Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

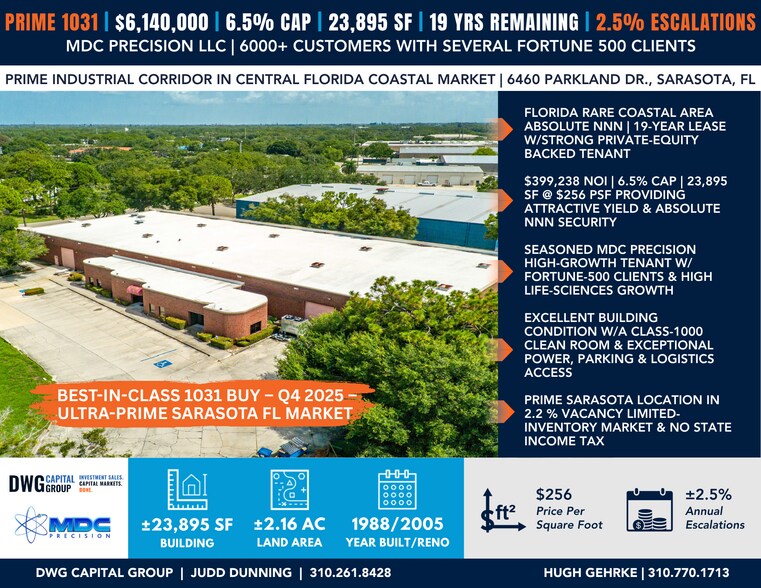

6460 Parkland Dr Industriel/Logistique 2 206 m² À vendre Sarasota, FL 34243 5 278 681 € (2 392,49 €/m²) Taux de capitalisation 6,50 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- 19 years of absolute NNN lease term with 2.5% annual escalations

- Acquisition basis at $256/SF versus replacement costs of $300–$350+/SF

- Submarket vacancy of just 2.2%, rent growth approaching 30% over three years

- Corporate guarantee from a private equity-backed global manufacturer

- Current rent levels in line with market averages, ensuring defensibility and upside

- Irreplaceable facility with specialized infrastructure and mission-critical role in MDC’s production

RÉSUMÉ ANALYTIQUE

Executive Overview

DWG Capital Group is pleased to present an institutional-quality coastal industrial investment located at 6460 Parkland Drive in Sarasota, Florida’s prime US-301 industrial corridor. The ±23,895 SF facility is fully leased to MDC Precision, LLC, a global manufacturer of precision vacuum components, under an absolute NNN lease with 19 years of term remaining and 2.5% fixed annual escalations, corporately guaranteed by its private equity sponsor.

The offering is priced at $6,140,000 ($256/SF), producing $399,238 in NOI for a 6.5% cap rate. This basis is materially below Sarasota replacement costs of $300–$350+/SF. With in-place rent of $16.72/SF NNN against submarket averages of $16–$20/SF, investors secure long-term passive cash flow on a credit-backed lease with clear reversionary potential.

Property & Lease Profile

The property was originally built in 1988 and underwent a comprehensive renovation in 2005, upgrading the facility to institutional standards. It features 25’ clear heights, a Class 1000 clean room, TIG/orbital welding infrastructure, vacuum brazing, 20kV testing, and 85% HVAC coverage throughout the manufacturing floor. The ±2.16-acre site provides 1,000 feet of visibility along U.S. Highway 301, efficient truck circulation, and quick access to I-75 and Sarasota-Bradenton International Airport, less than two miles away.

The lease is structured as absolute NNN, eliminating landlord responsibilities and delivering bond-like income. With nearly two decades of term, contractual escalations, and corporate backing, the asset is ideally suited for 1031 buyers, private capital, and institutional investors seeking long-duration income and appreciation.

Tenant & Credit Strength

MDC Precision, LLC has been operating since 1975 and today is a global leader in precision vacuum technology, serving more than 6,000 customers worldwide, including multiple Fortune 500 clients, aerospace/defense contractors, and leading university and government research institutions.

Backed by private equity, MDC is forecast to generate $90M+ in 2024 sales, building upon historical averages of $70–$80M and a cycle peak of $130M in 2022. Its Sarasota facility is the sole Eastern U.S. insulator-seal production hub, producing eight product groups manufactured nowhere else in the company’s platform. The tenant is ISO 9001:2015 certified, ITAR registered, and operates global facilities in the U.S. and U.K. This combination of mission-critical role, financial scale, and PE backing provides both defensive credit quality and growth-driven scalability.

