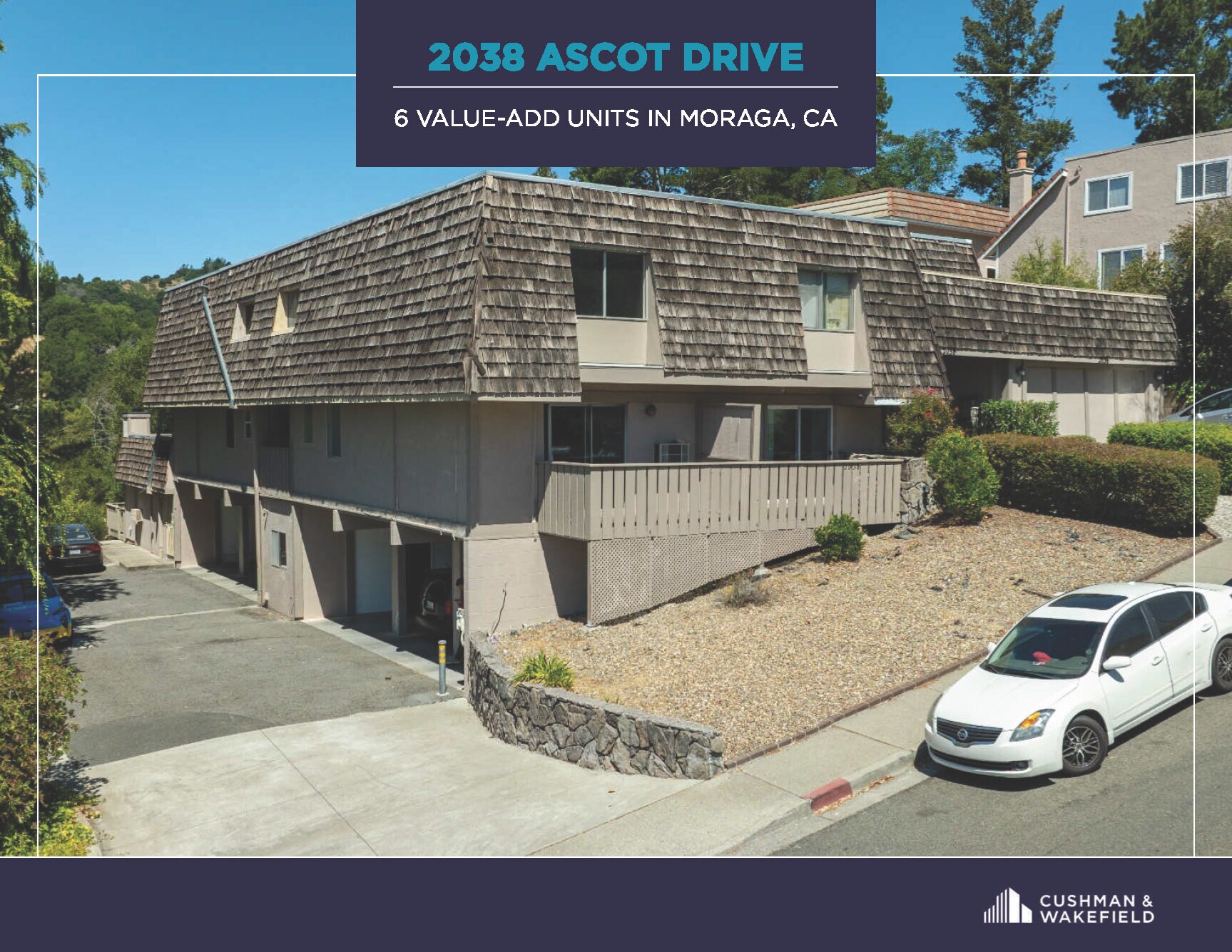

Moraga, CA | 6 Value-Add Units | 2038 Ascot Dr

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

Moraga, CA | 6 Value-Add Units 2038 Ascot Dr Immeuble residentiel 6 lots 2 188 825 € (364 804 €/Lot) Taux de capitalisation 5,86 % Moraga, CA 94556

