Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

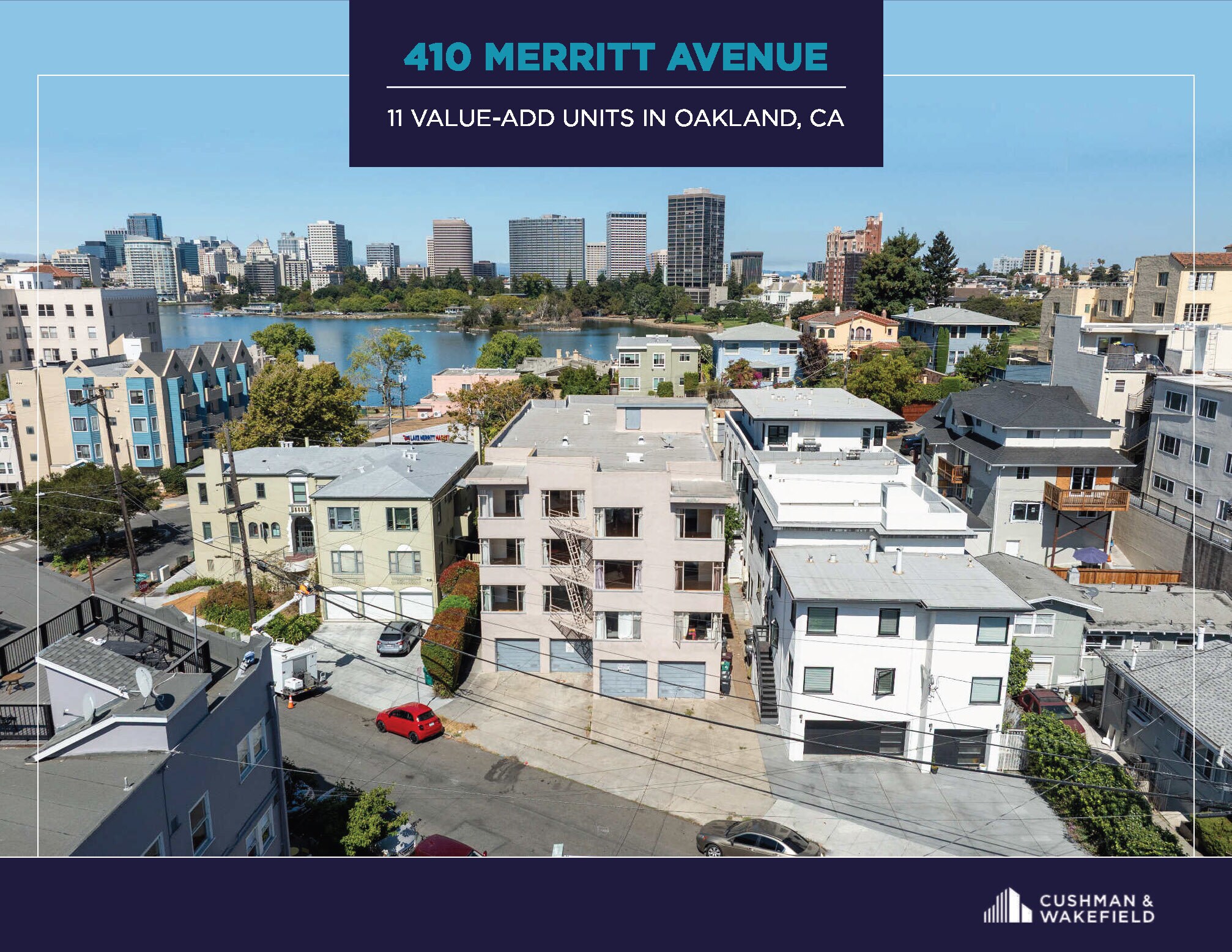

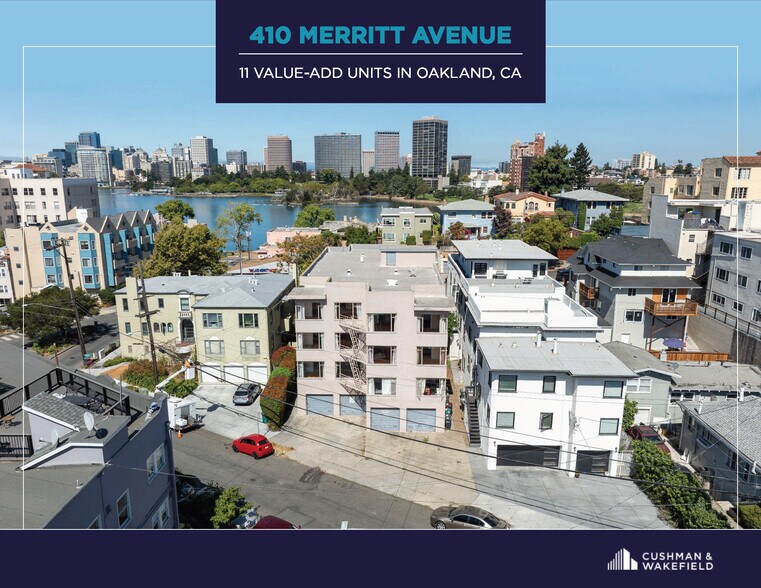

11 Value-Add Units | Cleveland Heights 410 Merritt Ave Immeuble residentiel 11 lots 1 911 058 € (173 733 €/Lot) Taux de capitalisation 8,83 % Oakland, CA 94610

