Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

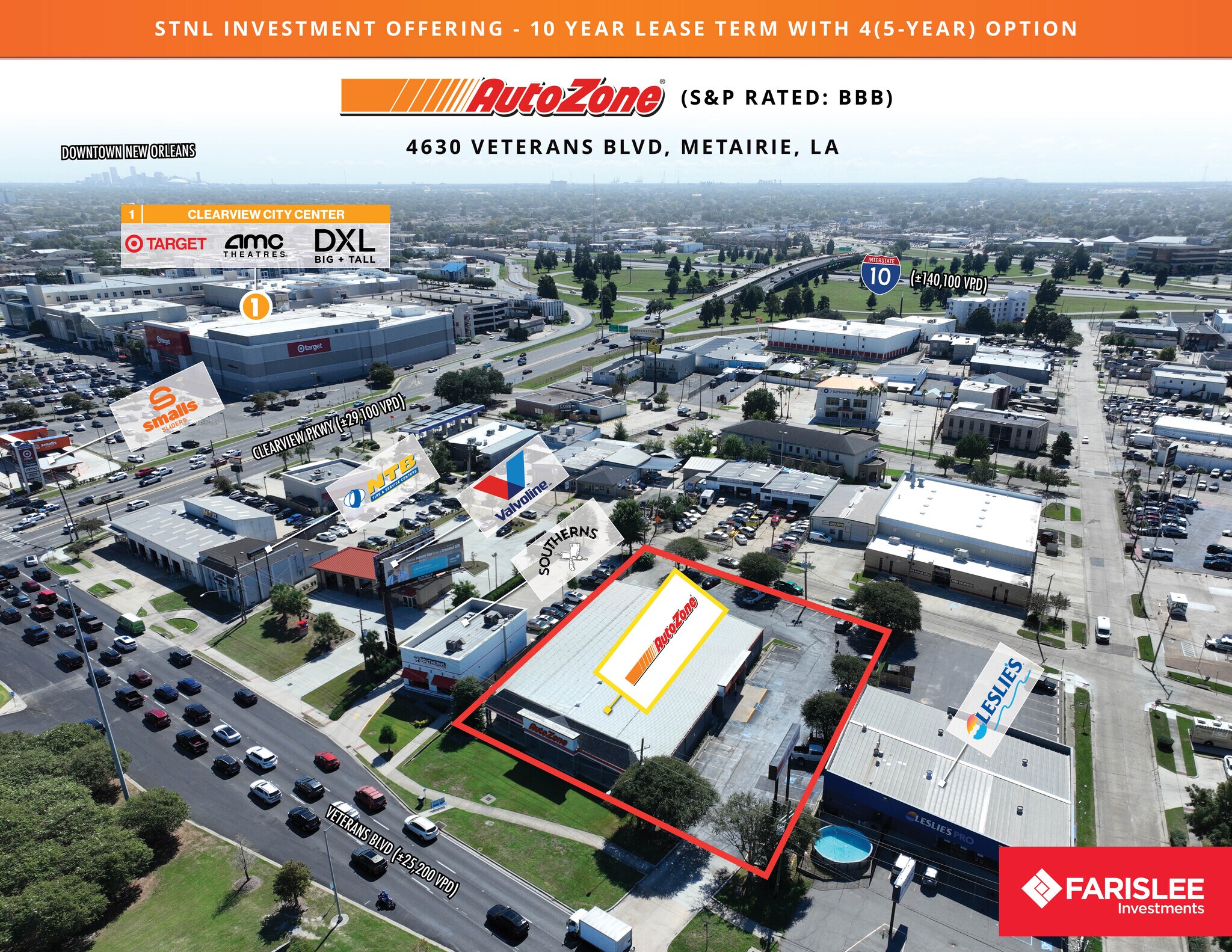

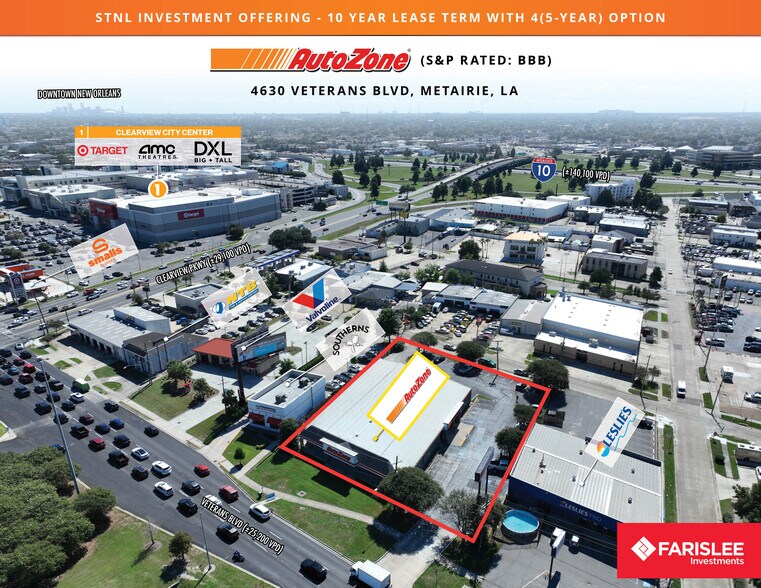

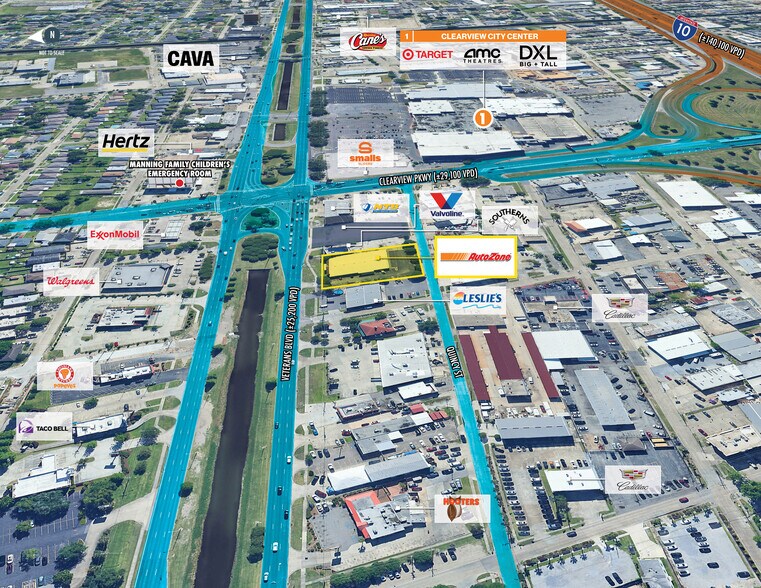

STNL AutoZone/BBB Credit/10 Yr Lease 4630 Veterans Memorial Blvd Local commercial 1 316 m² À vendre Metairie, LA 70006 4 682 150 € (3 557,94 €/m²) Taux de capitalisation 5,41 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- AutoZone: Largest U.S. auto parts retailer (NYSE: AZO) with 7,100+ stores worldwide, $18.5B+ in 2024 revenue, and BBB (S&P) credit rating.

- Long-Term Lease: New 10-year AutoZone lease with four 5-year renewal options provides up to 30 years of stable income.

- Prime Metairie, LA Location: 4th largest city in Louisiana with 133,000+ residents nearby, just 6 miles from downtown New Orleans

- Easy Management & Single-Tenant NNN Lease: Tenant covers all expenses, including maintenance, taxes, and insurance, ideal for passive or 1031 investor

- Growing Income Stream: 8% rent increases every 5 years provide rising cash flow, value growth, and an inflation hedge.

RÉSUMÉ ANALYTIQUE

LOUISIANA BROKER OF RECORD ….SRSA Commercial Real Estate / Steve Reisig / License No. 14916A

Faris Lee Investments is pleased to present the unique opportunity to acquire a single-tenant, triple-net (NNN) leased property occupied by AutoZone, a dominant force in the automotive aftermarket industry. This asset represents a premier passive investment, secured by a long-term lease with a high-credit national tenant located in a core market of the New Orleans MSA.