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

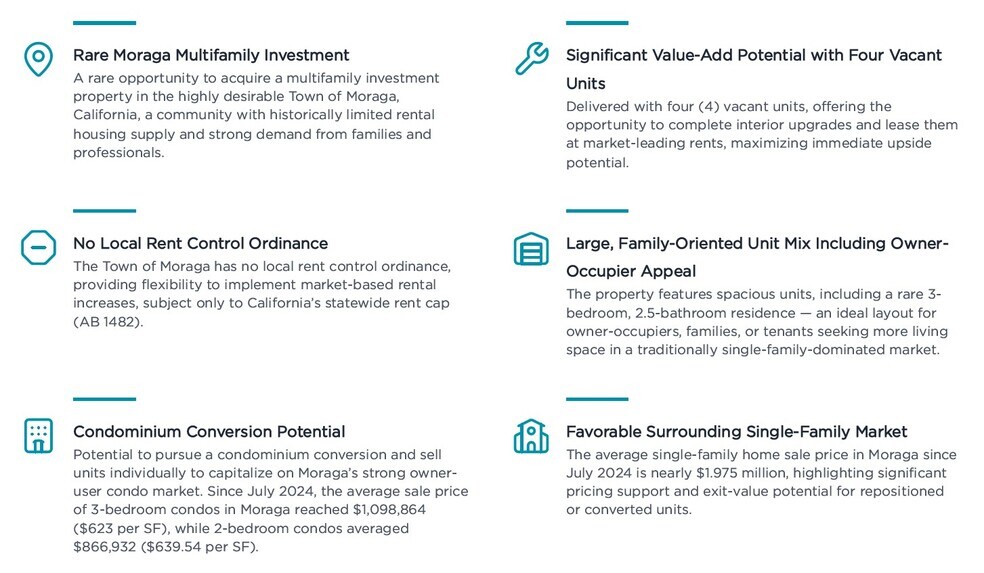

- Rare Moraga Multifamily Investment

- Significant Value-Add Potential with Four Vacant Units

- Exceptional Public School System

- No Local Rent Control Ordinance

- Large, Family-Oriented Unit Mix Including Owner-Occupier Appeal

- Extremely Limited Multifamily Pipeline

RÉSUMÉ ANALYTIQUE

The Cushman & Wakefield Northern California Multifamily Capital Markets Team is pleased to offer for sale, 2036-2038 Ascot Drive.