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Premier Location in Cleveland Heights

- Concrete Podium Construction

- Attractive Stabilized Return Profile

- Flexible Layouts with Density Upside

- Opportunity to Renovate 7 Units & Achieve Top of The Market Rents

- Highly Walkable, Transit-Rich Location

RÉSUMÉ ANALYTIQUE

Property Tours are available by appointment.

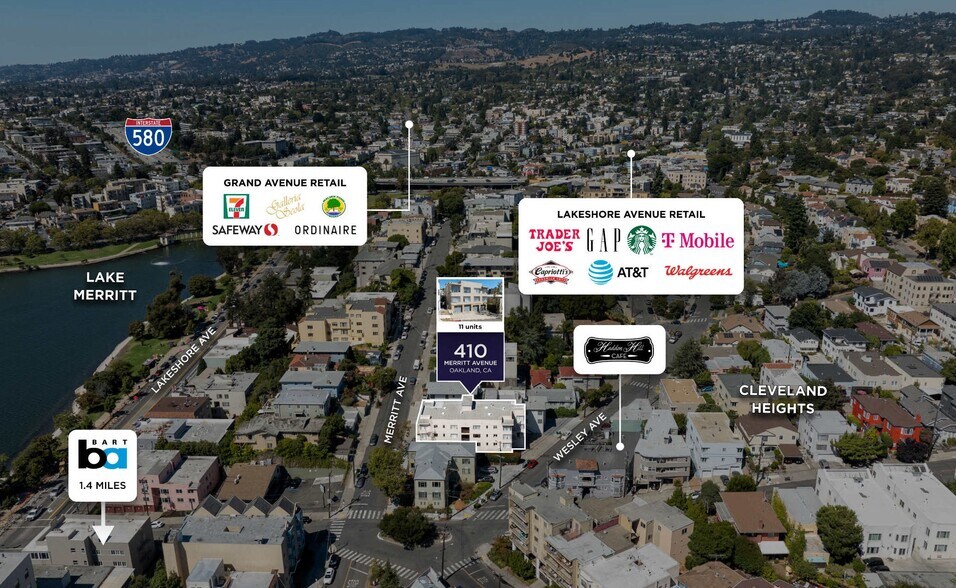

The Cushman & Wakefield Northern California Multifamily Capital Markets Group is pleased to offer for sale 410 Merritt Avenue, an 11-unit multifamily investment opportunity in Oakland’s highly desirable Cleveland Heights neighborhood. The offering provides investors with the ability to immediately implement a renovation program and capture significant upside through repositioning. The property is ideally suited for a value-add strategy, combining strong in-place fundamentals with meaningful near-term potential to drive rental income growth.

The unit mix is both spacious and efficient, featuring three 2-bedroom units averaging 945 square feet, seven 1-bedroom units averaging 711 square feet, and one 320-square-foot studio. Each 1- and 2-bedroom unit includes a dining nook that can be converted into an additional bedroom through a cost-effective process, creating the opportunity to increase density and further enhance revenue. The property also features 8 single-car garages with room to park an additional vehicle in front of each garage. Upon stabilization, the property is projected to achieve an attractive 8.83% cap rate, highlighting the compelling investment returns available to an active operator.

The building was constructed with a concrete podium that exempts it from Oakland’s mandatory soft story retrofit program, reducing exposure to costly seismic upgrades. Beyond its physical attributes, the property enjoys a highly walkable location with a 91 Walk Score, providing residents with convenient access to AC Transit, major freeway on-ramps, and nearby BART stations for seamless regional connectivity.

Just steps from Lakeshore Avenue and Grand Avenue, two of Oakland’s most vibrant commercial corridors, the property is surrounded by a diverse mix of dining, retail, and entertainment amenities. This dynamic location, paired with the property’s strong fundamentals and substantial repositioning potential, makes this offer an exceptional opportunity for investors seeking long-term growth and cash flow in one of Oakland’s most sought-after rental submarkets.

The Cushman & Wakefield Northern California Multifamily Capital Markets Group is pleased to offer for sale 410 Merritt Avenue, an 11-unit multifamily investment opportunity in Oakland’s highly desirable Cleveland Heights neighborhood. The offering provides investors with the ability to immediately implement a renovation program and capture significant upside through repositioning. The property is ideally suited for a value-add strategy, combining strong in-place fundamentals with meaningful near-term potential to drive rental income growth.

