, cash-out refinance upon stabilization, or break-up strategy (selective dispositions of higher-performing assets).

• Low Relative Basis: Entry pricing supports resilience, optional capex, and flexibility in strategy across sub-portfolios.

• Transparent Underwriting: Dynamic model shows Annual Rent, NOI, Sale Price, Loan Amount, ADS, CF After Debt, Equity, and CoC per asset and in aggregate; summary totals are filter-aware.

Value-Add Levers

• Rent optimization as leases roll; align below-market units to comps.

• Light CAPEX to improve finishes/curb appeal where warranted to support rent deltas.

• Expense controls: Vendor consolidation, bulk purchasing, and preventive maintenance cadence.

• Utility recapture (where feasible): Implement RUBS or structured passthroughs to reduce owner-paid expenses.

• Tax strategy: Review and appeal opportunities on a rolling basis (tax year and amounts provided per asset).

Underwriting Assumptions (for reference)

• Cap rate shown is unlevered (NOI ÷ Price) and excludes debt service.

• NOI modeled with a 30% expense ratio on collected rents (simple, conservative proxy).

• Illustrative financing example is not a loan commitment; buyer to underwrite with their own rate, fees, and reserve policies.

• Capex, taxes, insurance, and reserves should be underwritten per buyer standards; detailed property-level taxes are included for transparency.

Process & Access

• Portfolio offered as a single package; seller may consider reasonable carve-outs or staged closings subject to pricing/terms.

• Data room access (rent roll, taxes, dynamic underwriting workbook) available upon NDA and proof of funds.

• Drive-by tours and grouped interior access can be scheduled for qualified investors.

• Buyer to verify all information independently; no representations or warranties are made outside of the purchase agreement.

Contact

For the full model, rent roll, and diligence materials, please inquire. Seller can provide the dynamic Excel where you can adjust price, rate, LTV, or expense assumptions and see portfolio return metrics update instantly.

TAXES ET FRAIS D’EXPLOITATION (PRO FORMA - 2025) Cliquez ici pour accéder à |

ANNUEL |

|---|---|

| Revenu de location brut |

$99,999

|

| Autres revenus |

-

|

| Perte due à la vacance |

-

|

| Revenu brut effectif |

$99,999

|

| Taxes |

$99,999

|

| Frais d’exploitation |

$99,999

|

| Total des frais |

$99,999

|

| Résultat net d’exploitation |

$99,999

|

TAXES ET FRAIS D’EXPLOITATION (PRO FORMA - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Autres revenus | |

|---|---|

| Annuel | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Frais d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 12 559 506 € | Statut | Actif |

| Prix/m² | 9 367 € / m² | Nb de biens | 2 |

| Condition de vente | Ventes de portefeuille | Individuellement en vente | 0 |

| Taux de capitalisation | 10,79 % | Surface totale de l’immeuble | 1 341 m² |

| Type de vente | Investissement | Surface totale du terrain | 0,13 ha |

| Prix | 12 559 506 € |

| Prix/m² | 9 367 € / m² |

| Condition de vente | Ventes de portefeuille |

| Taux de capitalisation | 10,79 % |

| Type de vente | Investissement |

| Statut | Actif |

| Nb de biens | 2 |

| Individuellement en vente | 0 |

| Surface totale de l’immeuble | 1 341 m² |

| Surface totale du terrain | 0,13 ha |

Biens

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

| 7933-7935 S Essex Ave, Chicago, IL 60617 | Immeuble residentiel | 765 m² | 1929 | - |

| 7831 S Colfax Ave, Chicago, IL 60649 | Immeuble residentiel | 576 m² | 1918 | - |

1 1

1 sur 2

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

91 SFR/Multi Portfolio | 24% CoC

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.