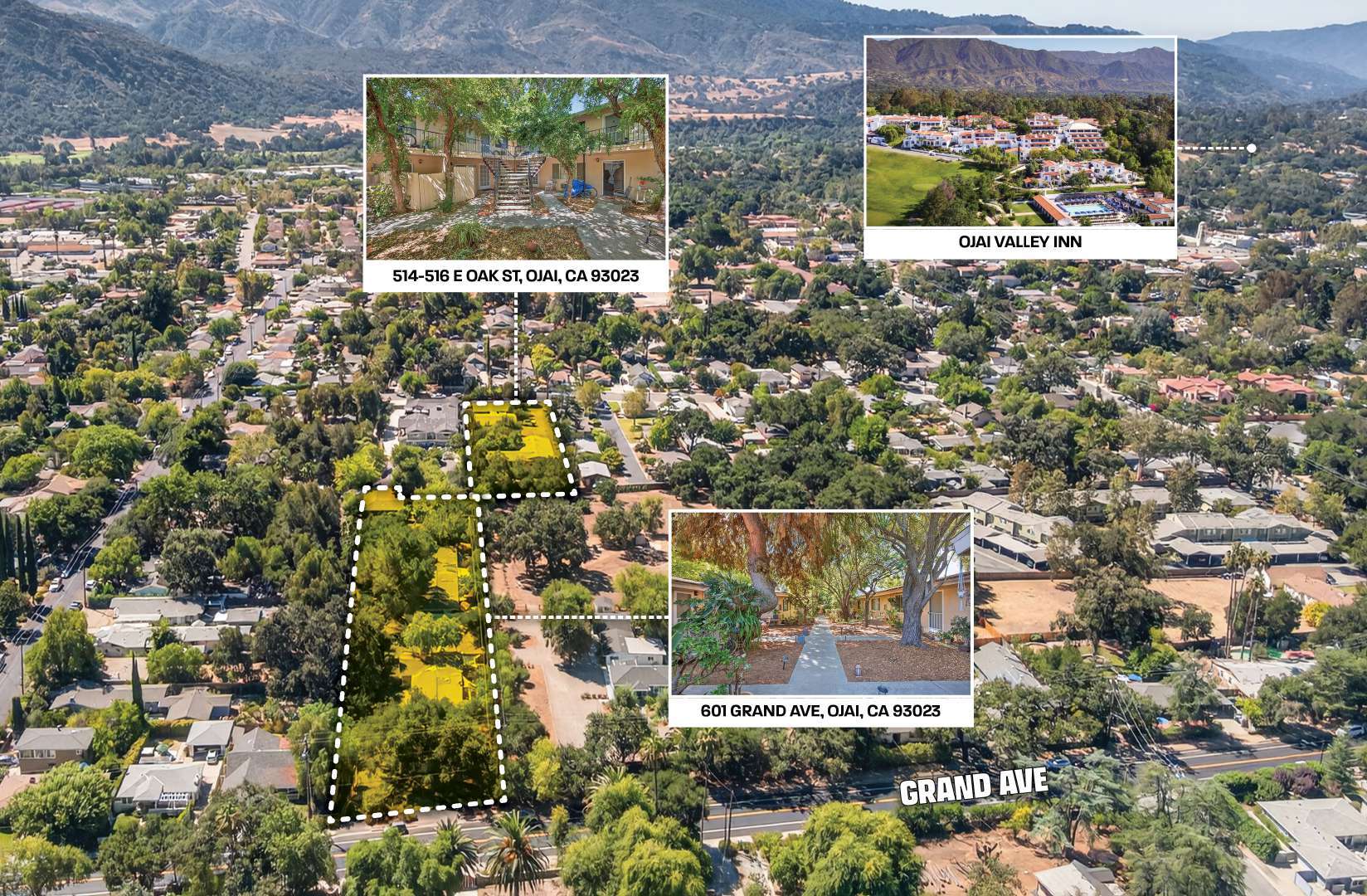

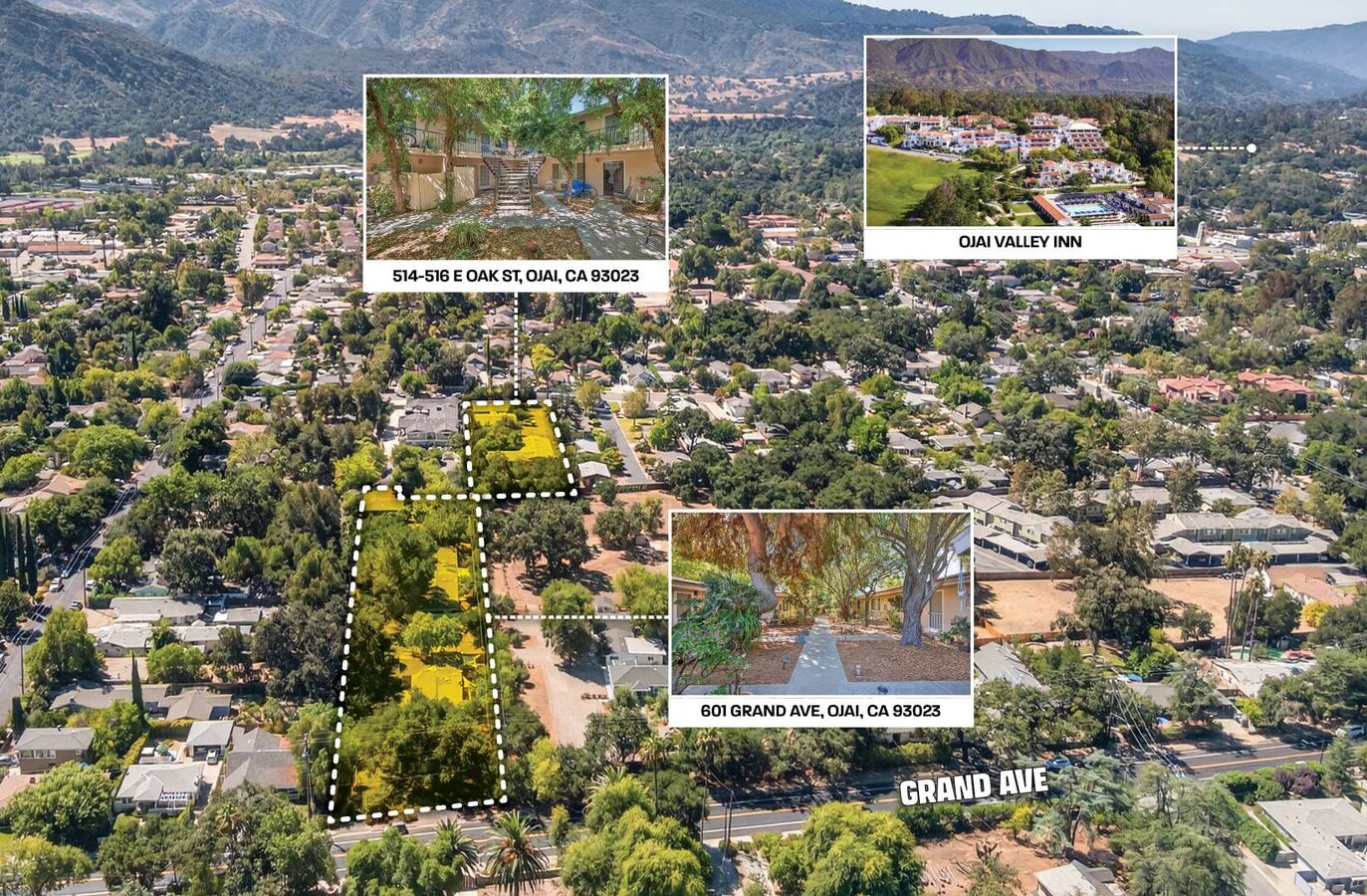

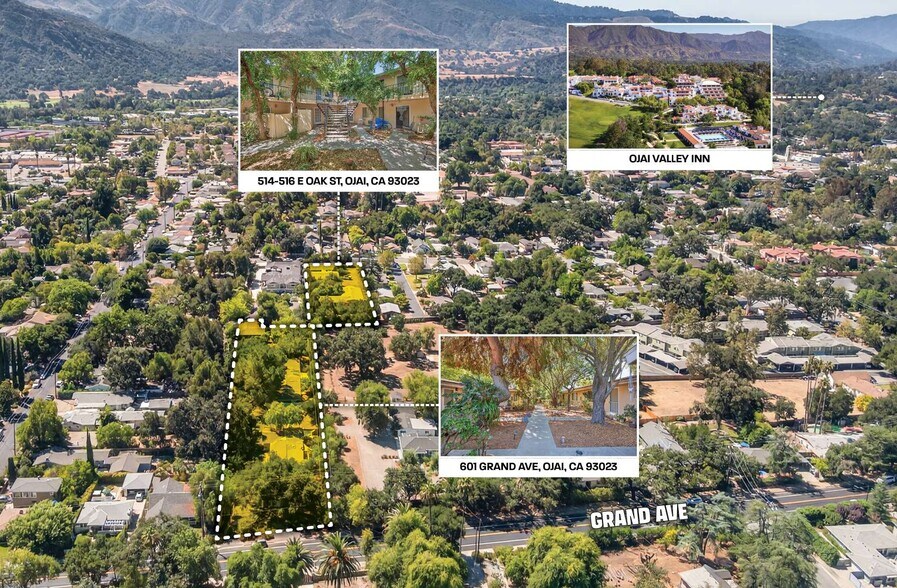

514-516 E Oak St | 601 Grand Ave

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

514-516 E Oak St 601 Grand Ave Immeuble residentiel 32 lots 7 369 800 € (230 306 €/Lot) Taux de capitalisation 5,37 % Ojai, CA 93023

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Generational Offering: First time on the market since the 1960s; long-term family ownership.

- Significant Rent Upside: Current average rents of $1,890/unit trail market by ~32 percent, with pro forma NOI of $702,178 (8.12 percent cap rate).

- Desirable Unit Mix: 20 × two-bed/one-bath (63 percent) and 11 × one-bed/one-bath (34 percent) units; average 772 SF.

- Expansive Land Holding: Two adjacent parcels combine for 2.75 acres in the heart of Ojai.

- ADU Expansion Potential: One studio ADU conversion available immediately (non-residential space). Up to 16 detached ADUs allowed under SB 1211 (2025).

- Renovated Units Demonstrate Premiums: Granite countertops, stainless appliances, recessed lighting, upgraded baths in select units.

RÉSUMÉ ANALYTIQUE

The LAAA Team of Marcus & Millichap is pleased to present the Grand East Oak Apartments, a 32-unit multifamily portfolio in the heart of Ojai, California. Spanning 2.75 acres across 601 Grand Avenue and 514–516 E Oak Street, the offering represents one of the largest multifamily landholdings in the city, where new supply is virtually impossible to replicate. The scale, location, and nearly three acres