Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

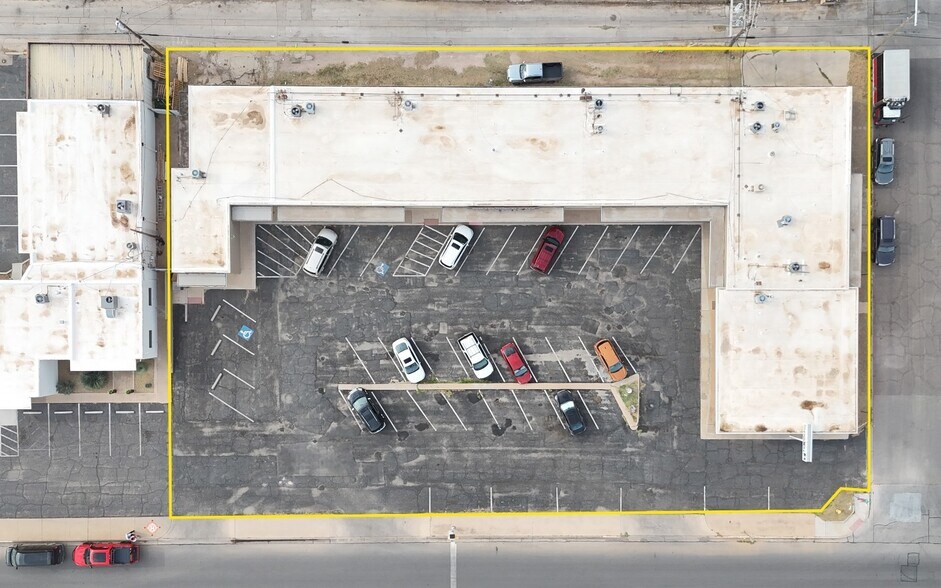

2109 W Texas Ave Bureau 1 029 m² 100 % Loué À vendre Midland, TX 79701 1 098 413 € (1 067,08 €/m²) Taux de capitalisation 9,61 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Strong rental demand location with 100% occupancy.

- Owner spent over $250,000 for capital improvements in the last three years.

- Excellent location just one block south of the Midland Memorial Hospital Main Campus

RÉSUMÉ ANALYTIQUE

Midland Medical Plaza is a 100% occupied, multi-tenant office/retail center with an outstanding corner location on West Texas Avenue, one block southeast of the Midland Memorial Hospital Main Camp;us and 200 feet east of Andrews Highway (SH-158). Andrews Highway is the main surface arterial highway between Midland and Odessa. The property is directly across Texas Avenue from St. Ann's Catholic School. The property includes 11,080 rentable square feet on a 31,494 square foot rectangular parcel. The property has approximately 230 linear feet of frontage on Texas Avenue and has approximately 35 parking spaces in an on-site surface parking lot. In addition, there are approximately thirteen public street parking spaces along the front and side of the property. This single-story property was constructed in 1960 and includes fourteen suites ranging from 347-1,756 square feet in size. The owner reportedly spent over $250,000 in renovation of the property, including expenses for roofs and HVAC systems since 2023. With one exception, lease rates are full-service gross and range from approximately $16.00 to $27.00/rsf/year, currently averaging $20.27/rsf/year. Eight of the suites are leased with leases terminating in 2026 through 2028. The average lease rate for those eight suites is $21.32/rsf/year. Six of the suites are leased on a month-to-month basis. The average lease rate for those six suites is $19.50/rsf/year. Most tenants operate local, service-based businesses.

Small suites in this prime location are extremely popular and there may be significant upside in lease rates for a new owner. The current owner has intentionally allowed several leases to expire with tenants continuing on a month-to-month basis to allow a buyer flexibility in his future operation of the property.

The purchase of Midland Medical Plaza is an excellent opportunity to acquire a stabilized, income-producing, multi-tenant office/retail asset with a strategic location in the heart of Midland. The city of Midland, with a population of 145,000 and its adjacent city of Odessa, with a population of 120,000, are located on one of the fastest growing markets in the Permian Basin region, the energy-producing hub of West Texas.

Small suites in this prime location are extremely popular and there may be significant upside in lease rates for a new owner. The current owner has intentionally allowed several leases to expire with tenants continuing on a month-to-month basis to allow a buyer flexibility in his future operation of the property.

The purchase of Midland Medical Plaza is an excellent opportunity to acquire a stabilized, income-producing, multi-tenant office/retail asset with a strategic location in the heart of Midland. The city of Midland, with a population of 145,000 and its adjacent city of Odessa, with a population of 120,000, are located on one of the fastest growing markets in the Permian Basin region, the energy-producing hub of West Texas.

DATA ROOM Cliquez ici pour accéder à

BILAN FINANCIER (PRO FORMA - 2025) |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

193 488 €

|

187,97 €

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

5 805 €

|

5,64 €

|

| Revenu brut effectif |

187 683 €

|

182,33 €

|

| Taxes |

6 937 €

|

6,74 €

|

| Frais d’exploitation |

75 180 €

|

73,03 €

|

| Total des frais |

82 116 €

|

79,77 €

|

| Résultat net d’exploitation |

105 566 €

|

102,55 €

|

BILAN FINANCIER (PRO FORMA - 2025)

| Revenu de location brut | |

|---|---|

| Annuel | 193 488 € |

| Annuel par m² | 187,97 € |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | 5 805 € |

| Annuel par m² | 5,64 € |

| Revenu brut effectif | |

|---|---|

| Annuel | 187 683 € |

| Annuel par m² | 182,33 € |

| Taxes | |

|---|---|

| Annuel | 6 937 € |

| Annuel par m² | 6,74 € |

| Frais d’exploitation | |

|---|---|

| Annuel | 75 180 € |

| Annuel par m² | 73,03 € |

| Total des frais | |

|---|---|

| Annuel | 82 116 € |

| Annuel par m² | 79,77 € |

| Résultat net d’exploitation | |

|---|---|

| Annuel | 105 566 € |

| Annuel par m² | 102,55 € |

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Condition de vente

1031 Exchange

Type de bien

Bureau

Sous-type de bien

Surface de l’immeuble

1 029 m²

Classe d’immeuble

C

Année de construction

1960

Prix

1 098 413 €

Prix par m²

1 067,08 €

Taux de capitalisation

9,61 %

RNE

105 566 €

Pourcentage loué

100 %

Occupation

Multi

Hauteur du bâtiment

1 étage

Surface type par étage

1 029 m²

Coefficient d’occupation des sols de l’immeuble

0,35

Surface du lot

0,29 ha

Zonage

LR2

Stationnement

35 places (34 places par 1 000 m² loué)

CARACTÉRISTIQUES

- Accès 24 h/24

- Signalisation

- Panneau monumental

- Climatisation

- Détecteur de fumée

1 1

Walk Score®

Très praticable à pied (74)

TAXES FONCIÈRES

| Numéro de parcelle | R000052-252 | Évaluation totale | 457 439 € |

| Évaluation du terrain | 108 549 € | Impôts annuels | 6 937 € (6,74 €/m²) |

| Évaluation des aménagements | 348 890 € | Année d’imposition | 2025 |

TAXES FONCIÈRES

Numéro de parcelle

R000052-252

Évaluation du terrain

108 549 €

Évaluation des aménagements

348 890 €

Évaluation totale

457 439 €

Impôts annuels

6 937 € (6,74 €/m²)

Année d’imposition

2025

1 sur 6

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

Tom Murray

2109 W Texas Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.