The unit mix is both spacious and efficient, featuring three 2-bedroom units averaging 945 square feet, seven 1-bedroom units averaging 711 square feet, and one 320-square-foot studio. Each 1- and 2-bedroom unit includes a dining nook that can be converted into an additional bedroom through a cost-effective process, creating the opportunity to increase density and further enhance revenue. The property also features 8 single-car garages with room to park an additional vehicle in front of each garage. Upon stabilization, the property is projected to achieve an attractive 8.83% cap rate, highlighting the compelling investment returns available to an active operator.

The building was constructed with a concrete podium that exempts it from Oakland’s mandatory soft story retrofit program, reducing exposure to costly seismic upgrades. Beyond its physical attributes, the property enjoys a highly walkable location with a 91 Walk Score, providing residents with convenient access to AC Transit, major freeway on-ramps, and nearby BART stations for seamless regional connectivity.

Just steps from Lakeshore Avenue and Grand Avenue, two of Oakland’s most vibrant commercial corridors, the property is surrounded by a diverse mix of dining, retail, and entertainment amenities. This dynamic location, paired with the property’s strong fundamentals and substantial repositioning potential, makes this offer an exceptional opportunity for investors seeking long-term growth and cash flow in one of Oakland’s most sought-after rental submarkets.

BILAN FINANCIER (RÉEL - 2024) |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

238 275 €

|

256,68 €

|

| Autres revenus |

7 683 €

|

8,28 €

|

| Perte due à la vacance |

11 913 €

|

12,83 €

|

| Revenu brut effectif |

234 045 €

|

252,13 €

|

| Taxes |

24 143 €

|

26,01 €

|

| Frais d’exploitation |

40 836 €

|

43,99 €

|

| Total des frais |

64 979 €

|

70,00 €

|

| Résultat net d’exploitation |

169 066 €

|

182,13 €

|

BILAN FINANCIER (RÉEL - 2024)

| Revenu de location brut | |

|---|---|

| Annuel | 238 275 € |

| Annuel par m² | 256,68 € |

| Autres revenus | |

|---|---|

| Annuel | 7 683 € |

| Annuel par m² | 8,28 € |

| Perte due à la vacance | |

|---|---|

| Annuel | 11 913 € |

| Annuel par m² | 12,83 € |

| Revenu brut effectif | |

|---|---|

| Annuel | 234 045 € |

| Annuel par m² | 252,13 € |

| Taxes | |

|---|---|

| Annuel | 24 143 € |

| Annuel par m² | 26,01 € |

| Frais d’exploitation | |

|---|---|

| Annuel | 40 836 € |

| Annuel par m² | 43,99 € |

| Total des frais | |

|---|---|

| Annuel | 64 979 € |

| Annuel par m² | 70,00 € |

| Résultat net d’exploitation | |

|---|---|

| Annuel | 169 066 € |

| Annuel par m² | 182,13 € |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 1 911 058 € | Style d’appartement | De faible hauteur |

| Prix par lot | 173 733 € | Classe d’immeuble | C |

| Type de vente | Investissement | Surface du lot | 0,06 ha |

| Taux de capitalisation | 8,83 % | Surface de l’immeuble | 928 m² |

| Multiplicateur du loyer brut | 8.04 | Nb d’étages | 2 |

| Nb de lots | 11 | Année de construction | 1950 |

| Type de bien | Immeuble residentiel | Ratio de stationnement | 0,15/1 000 m² |

| Sous-type de bien | Appartement |

| Prix | 1 911 058 € |

| Prix par lot | 173 733 € |

| Type de vente | Investissement |

| Taux de capitalisation | 8,83 % |

| Multiplicateur du loyer brut | 8.04 |

| Nb de lots | 11 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | C |

| Surface du lot | 0,06 ha |

| Surface de l’immeuble | 928 m² |

| Nb d’étages | 2 |

| Année de construction | 1950 |

| Ratio de stationnement | 0,15/1 000 m² |

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| Studios | 1 | 1 618 € | 30 |

| 1+1 | 7 | 2 129 € | 65 - 66 |

| 2+1 | 3 | 2 470 € | 88 |

1 1

Walk Score®

Idéal pour les promeneurs (91)

Bike Score®

Très praticable en vélo (76)

TAXES FONCIÈRES

| Numéro de parcelle | 023-0413-008-01 | Évaluation totale | 276 115 € (2025) |

| Évaluation du terrain | 96 007 € (2025) | Impôts annuels | 24 143 € (26,01 €/m²) |

| Évaluation des aménagements | 169 088 € (2025) | Année d’imposition | 2024 |

TAXES FONCIÈRES

Numéro de parcelle

023-0413-008-01

Évaluation du terrain

96 007 € (2025)

Évaluation des aménagements

169 088 € (2025)

Évaluation totale

276 115 € (2025)

Impôts annuels

24 143 € (26,01 €/m²)

Année d’imposition

2024

1 sur 28

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

11 Value-Add Units | Cleveland Heights | 410 Merritt Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.