12766 US-441

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

12766 US-441 34 Lot Offre d’immeuble d’habitation à 3 621 000 € à un taux de capitalisation de 7,89 % Okeechobee, FL 34974

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Water’s Edge Motor Coach RV & Resort represents a compelling investment seeking stable cash flow with upside

- Clubhouse, Pool, Dock, Tiki Hut, Boat Ramp

- This feature allows for the recapture of capital by retailing individual lots while still retaining ownership and control of the resort’s common areas

- Gated 30 Paved RV Campsites/Pads in Waterfront "Rim" Gated Community + Lakeside Cottage + 3 Overflow pads | 7.8% Cap Rate

- Unique Flexibility & Ongoing Revenue Stream - as an individually deeded RV resort Buyer has the ability to sell off individual pads on a condo basis.

- Management and HOA fees can be earned by leasing out privately owned pads through a rental pool or reservation system, creating a revenue stream

RÉSUMÉ ANALYTIQUE

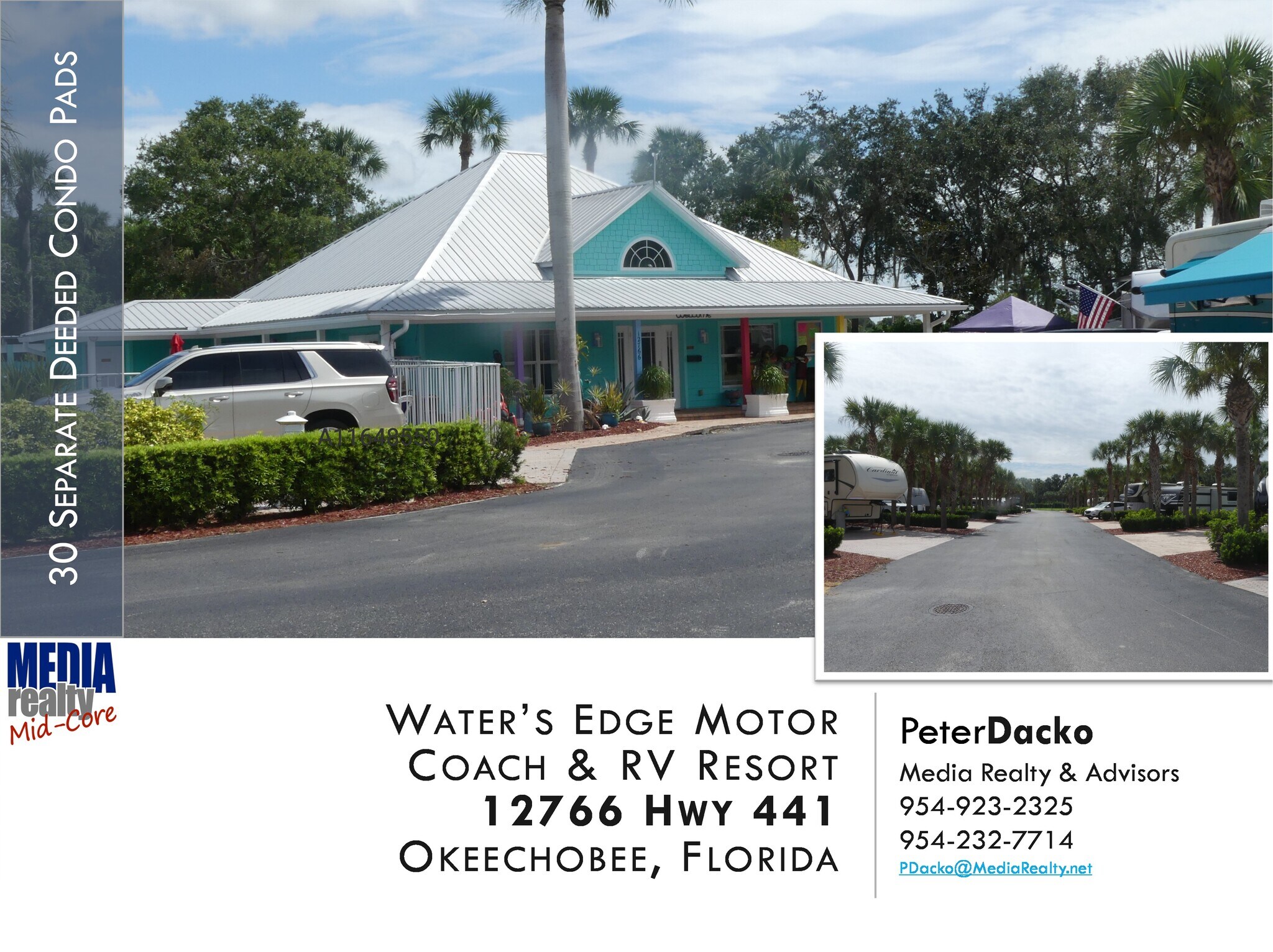

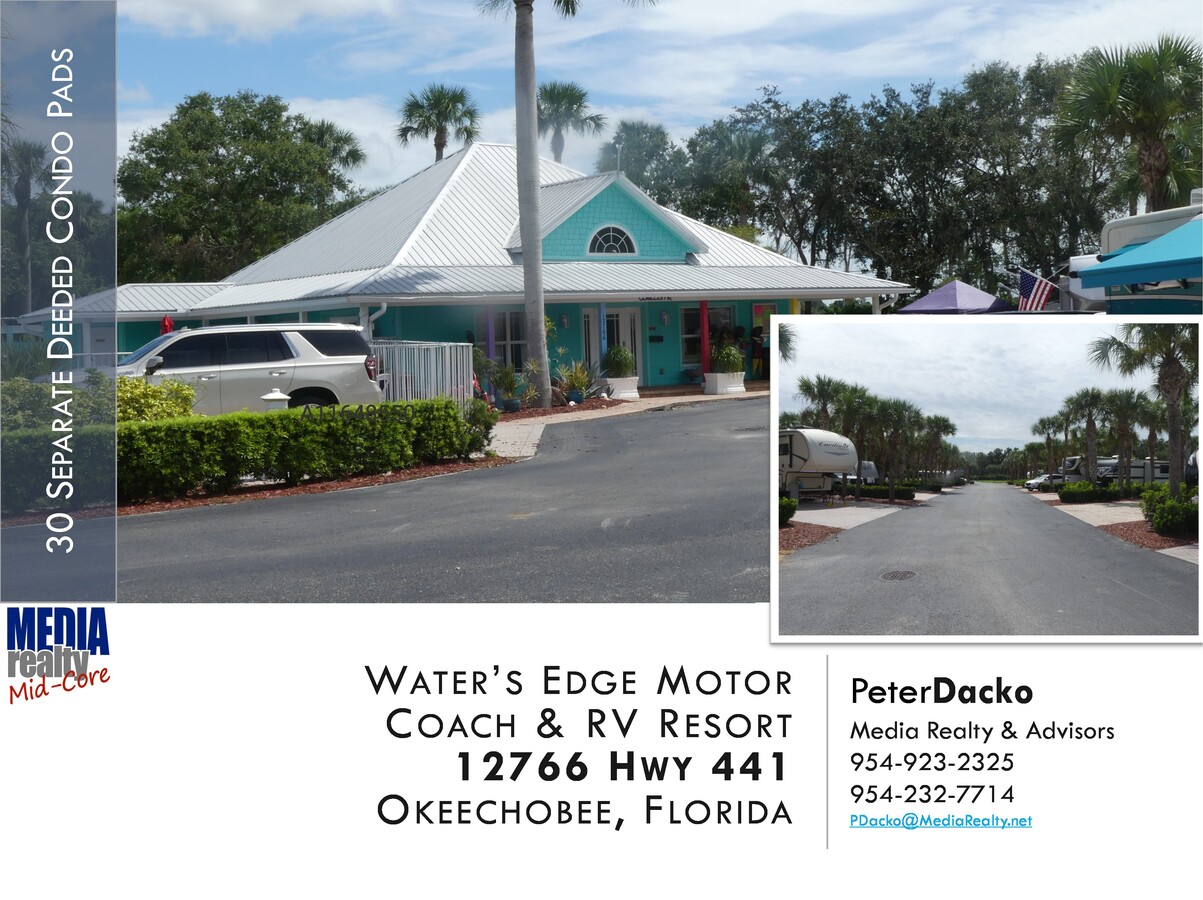

Water’s Edge Motor Coach & RV Resort

Okeechobee, Florida

Water’s Edge Motor Coach & RV Resort presents a rare opportunity to acquire a highly desirable waterfront hospitality asset consisting of 36 parcels in one of Florida’s most recognized recreation markets. Ideally positioned along the shores of Lake Okeechobee—the largest freshwater lake in the state—the property combines income diversity, waterfront appeal, and long-term growth potential.