Market Rent & Comparable Positioning

* The investment is priced and leased on a highly competitive basis relative to Sarasota submarket fundamentals:

* In-Place Rent: $16.72/SF NNN

* Market Rents: $16.00–$20.00/SF NNN across Sarasota industrial; flex and specialty space trading above $18/SF

* Recent Lease Comps: Specialty Class B industrial clean/conditioned space achieving $17.00–$19.50/SF NNN

* Recent Sale Comps: Coastal Florida industrial trades closing at $265–$345/SF with cap rates 5.25%–6.00%

At $256/SF, the subject property is priced at a discount to replacement cost, while current rent aligns with competitive market positioning, offering defensible economics and clear mark-to-market upside.

Sarasota Submarket

The property sits within Sarasota’s prime industrial corridor along US-301, one of Florida’s most supply-constrained coastal markets. Vacancy is currently 2.2% versus a national average of 6.16%, underscoring scarcity. Rents have increased by nearly 30% in the past three years, supported by population growth of 26% since 2010 to nearly 900,000 residents.

The location offers direct access to I-75, U.S. 41, and Port Manatee, as well as proximity to Sarasota-Bradenton International Airport, which carried 4.3 million passengers in 2023 (a 215% increase since 2018). Sarasota’s industrial base is diversified — logistics, aerospace, biotech, and advanced manufacturing users — creating a high-barrier, high-growth environment with limited new supply. Only 66,000 SF is currently under construction across the entire metro.

Investment Rationale

The Sarasota MDC offering represents a rare combination of long-term credit stability and embedded value creation:

* 19 years of absolute NNN lease term with 2.5% annual escalations

* Corporate guarantee from a private equity-backed global manufacturer

* Acquisition basis at $256/SF versus replacement costs of $300–$350+/SF

* Current rent levels in line with market averages, ensuring defensibility and upside

* Submarket vacancy of just 2.2%, rent growth approaching 30% over three years

* Irreplaceable facility with specialized infrastructure and mission-critical role in MDC’s production

This is a textbook institutional acquisition for 1031 exchange investors, private equity platforms, and net-lease buyers seeking stable yield and appreciation in one of Florida’s strongest coastal industrial markets.

About DWG Capital Group

DWG Capital Group is a national investment sales and advisory platform with more than $2 billion in closed transactions across 41 states and over 15,000 units executed. The firm specializes in industrial, commercial, multifamily, development, and capital markets advisory. The leadership team — Judd Dunning, Hugh Gehrke, and Mike Paytonjian — brings decades of capital markets and private equity experience, with backgrounds at Newmark Capital Markets and multiple CoStar Power Broker and LABJ CRE Gold Award recognitions.

DWG Capital Group is pleased to present an institutional-quality coastal industrial investment located at 6460 Parkland Drive in Sarasota, Florida’s prime US-301 industrial corridor. The ±23,895 SF facility is fully leased to MDC Precision, LLC, a global manufacturer of precision vacuum components, under an absolute NNN lease with 19 years of term remaining and 2.5% fixed annual escalations, corporately guaranteed by its private equity sponsor.

The offering is priced at $6,140,000 ($256/SF), producing $399,238 in NOI for a 6.5% cap rate. This basis is materially below Sarasota replacement costs of $300–$350+/SF. With in-place rent of $16.72/SF NNN against submarket averages of $16–$20/SF, investors secure long-term passive cash flow on a credit-backed lease with clear reversionary potential.

Property & Lease Profile

The property was originally built in 1988 and underwent a comprehensive renovation in 2005, upgrading the facility to institutional standards. It features 25’ clear heights, a Class 1000 clean room, TIG/orbital welding infrastructure, vacuum brazing, 20kV testing, and 85% HVAC coverage throughout the manufacturing floor. The ±2.16-acre site provides 1,000 feet of visibility along U.S. Highway 301, efficient truck circulation, and quick access to I-75 and Sarasota-Bradenton International Airport, less than two miles away.

The lease is structured as absolute NNN, eliminating landlord responsibilities and delivering bond-like income. With nearly two decades of term, contractual escalations, and corporate backing, the asset is ideally suited for 1031 buyers, private capital, and institutional investors seeking long-duration income and appreciation.

Tenant & Credit Strength

MDC Precision, LLC has been operating since 1975 and today is a global leader in precision vacuum technology, serving more than 6,000 customers worldwide, including multiple Fortune 500 clients, aerospace/defense contractors, and leading university and government research institutions.

Backed by private equity, MDC is forecast to generate $90M+ in 2024 sales, building upon historical averages of $70–$80M and a cycle peak of $130M in 2022. Its Sarasota facility is the sole Eastern U.S. insulator-seal production hub, producing eight product groups manufactured nowhere else in the company’s platform. The tenant is ISO 9001:2015 certified, ITAR registered, and operates global facilities in the U.S. and U.K. This combination of mission-critical role, financial scale, and PE backing provides both defensive credit quality and growth-driven scalability.