of contiguous land make this a rare opportunity for an investor to become one of Ojai’s largest private landowners. After more than six decades of family ownership, the properties are available for the first time since the 1960s, marking a generational opportunity in one of Southern California’s most tightly held markets.

The unit mix consists of 63 percent two-bedroom units and 34 percent one-bedroom units, with an average unit size of 772 SF. Current average rents of $1,890/unit ($2.45/SF) trail market averages of $2,503/unit ($3.24/SF), creating a 32% rental upside through natural turnover and light renovations. The property is subject to the City of Ojai’s local rent stabilization ordinance, which generally limits annual rent increases to 4% for non-exempt multifamily properties built before 1995, while still allowing landlords to set initial rents at market upon vacancy.

Select units have already been modernized with granite countertops, stainless steel appliances, recessed lighting, and upgraded bathrooms, demonstrating the property’s ability to capture premium rents. Community amenities include a resurfaced 20' × 40' swimming pool with its own bathroom and storage room, and many units feature large private backyards and/or patios, a rarity in multifamily properties of this size.

Beyond the embedded rent growth, the portfolio offers rare ADU development potential. An existing non-residential space can be easily converted into a studio ADU today, and under California Senate Bill 1211 (2025), the two parcels can support up to 16 detached ADUs (eight per parcel). Additional interior ADUs may be created through the conversion of existing storage or utility spaces, further increasing long-term density and returns.

At the current list price of $8,650,000 ($270,313/unit | $350/SF), the portfolio generates a 5.37 percent CAP rate on current income with a clear path to an 8.12 percent CAP rate on pro forma rents, offering both immediate cash flow and significant long-term upside.

The Grand East Oak Apartments are ideally located in the heart of Ojai, one of California’s most desirable lifestyle markets. Nestled in a tranquil valley surrounded by the Topa Topa Mountains and adjacent to the Los Padres National Forest, Ojai has cultivated a global reputation as a sanctuary for wellness, arts, and outdoor living.

Ojai’s unique identity is fiercely protected. The city maintains a ban on chain stores, ensuring a vibrant downtown of independent boutiques, art galleries, and restaurants. With a median home value of $1.4 million, many residents are renters by necessity despite above-average household incomes. Vacancy remains structurally low (Ventura County multifamily vacancy ~3.8%, Ojai tighter), and year-over-year rent growth has consistently outpaced regional and national averages.

Regionally, Ojai offers a rare “best of both worlds” proposition: a serene, small-town lifestyle with easy access to major employment centers. The property is 20 minutes to Ventura, 45 minutes to Santa Barbara, and 90 minutes to Los Angeles, making it attractive to professionals, families, and retirees alike.

