Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

Land - Candlewood Suites San Antonio Med Ctr 5353 Prue Rd Lot | Terrain commercial | 0,96 ha | À vendre | 1 251 306 € | San Antonio, TX 78240

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- The extended-stay orientation helps drive occupancy levels & reduce staff-to-guest ratio, resulting in lower operating costs & higher profit margins.

- Once developed, the hotel will be the newest hotel in the competitive set, superior to its competitors in terms of quality & product offering.

- Other corporate demand generators nearby include USAA’s corporate HQ campus, LabCorp, Frost Bank, Whataburger, HEB, Valero, Tesoro, & Rackspace.

- There is a shortage of newer, premium-branded, extended-stay hotels in the local submarket, which also lacks a midscale extended-stay hotel product.

- Strategically located just west of the Huebner Road Exit along I-10, approx. 3 mi from South Texas Medical Ctr. & 5 mi from Six Flags Fiesta Texas.

- This is an opportunity to construct a Candlewood Suites hotel in a major metropolitan area, with a potentially attractive exit capitalization rate.

RÉSUMÉ ANALYTIQUE

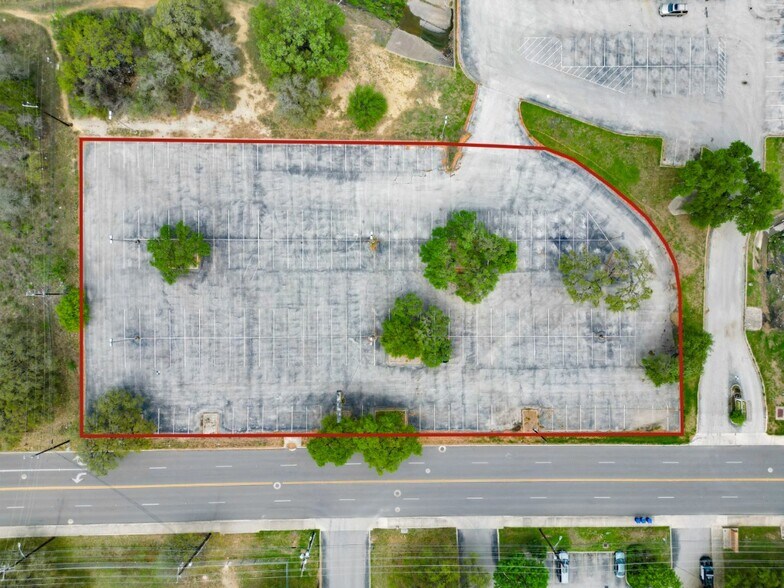

HVS Brokerage & Advisory, as the exclusive representative of ownership, is pleased to present the opportunity to acquire a strategically located 2.36-acre parcel totaling 102,845 square feet, fully entitled for the development of an 86-key Candlewood Suites hotel and an adjacent pad site in San Antonio, Texas. The property is located approximately three miles northwest of the South Texas Medical Center (STMC), a major hub for medical research and healthcare in the region.

PRICE REDUCTION: $1,450,000

Ownership is motivated to sell the property and has agreed to reduce the price to $1,450,000. Please contact Matthew Omansky for more details.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 1 251 306 € | Sous-type de bien | Terrain commercial |

| Type de vente | Investissement | Usage proposé | |

| Nb de lots | 1 | Surface totale du lot | 0,96 ha |

| Type de bien | Terrain | ||

| Zonage | c-3 | ||

| Prix | 1 251 306 € |

| Type de vente | Investissement |

| Nb de lots | 1 |

| Type de bien | Terrain |

| Sous-type de bien | Terrain commercial |

| Usage proposé | |

| Surface totale du lot | 0,96 ha |

| Zonage | c-3 |

1 LOT DISPONIBLE

Lot

| Prix | 1 251 306 € | Surface du lot | 0,96 ha |

| Prix par ha | 1 309 633,92 € |

| Prix | 1 251 306 € |

| Prix par ha | 1 309 633,92 € |

| Surface du lot | 0,96 ha |

Parcel Numbers: 1412336 & 1412337

DESCRIPTION

Highly Desirable Candlewood Suites Extended-Stay Hotel Development Opportunity Upon approval and development of the Candlewood Suites, an investor can expect a new, 20-year license agreement with InterContinental Hotels Group (IHG). The all-suite design promotes guest independence, which yields to lower housekeeping costs and higher profits. This business model benefits an investor to operate an asset that yields high gross-operating-profit (GOP) margins and net operating income (NOI) flow-through. The brand’s extended-stay orientation helps to drive occupancy levels and reduce the team member-to-guest ratio, resulting in lower operating costs and some of the highest profit margins in the industry. With more than 100 million members, IHG gives members access to more than 6,600 hotels across 19 brands. The IHG One Rewards is an effective tool for driving customers to IHG hotels and creating brand loyalty. Strong Market Fundamentals, Absence of Midscale Extended-Stay Supply There is a shortage of newer vintage, premium-branded, extended-stay hotels in the local submarket, which also lacks a midscale extended-stay hotel product, such as a Candlewood Suites hotel. Per the STR trend report, the competitive submarket—comprising four midscale to upper-midscale extended-stay and limited-service hotels—achieved an average occupancy level of 62.6%, average daily rate (ADR) of $101, and RevPAR of $63 for the trailing-twelve-month (TTM) period ending February 2025. According to the occupancy tax receipts for year-end 2024, the 2007-built TownePlace Suites by Marriott San Antonio Northwest, located adjacent to the property, achieved a RevPAR of $47, amounting to $2.1 million (rounded) in rooms revenue. Once developed, the proposed hotel will be the newest hotel in the competitive set, superior to its competitors in terms of quality and product offering, inclusive of the in-room kitchens. Based on HVS pro-forma projections, stabilized rooms revenue is anticipated to exceed $2.4 million, with an NOI flow-through of over $1,100,000 (rounded), resulting in a RevPAR of over $78. Excellent I-10 Location Among Strong Corporate & Leisure Demand Generators The property is strategically located near the intersection of Fredericksburg and Prue Roads, just west of the Huebner Road Exit along Interstate 10 (1-10), approximately three miles from the South Texas Medical Center (STMC) and five miles from Six Flags Fiesta Texas. Other corporate demand generators nearby include USAA’s corporate headquarters’ campus, LabCorp, Frost Bank, Whataburger, HEB, Valero, Tesoro, and Rackspace. Available dining options near the property include Cracker Barrel Old Country Store; Bill Miller BBQ; Magnolia Pancake Haus; Snooze, an A.M. Eatery; and Alamo Biscuit Company & Panadería. Significant Upside for Developer to Exit The offering presents a developer with an opportunity to construct a Candlewood Suites hotel in a major metropolitan area, with a potentially attractive exit capitalization rate. Following construction and stabilization of operations, the hotel asset would be a desired investment for the comprehensive pool of regional and national investors interested in premium-branded hotel investments. The offering also includes an option to develop the adjoining pad site for retail use or quick-service restaurant (QSR) construction, which would provide natural synergy for an extended-stay hotel to further increase guest retention; alternatively, an investor would have the ability to subdivide and sell off the pad site.

Présenté par

Land - Candlewood Suites San Antonio Med Ctr | 5353 Prue Rd

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.