Property Overview

The gated resort features a blend of short-term vacation and extended-stay accommodations, including 30 large individually deeded private and beautifully landscaped paved back in RV pad sites, three overflow pads, asphalt roads, a beautifully renovated lakefront cottage, clubhouse, pool, boat ramp, waterfront Chickee Hut, a five 200 ft.² bay storage warehouse and ample green space with over 250 palm trees.

This unique combination allows operators to capture both the seasonal RV traveler market as well as year-round vacationers, fishing enthusiasts, and eco-tourism guests due to its rim canal location. The resort’s direct access to boating, fishing, and the extensive Lake Okeechobee Scenic Trail makes it a preferred destination for outdoor recreation seekers from across Florida and the Southeast.

Investment Highlights

Waterfront Location – Situated directly on the canal system with convenient access to Lake Okeechobee, one of the nation’s premier freshwater fishing destinations.

Multiple Revenue Streams – Income generated through RV site rentals, nightly stays, and extended occupancy.

Amenity Package – Includes boat slips, recreation areas, clubhouse facilities, and well-maintained grounds that enhance guest experience and support long-term occupancy.

Strong Market Demand – Okeechobee benefits from a steady inflow of seasonal visitors, snowbirds, and year-round tourism driven by fishing tournaments, eco-tourism, and regional events.

Upside Potential – Opportunity to increase rates, reposition select assets with light capital improvements, and expand marketing to capitalize on Florida’s growing RV and outdoor recreation demand.

Market Position

Lake Okeechobee continues to experience strong demand from RVers and outdoor enthusiasts, with occupancy supported by regional drive-to markets such as Miami, Fort Lauderdale, Orlando, and Tampa. As RV ownership and tourism continue to grow nationwide, properties with waterfront access and diversified lodging options are increasingly sought after by both operators and investors.

Unique Buyer Flexibility & Ongoing Revenue Stream

Because the property is structured as an individually deeded RV resort, purchasers have the rare ability to sell off individual pads on a condominium-style basis. This feature allows an investor to recapture capital quickly by retailing individual lots while still retaining ownership and control of the resort’s common areas and operations.

The resort’s management framework provides for a recurring income opportunity:

The seller or operator can retain management rights over the community even as pads are sold to individual owners.

Management fees are earned by leasing out privately owned pads through a rental pool or reservation system, creating a revenue stream tied directly to occupancy.

In addition, the operator may collect association fees or administrative charges tied to maintenance, marketing, and amenity usage.