Market Rent & Comparable Positioning

* The investment is priced and leased on a highly competitive basis relative to Sarasota submarket fundamentals:

* In-Place Rent: $16.72/SF NNN

* Market Rents: $16.00–$20.00/SF NNN across Sarasota industrial; flex and specialty space trading above $18/SF

* Recent Lease Comps: Specialty Class B industrial clean/conditioned space achieving $17.00–$19.50/SF NNN

* Recent Sale Comps: Coastal Florida industrial trades closing at $265–$345/SF with cap rates 5.25%–6.00%

At $256/SF, the subject property is priced at a discount to replacement cost, while current rent aligns with competitive market positioning, offering defensible economics and clear mark-to-market upside.

Sarasota Submarket

The property sits within Sarasota’s prime industrial corridor along US-301, one of Florida’s most supply-constrained coastal markets. Vacancy is currently 2.2% versus a national average of 6.16%, underscoring scarcity. Rents have increased by nearly 30% in the past three years, supported by population growth of 26% since 2010 to nearly 900,000 residents.

The location offers direct access to I-75, U.S. 41, and Port Manatee, as well as proximity to Sarasota-Bradenton International Airport, which carried 4.3 million passengers in 2023 (a 215% increase since 2018). Sarasota’s industrial base is diversified — logistics, aerospace, biotech, and advanced manufacturing users — creating a high-barrier, high-growth environment with limited new supply. Only 66,000 SF is currently under construction across the entire metro.

Investment Rationale

The Sarasota MDC offering represents a rare combination of long-term credit stability and embedded value creation:

* 19 years of absolute NNN lease term with 2.5% annual escalations

* Corporate guarantee from a private equity-backed global manufacturer

* Acquisition basis at $256/SF versus replacement costs of $300–$350+/SF

* Current rent levels in line with market averages, ensuring defensibility and upside

* Submarket vacancy of just 2.2%, rent growth approaching 30% over three years

* Irreplaceable facility with specialized infrastructure and mission-critical role in MDC’s production

This is a textbook institutional acquisition for 1031 exchange investors, private equity platforms, and net-lease buyers seeking stable yield and appreciation in one of Florida’s strongest coastal industrial markets.

About DWG Capital Group

DWG Capital Group is a national investment sales and advisory platform with more than $2 billion in closed transactions across 41 states and over 15,000 units executed. The firm specializes in industrial, commercial, multifamily, development, and capital markets advisory. The leadership team — Judd Dunning, Hugh Gehrke, and Mike Paytonjian — brings decades of capital markets and private equity experience, with backgrounds at Newmark Capital Markets and multiple CoStar Power Broker and LABJ CRE Gold Award recognitions.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 5 278 681 € | Surface utile brute | 2 206 m² |

| Prix par m² | 2 392,49 € | Nb d’étages | 1 |

| Type de vente | Investissement | Année de construction | 1988 |

| Taux de capitalisation | 6,50 % | Occupation | Mono |

| Type de bien | Industriel/Logistique | Ratio de stationnement | 0,16/1 000 m² |

| Sous-type de bien | Entrepôt | Hauteur libre du plafond | 7,32 m |

| Classe d’immeuble | C | Nb d’accès plain-pied/portes niveau du sol | 1 |

| Surface du lot | 0,69 ha | ||

| Zonage | HM, Samoset - Fabrication lourde | ||

| Prix | 5 278 681 € |

| Prix par m² | 2 392,49 € |

| Type de vente | Investissement |

| Taux de capitalisation | 6,50 % |

| Type de bien | Industriel/Logistique |

| Sous-type de bien | Entrepôt |

| Classe d’immeuble | C |

| Surface du lot | 0,69 ha |

| Surface utile brute | 2 206 m² |

| Nb d’étages | 1 |

| Année de construction | 1988 |

| Occupation | Mono |

| Ratio de stationnement | 0,16/1 000 m² |

| Hauteur libre du plafond | 7,32 m |

| Nb d’accès plain-pied/portes niveau du sol | 1 |

| Zonage | HM, Samoset - Fabrication lourde |

1 of 1

TAXES FONCIÈRES

| Numéro de parcelle | 18498-2080-6 | Évaluation des aménagements | 3 069 249 € |

| Évaluation du terrain | 349 076 € | Évaluation totale | 3 418 325 € |

TAXES FONCIÈRES

Numéro de parcelle

18498-2080-6

Évaluation du terrain

349 076 €

Évaluation des aménagements

3 069 249 €

Évaluation totale

3 418 325 €

1 de 9

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

6460 Parkland Dr

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.