Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

24 Value-Add unit Trophy Asset 2451 Le Conte Ave Immeuble residentiel 24 lots 4 908 775 € (204 532 €/Lot) Taux de capitalisation 5,81 % Berkeley, CA 94709

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

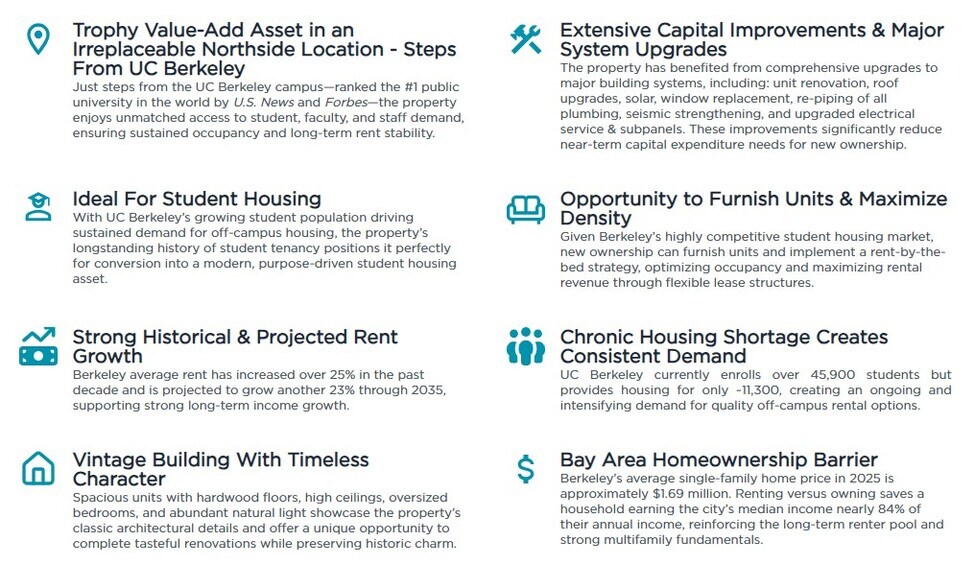

- Trophy Value-Add Asset in an Irreplaceable Northside Location - Steps From UC Berkeley

- Strong Historical & Projected Rent Growth

- Opportunity to Furnish Units & Maximize Density

- Ideal For Student Housing

- Extensive Capital Improvements & Major System Upgrades

- Chronic Housing Shortage Creates Consistent Demand

RÉSUMÉ ANALYTIQUE

PROPERTY TOURS AVAILABLE BY APPOINTMENT.

Please reach out to the listing team to schedule a tour.

The Cushman & Wakefield Northern California Capital Markets Group is pleased to present 2451 Le Conte Avenue, a 24-unit trophy multifamily asset in an irreplaceable Northside Berkeley location, just steps from the UC Berkeley campus. This rare investment offering combines turn-key capital improvements with meaningful rental upside in one of the Bay Area’s most enduring and supply-constrained housing markets.

The property has benefited from a series of major capital upgrades, including new dual-pane vinyl windows throughout, a complete copper re-piping, electrical service and subpanel replacements, a new roof, and a voluntary seismic retrofit. These improvements significantly reduce near-term capital expenditure needs and enhance the property’s long-term durability, positioning it as a low-maintenance asset for new ownership.

Comprising entirely studio units, the property is currently nearly fully leased, with all but two units occupied—providing strong in-place income and operational stability. Existing rents average $1,932 per unit, offering clear upside as units turn over. Comparable renovated studios in the immediate area are achieving rents exceeding $2,500 per unit, underscoring the property’s value-add potential through rent growth and management optimization. With Berkeley rents increasing more than 21% since 2021 and continued growth expected, the income trajectory for 2451 Le Conte Avenue remains highly favorable.

Ideally located just north of campus, 2451 Le Conte Avenue offers residents unparalleled proximity to UC Berkeley and the surrounding neighborhood’s premier amenities. The property boasts a Walk Score of 92 and Bike Score of 71, reflecting its exceptional accessibility to Downtown Berkeley, the Gourmet Ghetto dining district, and a vibrant mix of retail, cafés, and cultural attractions. Easy access to AC Transit and BART further enhances connectivity across the East Bay and into San Francisco—an essential amenity for students and professionals alike.

The Berkeley multifamily market continues to demonstrate remarkable resilience, supported by a chronic housing shortage and barriers to new construction near campus. This enduring imbalance between supply and demand strengthens the long-term investment fundamentals for well-located assets like 2451 Le Conte Avenue, ensuring consistent tenant demand and sustained rent growth.

2451 Le Conte Avenue represents a rare opportunity to acquire a stabilized, extensively upgraded property with immediate cash flow and substantial future upside, anchored by an irreplaceable location adjacent to UC Berkeley and the powerful long-term dynamics of one of Northern California’s strongest rental markets.

Please reach out to the listing team to schedule a tour.

The Cushman & Wakefield Northern California Capital Markets Group is pleased to present 2451 Le Conte Avenue, a 24-unit trophy multifamily asset in an irreplaceable Northside Berkeley location, just steps from the UC Berkeley campus. This rare investment offering combines turn-key capital improvements with meaningful rental upside in one of the Bay Area’s most enduring and supply-constrained housing markets.

The property has benefited from a series of major capital upgrades, including new dual-pane vinyl windows throughout, a complete copper re-piping, electrical service and subpanel replacements, a new roof, and a voluntary seismic retrofit. These improvements significantly reduce near-term capital expenditure needs and enhance the property’s long-term durability, positioning it as a low-maintenance asset for new ownership.

