Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

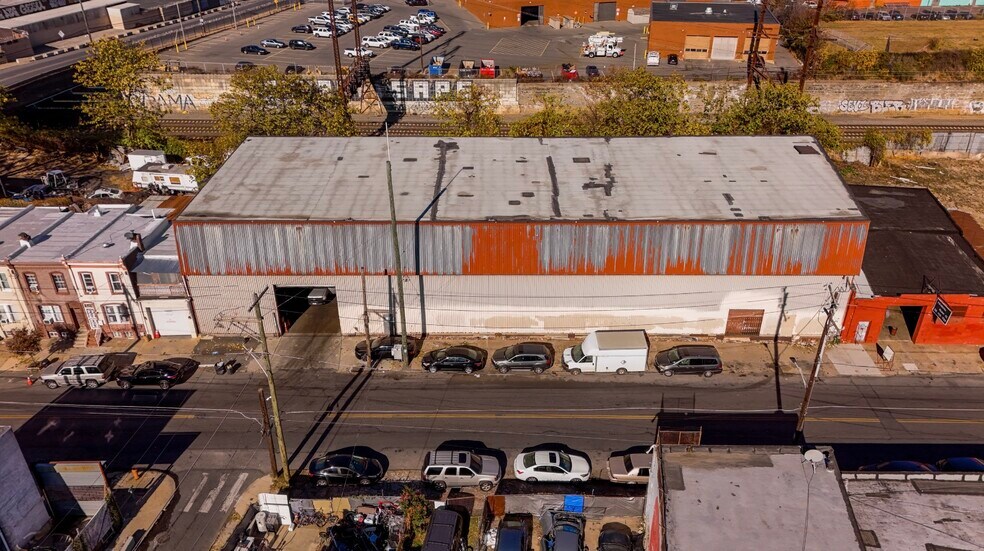

147-161 W Glenwood Ave Industriel/Logistique 1 115 m² À vendre Philadelphia, PA 19140 856 350 € (768,14 €/m²) Taux de capitalisation 9,72 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Large adaptive reuse play

- low over head with upward growth ability

- owner operator willing to stay on

RÉSUMÉ ANALYTIQUE

Highlights – Business

Industry: Steel manufacturing & distribution.

EBITDA: 5-year average ˜ $60K/year (2019–2023).

Valuation: ˜ $250K at 4× EBITDA (excludes equipment & goodwill).

Staffing: 5 employees + owner (owner to remain 1–2 years post-sale).

Growth Potential: Increase production, expand customer base, leverage existing vendor & client relationships.

Equipment (Depreciated Market Value ˜ $425,000)

Yoder Uncoiler & Coil Car – $50,000

Yoder 54” Slitter – $50,000Yoder 54” Recoiler – $60,000

Niles Overhead Crane (40,000#) – $50,000

Niles Overhead Crane (30,000#) – $45,000

Yale Forklift (20,000#) – $100,000

Signode Banding Station – $60,000

Bushman Upender – $10,000

(New replacement cost significantly higher — e.g., new 20,000# forklift = $435K in 2025)

Real Estate Portfolio (Combined Value ˜ $2.39M)

147–161 W Glenwood Ave – Main Warehouse

12,000 SF industrial building, 30’ clear, multiple docks & drive-in.

Market rent ˜ $7.50/SF NNN ? NOI ˜ $90K/year.

Cap rate @ ask: ~7.5%.

Offered at $1,200,000.

Package Purchase Advantages

Combined NOI (warehouse + yard): ˜ $153K/year ? ~8.1% cap on income assets.

Strategic Control: Main facility + adjacent land for operations, expansion, or redevelopment.

Owner Leaseback: Seller willing to lease warehouse for 1–2 years at market rate.

Upside: Formalize yard lease, redevelop lots, grow business EBITDA.

Package Price: Warehouse $1,150,000 + Rear Lot $250,000 + Lots $500,000 = $1,900,00

Industry: Steel manufacturing & distribution.

EBITDA: 5-year average ˜ $60K/year (2019–2023).

Valuation: ˜ $250K at 4× EBITDA (excludes equipment & goodwill).

Staffing: 5 employees + owner (owner to remain 1–2 years post-sale).

Growth Potential: Increase production, expand customer base, leverage existing vendor & client relationships.

Equipment (Depreciated Market Value ˜ $425,000)

Yoder Uncoiler & Coil Car – $50,000

Yoder 54” Slitter – $50,000Yoder 54” Recoiler – $60,000

Niles Overhead Crane (40,000#) – $50,000

Niles Overhead Crane (30,000#) – $45,000

Yale Forklift (20,000#) – $100,000

Signode Banding Station – $60,000

Bushman Upender – $10,000

(New replacement cost significantly higher — e.g., new 20,000# forklift = $435K in 2025)

Real Estate Portfolio (Combined Value ˜ $2.39M)

147–161 W Glenwood Ave – Main Warehouse

12,000 SF industrial building, 30’ clear, multiple docks & drive-in.

Market rent ˜ $7.50/SF NNN ? NOI ˜ $90K/year.

Cap rate @ ask: ~7.5%.

Offered at $1,200,000.

Package Purchase Advantages

Combined NOI (warehouse + yard): ˜ $153K/year ? ~8.1% cap on income assets.

Strategic Control: Main facility + adjacent land for operations, expansion, or redevelopment.

Owner Leaseback: Seller willing to lease warehouse for 1–2 years at market rate.

Upside: Formalize yard lease, redevelop lots, grow business EBITDA.

Package Price: Warehouse $1,150,000 + Rear Lot $250,000 + Lots $500,000 = $1,900,00

BILAN FINANCIER (PRO FORMA - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

$99,999

|

$9.99

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

$99,999

|

$9.99

|

| Taxes |

$99,999

|

$9.99

|

| Frais d’exploitation |

-

|

-

|

| Total des frais |

$99,999

|

$9.99

|

| Résultat net d’exploitation |

-

|

-

|

BILAN FINANCIER (PRO FORMA - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Taxes | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Frais d’exploitation | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

INFORMATIONS SUR L’IMMEUBLE

CARACTÉRISTIQUES

- Terrain clôturé

SERVICES PUBLICS

- Éclairage

- Gaz

- Eau

- Égout

- Chauffage

1 1

Walk Score®

Très praticable à pied (71)

TAXES FONCIÈRES

| Numéro de parcelle | 884341250 | Évaluation totale | 248 513 € (2026) |

| Évaluation du terrain | 74 554 € (2026) | Impôts annuels | -1 € (0,00 €/m²) |

| Évaluation des aménagements | 173 959 € (2026) | Année d’imposition | 2025 |

TAXES FONCIÈRES

Numéro de parcelle

884341250

Évaluation du terrain

74 554 € (2026)

Évaluation des aménagements

173 959 € (2026)

Évaluation totale

248 513 € (2026)

Impôts annuels

-1 € (0,00 €/m²)

Année d’imposition

2025

1 sur 11

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

147-161 W Glenwood Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.