The unit mix consists of 63 percent two-bedroom units and 34 percent one-bedroom units, with an average unit size of 772 SF. Current average rents of $1,890/unit ($2.45/SF) trail market averages of $2,503/unit ($3.24/SF), creating a 32% rental upside through natural turnover and light renovations. The property is subject to the City of Ojai’s local rent stabilization ordinance, which generally limits annual rent increases to 4% for non-exempt multifamily properties built before 1995, while still allowing landlords to set initial rents at market upon vacancy.

Select units have already been modernized with granite countertops, stainless steel appliances, recessed lighting, and upgraded bathrooms, demonstrating the property’s ability to capture premium rents. Community amenities include a resurfaced 20' × 40' swimming pool with its own bathroom and storage room, and many units feature large private backyards and/or patios, a rarity in multifamily properties of this size.

Beyond the embedded rent growth, the portfolio offers rare ADU development potential. An existing non-residential space can be easily converted into a studio ADU today, and under California Senate Bill 1211 (2025), the two parcels can support up to 16 detached ADUs (eight per parcel). Additional interior ADUs may be created through the conversion of existing storage or utility spaces, further increasing long-term density and returns.

At the current list price of $8,650,000 ($270,313/unit | $350/SF), the portfolio generates a 5.37 percent CAP rate on current income with a clear path to an 8.12 percent CAP rate on pro forma rents, offering both immediate cash flow and significant long-term upside.

The Grand East Oak Apartments are ideally located in the heart of Ojai, one of California’s most desirable lifestyle markets. Nestled in a tranquil valley surrounded by the Topa Topa Mountains and adjacent to the Los Padres National Forest, Ojai has cultivated a global reputation as a sanctuary for wellness, arts, and outdoor living.

Ojai’s unique identity is fiercely protected. The city maintains a ban on chain stores, ensuring a vibrant downtown of independent boutiques, art galleries, and restaurants. With a median home value of $1.4 million, many residents are renters by necessity despite above-average household incomes. Vacancy remains structurally low (Ventura County multifamily vacancy ~3.8%, Ojai tighter), and year-over-year rent growth has consistently outpaced regional and national averages.

Regionally, Ojai offers a rare “best of both worlds” proposition: a serene, small-town lifestyle with easy access to major employment centers. The property is 20 minutes to Ventura, 45 minutes to Santa Barbara, and 90 minutes to Los Angeles, making it attractive to professionals, families, and retirees alike.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 7 369 800 € | Sous-type de bien | Appartement |

| Prix par lot | 230 306 € | Style d’appartement | Avec jardin |

| Type de vente | Investissement | Classe d’immeuble | C |

| Taux de capitalisation | 5,37 % | Surface du lot | 1,11 ha |

| Multiplicateur du loyer brut | 11.86 | Surface de l’immeuble | 2 295 m² |

| Nb de lots | 32 | Nb d’étages | 2 |

| Type de bien | Immeuble residentiel | Année de construction | 1965 |

| Zonage | MULT | ||

| Prix | 7 369 800 € |

| Prix par lot | 230 306 € |

| Type de vente | Investissement |

| Taux de capitalisation | 5,37 % |

| Multiplicateur du loyer brut | 11.86 |

| Nb de lots | 32 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Style d’appartement | Avec jardin |

| Classe d’immeuble | C |

| Surface du lot | 1,11 ha |

| Surface de l’immeuble | 2 295 m² |

| Nb d’étages | 2 |

| Année de construction | 1965 |

| Zonage | MULT |

CARACTÉRISTIQUES

CARACTÉRISTIQUES DU LOT

- Climatisation

- Micro-ondes

- Chauffage

- Cuisine

- Réfrigérateur

- Four

- Cour

- Congélateur

CARACTÉRISTIQUES DU SITE

- Accès 24 h/24

- Terrain clôturé

- Piscine

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| 1+1 | 11 | - | 58 |

| 2+1 | 21 | - | 79 |

1 of 1

Walk Score®

Très praticable à pied (72)

TAXES FONCIÈRES

| Numéro de parcelle | 022-0-090-450 | Évaluation des aménagements | 3 091 772 € |

| Évaluation du terrain | 1 157 312 € | Évaluation totale | 4 249 083 € |

TAXES FONCIÈRES

Numéro de parcelle

022-0-090-450

Évaluation du terrain

1 157 312 €

Évaluation des aménagements

3 091 772 €

Évaluation totale

4 249 083 €

1 de 12

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

514-516 E Oak St | 601 Grand Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.