This specific location is in Metairie, Louisiana, which is a strategically positioned suburb just six miles northwest of downtown New Orleans. Metairie is a robust market, ranking as the fourth most populous community in Louisiana and boasting a high-density population of over 133,000 residents within a three-mile radius. This area is a significant regional economic hub and is notably home to the corporate headquarters and training facilities for both the New Orleans Saints (NFL) and the New Orleans Pelicans (NBA).

The investment is backed by an exeptionally strong corporate guarantee. AutoZone (NYSE: ATO) is the largest auto parts retailer in the U.S. and carries an investment-grade credit rating of ‘BBB’ from S&P. AutoZone demonstrates exceptional financial strength with a massive market capitalization of approximately $67.42 billion and fiscal year 2024 revenues exceeding $18.5 billion.

An ideal feature is the triple-net (NNN) lease structure, which transfers sole responsibility for property taxes, insurance, and CAM directly to the tenant. Landlord is responsible for roof and structure, as well as parking lot repairs only for the first three years. This complete delegation of responsibilities provides a management-free asset perfect for a passive investor, a 1031 exchange, or anyone seeking a secure addition to their portfolio.

Long-term stability and income growth are built directly into the lease. AutoZone recently executed a new 10-year primary lease term with 4 (5-year) options, creating a potential total lease term of up to thirty years. Furthermore, the lease includes a growing income stream with 8% rental increases every five years. These scheduled escalations ensure consistently increasing cash flow for the investor, creating long-term value appreciation and serving as a robust hedge against inflation.

Faris Lee Investments is pleased to present the unique opportunity to acquire a single-tenant, triple-net (NNN) leased property occupied by AutoZone, a dominant force in the automotive aftermarket industry. This asset represents a premier passive investment, secured by a long-term lease with a high-credit national tenant located in a core market of the New Orleans MSA.

This specific location is in Metairie, Louisiana, which is a strategically positioned suburb just six miles northwest of downtown New Orleans. Metairie is a robust market, ranking as the fourth most populous community in Louisiana and boasting a high-density population of over 133,000 residents within a three-mile radius. This area is a significant regional economic hub and is notably home to the corporate headquarters and training facilities for both the New Orleans Saints (NFL) and the New Orleans Pelicans (NBA).

The investment is backed by an exeptionally strong corporate guarantee. AutoZone (NYSE: ATO) is the largest auto parts retailer in the U.S. and carries an investment-grade credit rating of ‘BBB’ from S&P. AutoZone demonstrates exceptional financial strength with a massive market capitalization of approximately $67.42 billion and fiscal year 2024 revenues exceeding $18.5 billion.

An ideal feature is the triple-net (NNN) lease structure, which transfers sole responsibility for property taxes, insurance, and CAM directly to the tenant. Landlord is responsible for roof and structure, as well as parking lot repairs only for the first three years. This complete delegation of responsibilities provides a management-free asset perfect for a passive investor, a 1031 exchange, or anyone seeking a secure addition to their portfolio.

Long-term stability and income growth are built directly into the lease. AutoZone recently executed a new 10-year primary lease term with 4 (5-year) options, creating a potential total lease term of up to thirty years. Furthermore, the lease includes a growing income stream with 8% rental increases every five years. These scheduled escalations ensure consistently increasing cash flow for the investor, creating long-term value appreciation and serving as a robust hedge against inflation.

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

1 316 m²

Classe d’immeuble

C

Année de construction

2024

Prix

4 682 150 €

Prix par m²

3 557,94 €

Taux de capitalisation

5,41 %

RNE

253 232 €

Occupation

Mono

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,37

Surface du lot

0,36 ha

Zonage

R1A

Stationnement

80 places (60,79 places par 1 000 m² loué)

Façade

34 m sur Veterans Memorial Blvd

1 1

Walk Score®

Très praticable à pied (80)

PRINCIPAUX COMMERCES À PROXIMITÉ

1 sur 8

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

STNL AutoZone/BBB Credit/10 Yr Lease | 4630 Veterans Memorial Blvd

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.