3211 Anton St

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

3211 Anton St Industriel/Logistique 2 138 m² À vendre Mobile, AL 36612 9 171 456 € (4 288,85 €/m²) Taux de capitalisation 6,25 %

RÉSUMÉ ANALYTIQUE

PRIME PORT LOCATION – The Port of Mobile ranks among the nation’s top ports by trade volume, with strategic connectivity that allows distributors to reach 50% of the U.S. population within 48 hours of cargo arrival. As of 2025, the Alabama Port Authority is in the final phase of a major deepening and widening project that will make Mobile the deepest port on the Gulf Coast. The project remains on schedule for completion by summer 2025 and is expected to significantly enhance vessel capacity, global trade access, and long-term economic growth for Alabama and the broader U.S. logistics network.

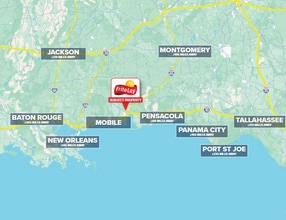

STRATEGIC INTERSTATE ACCESS – Positioned directly along Interstate 65 (I-65) and in close proximity to Interstate 10 (I-10), the property offers exceptional access to two of the nation’s most critical freight corridors. I-65 serves as a major north-south route connecting Mobile to Chicago and the Midwest, while I-10 spans over 2,460 miles across key southern states from California to Florida. This strategic location also provides quick connectivity to regional transportation hubs, including the Brookley Aeroplex and Mobile International Airport.

FRITO-LAY / PEPSICO – Frito-Lay, a division of PepsiCo, Inc., continues to lead the national snack industry with renowned brands such as Lay’s, Doritos, Fritos, Cheetos, Tostitos, Sun Chips, and Ruffles. In 2024, Frito-Lay North America (FLNA) reported net revenue of $24.75 billion, accounting for approximately 27% of PepsiCo’s total net revenue of $91.85 billion. PepsiCo’s operating profit for 2024 was $12.89 billion, with FLNA contributing $6.32 billion, representing approximately 49% of the total operating profit. PepsiCo maintains a strong credit rating, with S&P Global Ratings assigning an A+ rating and Moody’s Investors Service affirming an A1 rating with a stable outlook. Established in 1898, PepsiCo was formed through the merger of Frito-Lay and Pepsi-Cola in 1965.

BRAND-NEW CONSTRUCTION / FUNCTIONAL INDUSTRIAL – This new distribution warehouse serves as a Product Exchange Center for Frito-Lay/PepsiCo as a ±23,018 square foot building on ±4.70 acres of land (11.23% Building/Lot Coverage). Featuring 16 docks, 1 grade level door, and abundant yard space for truck loading and parking – this property is a highly functional building while also maintaining the ability to further expand the facility with additional square footage in the future.

LONG TERM INDUSTRIAL NNN LEASE / ANNUAL RENT INCREASES – Frito-Lay signed a 10-year Industrial NNN lease that commenced in May 2025 featuring 2.00% annual rent increases allowing a strong hedge against inflation.

STRATEGIC INTERSTATE ACCESS – Positioned directly along Interstate 65 (I-65) and in close proximity to Interstate 10 (I-10), the property offers exceptional access to two of the nation’s most critical freight corridors. I-65 serves as a major north-south route connecting Mobile to Chicago and the Midwest, while I-10 spans over 2,460 miles across key southern states from California to Florida. This strategic location also provides quick connectivity to regional transportation hubs, including the Brookley Aeroplex and Mobile International Airport.

FRITO-LAY / PEPSICO – Frito-Lay, a division of PepsiCo, Inc., continues to lead the national snack industry with renowned brands such as Lay’s, Doritos, Fritos, Cheetos, Tostitos, Sun Chips, and Ruffles. In 2024, Frito-Lay North America (FLNA) reported net revenue of $24.75 billion, accounting for approximately 27% of PepsiCo’s total net revenue of $91.85 billion. PepsiCo’s operating profit for 2024 was $12.89 billion, with FLNA contributing $6.32 billion, representing approximately 49% of the total operating profit. PepsiCo maintains a strong credit rating, with S&P Global Ratings assigning an A+ rating and Moody’s Investors Service affirming an A1 rating with a stable outlook. Established in 1898, PepsiCo was formed through the merger of Frito-Lay and Pepsi-Cola in 1965.

BRAND-NEW CONSTRUCTION / FUNCTIONAL INDUSTRIAL – This new distribution warehouse serves as a Product Exchange Center for Frito-Lay/PepsiCo as a ±23,018 square foot building on ±4.70 acres of land (11.23% Building/Lot Coverage). Featuring 16 docks, 1 grade level door, and abundant yard space for truck loading and parking – this property is a highly functional building while also maintaining the ability to further expand the facility with additional square footage in the future.

LONG TERM INDUSTRIAL NNN LEASE / ANNUAL RENT INCREASES – Frito-Lay signed a 10-year Industrial NNN lease that commenced in May 2025 featuring 2.00% annual rent increases allowing a strong hedge against inflation.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 9 171 456 € | Surface utile brute | 2 138 m² |

| Prix par m² | 4 288,85 € | Nb d’étages | 1 |

| Type de vente | Investissement triple net | Année de construction | 2025 |

| Taux de capitalisation | 6,25 % | Occupation | Mono |

| Type de bien | Industriel/Logistique | Nb de portes élevées/de chargement | 16 |

| Sous-type de bien | Entrepôt | Nb d’accès plain-pied/portes niveau du sol | 1 |

| Classe d’immeuble | B | Zone de développement économique [USA] |

Oui

|

| Surface du lot | 1,9 ha |

| Prix | 9 171 456 € |

| Prix par m² | 4 288,85 € |

| Type de vente | Investissement triple net |

| Taux de capitalisation | 6,25 % |

| Type de bien | Industriel/Logistique |

| Sous-type de bien | Entrepôt |

| Classe d’immeuble | B |

| Surface du lot | 1,9 ha |

| Surface utile brute | 2 138 m² |

| Nb d’étages | 1 |

| Année de construction | 2025 |

| Occupation | Mono |

| Nb de portes élevées/de chargement | 16 |

| Nb d’accès plain-pied/portes niveau du sol | 1 |

| Zone de développement économique [USA] |

Oui |

1 of 1

1 de 8

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

3211 Anton St

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.