Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- EXCEPTIONAL STNL INDUSTRIAL INVESTMENT OPPORTUNITY

- HIGHLY DESIRABLE INDUSTRIAL LOCATION WITH AFFLUENT POPULATION BASE

- COMPELLING MARKET FUNDAMENTALS

RÉSUMÉ ANALYTIQUE

COPY LINK TO DOWNLOAD OFFERING MEMORANDUM: https://www.pcplistings.com/listings/27635diaz/

EXCEPTIONAL STNL INDUSTRIAL INVESTMENT OPPORTUNITY

— Strategic Investment | The offering presents a rare opportunity to acquire a fully improved industrial building in Temecula, CA. The property was turn-keyed for Tesla, Inc. as a collision center servicing the affluent Southwest Riverside County population base.

— Durable Cash Flow with Inflationary Hedge | New ownership enjoys an in-place lease that spans nearly 12 more years. The lease generates a net income of $968,083 in the first year of ownership. A three-percent annual increase in rent provides an attractive hedge against future inflationary pressures.

— Investment-Grade Tenancy | Tesla, Inc. (Moody’s: Baa3) is the most valuable car maker in the world by a wide margin over its competitors. It remains one of the most valuable brands in the world, according to Interbrand.

— Bonus Depreciation Advantage | Given the new tax legislation passed July 2025, new ownership has the opportunity to accelerate the depreciation deduction in the first year of ownership, which would provide significant upfront tax savings and improve cash flow. CBRE's Cost Segregation Analysis estimates that such Year 1 deduction could total as much as ±2.9 million with this acquisition.

COMPELLING MARKET FUNDAMENTALS

— Pro-Growth | The City of Temecula actively promotes incentive programs such as “FRESH Incentive” to lure new capital investment, diversify the tax base and create jobs. .

— Diversified Industries | Known historically as wine country, Temecula in recent years has made a push to diversify the industry base by establishing itself as a hub for advanced manufacturing, AI/robotics, biotech, life sciences, aerospace and more.

— Leading Market for Electric Vehicles (EV) | California is the largest EV market in the country, according to the U.S. Department of Energy’s TransAtlas dashboard. EV registration in California has grown 359% in the last five years, to 1.26 million registrations in 2023. California has only 10 years to meet its Zero-Emission Mandate. Yet, EVs represent only 3.4% of the car market in California, which provides Tesla an incredible opportunity for continuing market penetration.

HIGHLY DESIRABLE INDUSTRIAL LOCATION WITH AFFLUENT POPULATION BASE

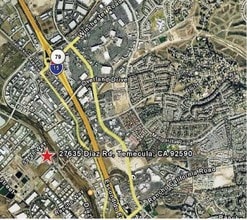

— Strong Industrial Location | Situated off Interstate-15, the property sits within a highly desirable industrial pocket in Temecula.

— Quality-of-Life and Amenity Base | Temecula offers lifestyle amenities such as wine country, resorts, tourism, and a casino, along with affordable housing, and expansive retail options that promotes a quality-of-life that is hard to replicate in Southern California.

EXCEPTIONAL STNL INDUSTRIAL INVESTMENT OPPORTUNITY

— Strategic Investment | The offering presents a rare opportunity to acquire a fully improved industrial building in Temecula, CA. The property was turn-keyed for Tesla, Inc. as a collision center servicing the affluent Southwest Riverside County population base.

— Durable Cash Flow with Inflationary Hedge | New ownership enjoys an in-place lease that spans nearly 12 more years. The lease generates a net income of $968,083 in the first year of ownership. A three-percent annual increase in rent provides an attractive hedge against future inflationary pressures.

— Investment-Grade Tenancy | Tesla, Inc. (Moody’s: Baa3) is the most valuable car maker in the world by a wide margin over its competitors. It remains one of the most valuable brands in the world, according to Interbrand.

— Bonus Depreciation Advantage | Given the new tax legislation passed July 2025, new ownership has the opportunity to accelerate the depreciation deduction in the first year of ownership, which would provide significant upfront tax savings and improve cash flow. CBRE's Cost Segregation Analysis estimates that such Year 1 deduction could total as much as ±2.9 million with this acquisition.

COMPELLING MARKET FUNDAMENTALS

— Pro-Growth | The City of Temecula actively promotes incentive programs such as “FRESH Incentive” to lure new capital investment, diversify the tax base and create jobs. .

— Diversified Industries | Known historically as wine country, Temecula in recent years has made a push to diversify the industry base by establishing itself as a hub for advanced manufacturing, AI/robotics, biotech, life sciences, aerospace and more.

— Leading Market for Electric Vehicles (EV) | California is the largest EV market in the country, according to the U.S. Department of Energy’s TransAtlas dashboard. EV registration in California has grown 359% in the last five years, to 1.26 million registrations in 2023. California has only 10 years to meet its Zero-Emission Mandate. Yet, EVs represent only 3.4% of the car market in California, which provides Tesla an incredible opportunity for continuing market penetration.

HIGHLY DESIRABLE INDUSTRIAL LOCATION WITH AFFLUENT POPULATION BASE

— Strong Industrial Location | Situated off Interstate-15, the property sits within a highly desirable industrial pocket in Temecula.

— Quality-of-Life and Amenity Base | Temecula offers lifestyle amenities such as wine country, resorts, tourism, and a casino, along with affordable housing, and expansive retail options that promotes a quality-of-life that is hard to replicate in Southern California.

INFORMATIONS SUR L’IMMEUBLE

| Type de vente | Investissement | Année de construction | 1985 |

| Type de bien | Industriel/Logistique | Occupation | Mono |

| Sous-type de bien | Manufacture | Ratio de stationnement | 0,07/1 000 m² |

| Classe d’immeuble | B | Hauteur libre du plafond | 6,10 m |

| Surface du lot | 1,36 ha | Nb de portes élevées/de chargement | 5 |

| Surface utile brute | 3 717 m² | Nb d’accès plain-pied/portes niveau du sol | 2 |

| Nb d’étages | 1 | ||

| Zonage | M3 | ||

| Type de vente | Investissement |

| Type de bien | Industriel/Logistique |

| Sous-type de bien | Manufacture |

| Classe d’immeuble | B |

| Surface du lot | 1,36 ha |

| Surface utile brute | 3 717 m² |

| Nb d’étages | 1 |

| Année de construction | 1985 |

| Occupation | Mono |

| Ratio de stationnement | 0,07/1 000 m² |

| Hauteur libre du plafond | 6,10 m |

| Nb de portes élevées/de chargement | 5 |

| Nb d’accès plain-pied/portes niveau du sol | 2 |

| Zonage | M3 |

CARACTÉRISTIQUES

- Terrain clôturé

- Signalisation

- Puits de lumière

- Climatisation

1 1

TAXES FONCIÈRES

| Numéro de parcelle | 921-030-043 | Évaluation des aménagements | 2 803 743 € |

| Évaluation du terrain | 2 383 182 € | Évaluation totale | 5 186 925 € |

TAXES FONCIÈRES

Numéro de parcelle

921-030-043

Évaluation du terrain

2 383 182 €

Évaluation des aménagements

2 803 743 €

Évaluation totale

5 186 925 €

1 sur 21

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

27635 Diaz Rd

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.