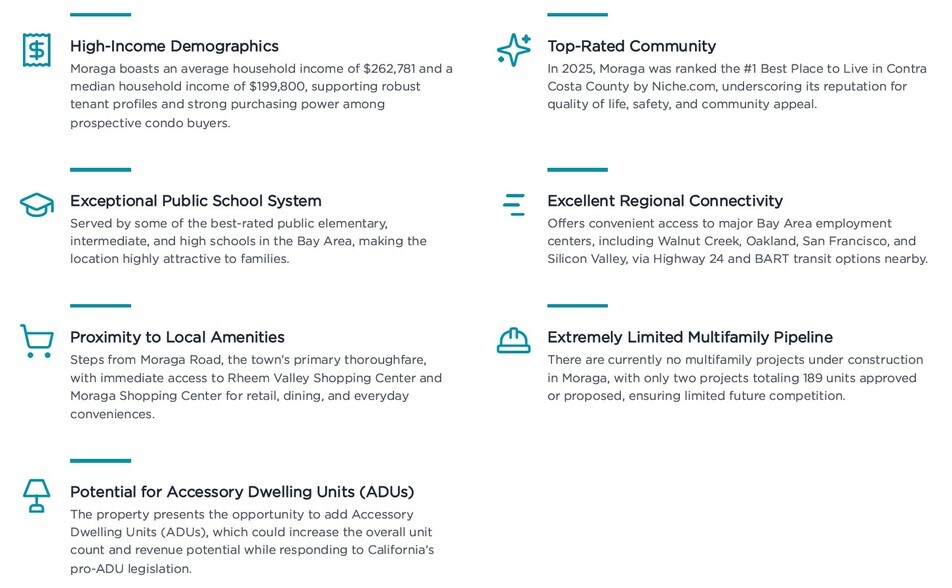

This offering presents a rare opportunity to acquire a six-unit value-add multifamily investment property in the highly desirable Town of Moraga, CA. Moraga is recognized as one of Contra Costa County’s premier communities, with top-rated schools, exceptional quality of life, and outstanding demographics — including an avg. household income of $262,781. Ranked the #1 Best Place to Live in Contra Costa County by Niche.com in 2025, Moraga continues to attract high-income families and professionals who value its safe neighborhoods and excellent public education system.

The property will be delivered with four vacant units, providing immediate upside potential for an investor to complete interior upgrades and lease the units at top-of-market rents. In addition, the large unit mix — including a spacious 3-bedroom, 2.5-bath residence — offers strong appeal to owner/occupiers and family renters seeking more living space. The Property also features a community pool, ample assigned parking, a large storage closet for each unit, and an on-site, coin-operated laundry facility. With no local rent control ordinance in Moraga, investors benefit from greater flexibility to reposition and optimize rents subject to statewide limits.

Further enhancing the opportunity is the potential for condominium conversion, supported by strong area condo pricing with 3-bedroom units averaging over $1.09 million and 2-bedroom units averaging nearly $867,000 since mid-2024. The property may also support Accessory Dwelling Unit (ADU) additions, increasing the overall unit count and revenue potential. Moreover, Moraga’s multifamily pipeline remains extremely constrained, with no projects currently under construction and only two projects totaling 189 units in the entitlement process, ensuring limited future competition.

Ideally located just steps from Moraga Road, the property offers convenient access to shopping centers, local amenities, and major Bay Area employment hubs via Highway 24 and nearby BART connections. This combination of a supply-constrained market, high-income demographics, excellent schools, and multiple value-add strategies makes this an outstanding investment opportunity in one of the East Bay’s most desirable suburban communities.

This offering presents a rare opportunity to acquire a six-unit value-add multifamily investment property in the highly desirable Town of Moraga, CA. Moraga is recognized as one of Contra Costa County’s premier communities, with top-rated schools, exceptional quality of life, and outstanding demographics — including an avg. household income of $262,781. Ranked the #1 Best Place to Live in Contra Costa County by Niche.com in 2025, Moraga continues to attract high-income families and professionals who value its safe neighborhoods and excellent public education system.

The property will be delivered with four vacant units, providing immediate upside potential for an investor to complete interior upgrades and lease the units at top-of-market rents. In addition, the large unit mix — including a spacious 3-bedroom, 2.5-bath residence — offers strong appeal to owner/occupiers and family renters seeking more living space. The Property also features a community pool, ample assigned parking, a large storage closet for each unit, and an on-site, coin-operated laundry facility. With no local rent control ordinance in Moraga, investors benefit from greater flexibility to reposition and optimize rents subject to statewide limits.

Further enhancing the opportunity is the potential for condominium conversion, supported by strong area condo pricing with 3-bedroom units averaging over $1.09 million and 2-bedroom units averaging nearly $867,000 since mid-2024. The property may also support Accessory Dwelling Unit (ADU) additions, increasing the overall unit count and revenue potential. Moreover, Moraga’s multifamily pipeline remains extremely constrained, with no projects currently under construction and only two projects totaling 189 units in the entitlement process, ensuring limited future competition.

Ideally located just steps from Moraga Road, the property offers convenient access to shopping centers, local amenities, and major Bay Area employment hubs via Highway 24 and nearby BART connections. This combination of a supply-constrained market, high-income demographics, excellent schools, and multiple value-add strategies makes this an outstanding investment opportunity in one of the East Bay’s most desirable suburban communities.