Comprising entirely studio units, the property is currently nearly fully leased, with all but two units occupied—providing strong in-place income and operational stability. Existing rents average $1,932 per unit, offering clear upside as units turn over. Comparable renovated studios in the immediate area are achieving rents exceeding $2,500 per unit, underscoring the property’s value-add potential through rent growth and management optimization. With Berkeley rents increasing more than 21% since 2021 and continued growth expected, the income trajectory for 2451 Le Conte Avenue remains highly favorable.

Ideally located just north of campus, 2451 Le Conte Avenue offers residents unparalleled proximity to UC Berkeley and the surrounding neighborhood’s premier amenities. The property boasts a Walk Score of 92 and Bike Score of 71, reflecting its exceptional accessibility to Downtown Berkeley, the Gourmet Ghetto dining district, and a vibrant mix of retail, cafés, and cultural attractions. Easy access to AC Transit and BART further enhances connectivity across the East Bay and into San Francisco—an essential amenity for students and professionals alike.

The Berkeley multifamily market continues to demonstrate remarkable resilience, supported by a chronic housing shortage and barriers to new construction near campus. This enduring imbalance between supply and demand strengthens the long-term investment fundamentals for well-located assets like 2451 Le Conte Avenue, ensuring consistent tenant demand and sustained rent growth.

2451 Le Conte Avenue represents a rare opportunity to acquire a stabilized, extensively upgraded property with immediate cash flow and substantial future upside, anchored by an irreplaceable location adjacent to UC Berkeley and the powerful long-term dynamics of one of Northern California’s strongest rental markets.

BILAN FINANCIER (RÉEL - 2024) |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

486 671 €

|

410,67 €

|

| Autres revenus |

3 121 €

|

2,63 €

|

| Perte due à la vacance |

14 600 €

|

12,32 €

|

| Revenu brut effectif |

475 192 €

|

400,98 €

|

| Taxes |

-

|

-

|

| Frais d’exploitation |

-

|

-

|

| Total des frais |

203 716 €

|

171,90 €

|

| Résultat net d’exploitation |

271 477 €

|

229,08 €

|

BILAN FINANCIER (RÉEL - 2024)

| Revenu de location brut | |

|---|---|

| Annuel | 486 671 € |

| Annuel par m² | 410,67 € |

| Autres revenus | |

|---|---|

| Annuel | 3 121 € |

| Annuel par m² | 2,63 € |

| Perte due à la vacance | |

|---|---|

| Annuel | 14 600 € |

| Annuel par m² | 12,32 € |

| Revenu brut effectif | |

|---|---|

| Annuel | 475 192 € |

| Annuel par m² | 400,98 € |

| Taxes | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Frais d’exploitation | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Total des frais | |

|---|---|

| Annuel | 203 716 € |

| Annuel par m² | 171,90 € |

| Résultat net d’exploitation | |

|---|---|

| Annuel | 271 477 € |

| Annuel par m² | 229,08 € |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 4 908 775 € | Style d’appartement | Maison unifamiliale |

| Prix par lot | 204 532 € | Classe d’immeuble | C |

| Type de vente | Investissement | Surface du lot | 0,06 ha |

| Taux de capitalisation | 5,81 % | Surface de l’immeuble | 1 185 m² |

| Multiplicateur du loyer brut | 9.87 | Occupation moyenne | 96% |

| Nb de lots | 24 | Nb d’étages | 3 |

| Type de bien | Immeuble residentiel | Année de construction | 1928 |

| Sous-type de bien | Appartement | Ratio de stationnement | 0,05/1 000 m² |

| Prix | 4 908 775 € |

| Prix par lot | 204 532 € |

| Type de vente | Investissement |

| Taux de capitalisation | 5,81 % |

| Multiplicateur du loyer brut | 9.87 |

| Nb de lots | 24 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Style d’appartement | Maison unifamiliale |

| Classe d’immeuble | C |

| Surface du lot | 0,06 ha |

| Surface de l’immeuble | 1 185 m² |

| Occupation moyenne | 96% |

| Nb d’étages | 3 |

| Année de construction | 1928 |

| Ratio de stationnement | 0,05/1 000 m² |

CARACTÉRISTIQUES

CARACTÉRISTIQUES DU LOT

- Chauffage

- Cuisine

- Planchers en bois

- Réfrigérateur

- Four

- Cuisinière

- Baignoire/Douche

- Dressing

- Fenêtres à double vitrage

- Armoire à linge

CARACTÉRISTIQUES DU SITE

- Accès 24 h/24

- Accès contrôlé

- CVC contrôlé par l’occupant

- Immeuble d’époque

- Détecteur de fumée

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| Studios | 24 | 2 134 € | 42 |

1 1

Walk Score®

Idéal pour les promeneurs (92)

Bike Score®

Très praticable en vélo (71)

TAXES FONCIÈRES

| Numéro de parcelle | 058-2193-005-00 | Évaluation des aménagements | 535 313 € (2025) |

| Évaluation du terrain | 157 057 € (2025) | Évaluation totale | 701 917 € (2025) |

TAXES FONCIÈRES

Numéro de parcelle

058-2193-005-00

Évaluation du terrain

157 057 € (2025)

Évaluation des aménagements

535 313 € (2025)

Évaluation totale

701 917 € (2025)

1 sur 35

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

24 Value-Add unit Trophy Asset | 2451 Le Conte Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.