This structure delivers both capital flexibility (through individual pad sales) and ongoing operational income (via management and leasing fees), making it an attractive hybrid model for investors seeking both liquidity and long-term cash flow

Okeechobee, Florida

Water’s Edge Motor Coach & RV Resort presents a rare opportunity to acquire a highly desirable waterfront hospitality asset consisting of 36 parcels in one of Florida’s most recognized recreation markets. Ideally positioned along the shores of Lake Okeechobee—the largest freshwater lake in the state—the property combines income diversity, waterfront appeal, and long-term growth potential.

Property Overview

The gated resort features a blend of short-term vacation and extended-stay accommodations, including 30 large individually deeded private and beautifully landscaped paved back in RV pad sites, three overflow pads, asphalt roads, a beautifully renovated lakefront cottage, clubhouse, pool, boat ramp, waterfront Chickee Hut, a five 200 ft.² bay storage warehouse and ample green space with over 250 palm trees.

This unique combination allows operators to capture both the seasonal RV traveler market as well as year-round vacationers, fishing enthusiasts, and eco-tourism guests due to its rim canal location. The resort’s direct access to boating, fishing, and the extensive Lake Okeechobee Scenic Trail makes it a preferred destination for outdoor recreation seekers from across Florida and the Southeast.

Investment Highlights

Waterfront Location – Situated directly on the canal system with convenient access to Lake Okeechobee, one of the nation’s premier freshwater fishing destinations.

Multiple Revenue Streams – Income generated through RV site rentals, nightly stays, and extended occupancy.

Amenity Package – Includes boat slips, recreation areas, clubhouse facilities, and well-maintained grounds that enhance guest experience and support long-term occupancy.

Strong Market Demand – Okeechobee benefits from a steady inflow of seasonal visitors, snowbirds, and year-round tourism driven by fishing tournaments, eco-tourism, and regional events.

Upside Potential – Opportunity to increase rates, reposition select assets with light capital improvements, and expand marketing to capitalize on Florida’s growing RV and outdoor recreation demand.

Market Position

Lake Okeechobee continues to experience strong demand from RVers and outdoor enthusiasts, with occupancy supported by regional drive-to markets such as Miami, Fort Lauderdale, Orlando, and Tampa. As RV ownership and tourism continue to grow nationwide, properties with waterfront access and diversified lodging options are increasingly sought after by both operators and investors.

Unique Buyer Flexibility & Ongoing Revenue Stream

Because the property is structured as an individually deeded RV resort, purchasers have the rare ability to sell off individual pads on a condominium-style basis. This feature allows an investor to recapture capital quickly by retailing individual lots while still retaining ownership and control of the resort’s common areas and operations.

The resort’s management framework provides for a recurring income opportunity:

The seller or operator can retain management rights over the community even as pads are sold to individual owners.

Management fees are earned by leasing out privately owned pads through a rental pool or reservation system, creating a revenue stream tied directly to occupancy.

In addition, the operator may collect association fees or administrative charges tied to maintenance, marketing, and amenity usage.

This structure delivers both capital flexibility (through individual pad sales) and ongoing operational income (via management and leasing fees), making it an attractive hybrid model for investors seeking both liquidity and long-term cash flow

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

$99,999

|

$9.99

|

| Autres revenus |

$99,999

|

$9.99

|

| Perte due à la vacance |

$99,999

|

$9.99

|

| Revenu brut effectif |

$99,999

|

$9.99

|

| Taxes |

-

|

-

|

| Frais d’exploitation |

-

|

-

|

| Total des frais |

$99,999

|

$9.99

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2024) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Autres revenus | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Perte due à la vacance | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Revenu brut effectif | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Taxes | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Frais d’exploitation | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Total des frais | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

CARACTÉRISTIQUES

CARACTÉRISTIQUES DU SITE

- Club-house

- Laverie

- Aire de jeux

- Piscine

- Bord de l’eau

- Clôturé

- Cabanon

- Aire de jeu pour animaux de compagnie

- Wi-Fi

- Espace d’entreposage

- Accès au lac

- Entretien sur site

1 of 1

1 de 27

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

12766 US-441

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.