Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

Dutch Bros Adj. to University of Illinois 809 W Green St Local commercial 97 m² À vendre Urbana, IL 61801 2 618 599 € (27 024,32 €/m²) Taux de capitalisation 5,50 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

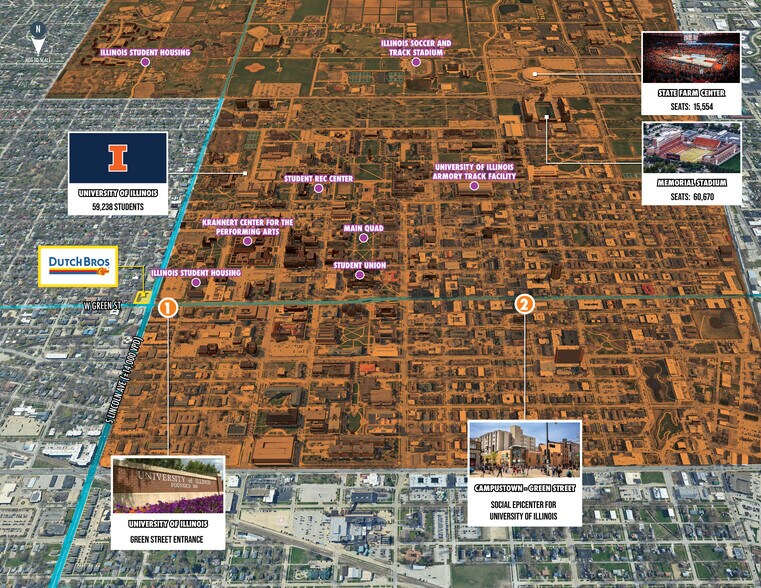

- Brand New Corporate Dutch Bros adjacent to University of Illinois

- Grand Opening Expected 4Q25 | Brand New BTS Construction

- Absolute NNN Lease: ultimate ease of management for investor

- University of Illinois: #9 Public University in the U.S. with 59,000+ students

- Long Term 15 Year Lease with multiple renewal options

- Fee Simple Interest: Land & Building ownership

RÉSUMÉ ANALYTIQUE

ILLINOIS BROKER OF RECORD...MICHAEL SCHERTLER....License No. 471011764

Faris Lee Investments is pleased to present the rare opportunity to acquire a brand-new, fee simple, drive-thru Dutch Bros adjacent to the University of Illinois. The property boasts excellent positioning at the intersection of Lincoln Avenue and Green Street, convenient to University destinations and the primary east-west thoroughfare for ‘Campustown’. Expected to open for business in 4Q25, this new construction, build-to-suit Dutch Bros will feature two drive-thru lanes and a walk-up window to satisfy heavy student & vehicle traffic. This QSR Coffee investment property is secured by a 15-year corporate lease (Boersma Bros LLC) with 10% rental increases every 5 years and multiple renewal options, providing investors with a long-term, inflation-hedged income stream. The long-term Absolute NNN lease has zero landlord responsibilities, making the offering ideal for a passive or out-of-state investor looking for a management-free, corporate-leased QSR asset.

The subject property is immediately surrounded by the University of Illinois, its academic facilities, and student housing complexes. The University now has over 59,000 students; approximately 50% of undergraduate students live on-campus, proximate to this brand-new Dutch Bros location. The campus is located within the Champaign-Urbana metro, which is located approximately 2.5 hours south of Chicago, and has approximately 236,000 residents. This offering combines fee simple ownership, brand-new construction, zero landlord responsibilities, and a corporate QSR tenant creating an exceptional opportunity for investors seeking a stable income stream in a premier university market.

Faris Lee Investments is pleased to present the rare opportunity to acquire a brand-new, fee simple, drive-thru Dutch Bros adjacent to the University of Illinois. The property boasts excellent positioning at the intersection of Lincoln Avenue and Green Street, convenient to University destinations and the primary east-west thoroughfare for ‘Campustown’. Expected to open for business in 4Q25, this new construction, build-to-suit Dutch Bros will feature two drive-thru lanes and a walk-up window to satisfy heavy student & vehicle traffic. This QSR Coffee investment property is secured by a 15-year corporate lease (Boersma Bros LLC) with 10% rental increases every 5 years and multiple renewal options, providing investors with a long-term, inflation-hedged income stream. The long-term Absolute NNN lease has zero landlord responsibilities, making the offering ideal for a passive or out-of-state investor looking for a management-free, corporate-leased QSR asset.

The subject property is immediately surrounded by the University of Illinois, its academic facilities, and student housing complexes. The University now has over 59,000 students; approximately 50% of undergraduate students live on-campus, proximate to this brand-new Dutch Bros location. The campus is located within the Champaign-Urbana metro, which is located approximately 2.5 hours south of Chicago, and has approximately 236,000 residents. This offering combines fee simple ownership, brand-new construction, zero landlord responsibilities, and a corporate QSR tenant creating an exceptional opportunity for investors seeking a stable income stream in a premier university market.

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

97 m²

Classe d’immeuble

C

Année de construction

2025

Prix

2 618 599 €

Prix par m²

27 024,32 €

Taux de capitalisation

5,50 %

RNE

144 040 €

Occupation

Mono

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,04

Surface du lot

0,25 ha

Zone de développement économique [USA]

Oui

Zonage

c

1 1

Walk Score®

Très praticable à pied (87)

Bike Score®

Très praticable en vélo (82)

PRINCIPAUX COMMERCES À PROXIMITÉ

TAXES FONCIÈRES

| Numéro de parcelle | 92-21-17-103-001 | Évaluation des aménagements | 104 778 € (2024) |

| Évaluation du terrain | 168 804 € (2024) | Évaluation totale | 273 582 € (2024) |

TAXES FONCIÈRES

Numéro de parcelle

92-21-17-103-001

Évaluation du terrain

168 804 € (2024)

Évaluation des aménagements

104 778 € (2024)

Évaluation totale

273 582 € (2024)

1 sur 9

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

Dutch Bros Adj. to University of Illinois | 809 W Green St

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.