BILAN FINANCIER (PRO FORMA - 2025) |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

177 768 €

|

240,21 €

|

| Autres revenus |

6 562 €

|

8,87 €

|

| Perte due à la vacance |

5 333 €

|

7,21 €

|

| Revenu brut effectif |

178 997 €

|

241,87 €

|

| Taxes |

24 382 €

|

32,95 €

|

| Frais d’exploitation |

26 370 €

|

35,63 €

|

| Total des frais |

50 752 €

|

68,58 €

|

| Résultat net d’exploitation |

128 245 €

|

173,29 €

|

BILAN FINANCIER (PRO FORMA - 2025)

| Revenu de location brut | |

|---|---|

| Annuel | 177 768 € |

| Annuel par m² | 240,21 € |

| Autres revenus | |

|---|---|

| Annuel | 6 562 € |

| Annuel par m² | 8,87 € |

| Perte due à la vacance | |

|---|---|

| Annuel | 5 333 € |

| Annuel par m² | 7,21 € |

| Revenu brut effectif | |

|---|---|

| Annuel | 178 997 € |

| Annuel par m² | 241,87 € |

| Taxes | |

|---|---|

| Annuel | 24 382 € |

| Annuel par m² | 32,95 € |

| Frais d’exploitation | |

|---|---|

| Annuel | 26 370 € |

| Annuel par m² | 35,63 € |

| Total des frais | |

|---|---|

| Annuel | 50 752 € |

| Annuel par m² | 68,58 € |

| Résultat net d’exploitation | |

|---|---|

| Annuel | 128 245 € |

| Annuel par m² | 173,29 € |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 2 188 825 € | Style d’appartement | De faible hauteur |

| Prix par lot | 364 804 € | Classe d’immeuble | C |

| Type de vente | Investissement | Surface du lot | 0,09 ha |

| Taux de capitalisation | 5,86 % | Surface de l’immeuble | 705 m² |

| Multiplicateur du loyer brut | 12.31 | Occupation moyenne | 33% |

| Nb de lots | 6 | Nb d’étages | 2 |

| Type de bien | Immeuble residentiel | Année de construction | 1971 |

| Sous-type de bien | Appartement |

| Prix | 2 188 825 € |

| Prix par lot | 364 804 € |

| Type de vente | Investissement |

| Taux de capitalisation | 5,86 % |

| Multiplicateur du loyer brut | 12.31 |

| Nb de lots | 6 |

| Type de bien | Immeuble residentiel |

| Sous-type de bien | Appartement |

| Style d’appartement | De faible hauteur |

| Classe d’immeuble | C |

| Surface du lot | 0,09 ha |

| Surface de l’immeuble | 705 m² |

| Occupation moyenne | 33% |

| Nb d’étages | 2 |

| Année de construction | 1971 |

CARACTÉRISTIQUES

- Détecteur de fumée

CARACTÉRISTIQUES DU LOT

- Balcon

- Lave-vaisselle

- Broyeur d’ordures

- Espace d’entreposage

- Chauffage

- Cuisine

- Réfrigérateur

- Four

- Cuisinière

- Baignoire/Douche

- Vues

- Terrasse

- Congélateur

- Armoire à linge

- Patio

CARACTÉRISTIQUES DU SITE

- Laverie

- Piscine

LOT INFORMATIONS SUR LA COMBINAISON

| DESCRIPTION | NB DE LOTS | MOY. LOYER/MOIS | m² |

|---|---|---|---|

| 2+1 | 1 | 2 408 € | - |

| 2+1.5 | 4 | 2 622 € | - |

| 3+2.5 | 1 | 4 159 € | - |

1 of 1

TAXES FONCIÈRES

| Numéro de parcelle | 255-461-005-1 | Évaluation totale | 1 367 699 € |

| Évaluation du terrain | 307 699 € | Impôts annuels | 24 382 € (34,60 €/m²) |

| Évaluation des aménagements | 1 060 000 € | Année d’imposition | 2025 |

TAXES FONCIÈRES

Numéro de parcelle

255-461-005-1

Évaluation du terrain

307 699 €

Évaluation des aménagements

1 060 000 €

Évaluation totale

1 367 699 €

Impôts annuels

24 382 € (34,60 €/m²)

Année d’imposition

2025

1 de 52

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

Moraga, CA | 6 Value-Add Units | 2038 Ascot Dr

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.