Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

Family Dollar/Hard Corner/Next to McDonalds 106 S Columbia St Local commercial 10 393 m² À vendre Union City, IN 47390 1 299 084 € (125,00 €/m²) Taux de capitalisation 7 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- National Tenant Family Dollar – 8,000+ locations, $13.3B revenue, and 64+ years of retail stability.

- Fee simple ownership offering strong cash flow, 1031 exchange eligibility, and tax benefits through depreciation.

- Prime signalized hard-corner location with unobstructed street visibility and long-term lease potential of up to 22 years.

- Single-tenant NNN lease with minimal landlord duties—tenant covers taxes, insurance, and CAM.

- Relocated from 6,800 SF to 11,868 SF store, nearly doubling size. Across the street from McDonalds.

- Low rent & Low cost $129 PSF investment with strong demos—20K+ population, $76K AHHI, and 200K+ annual visits

RÉSUMÉ ANALYTIQUE

INDIANA BROKER OF RECORD... AARON MCDERMOTT ...License No. PB20600956

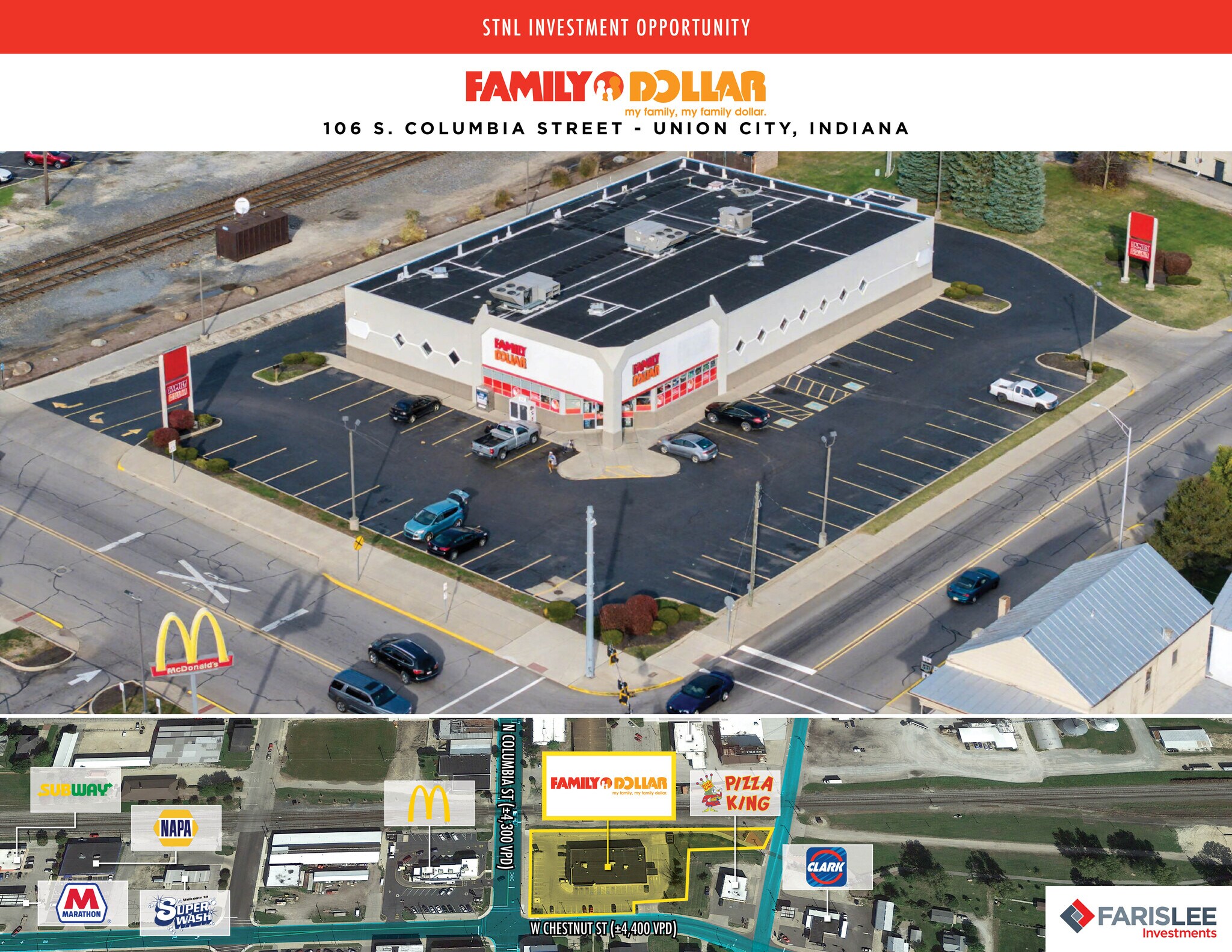

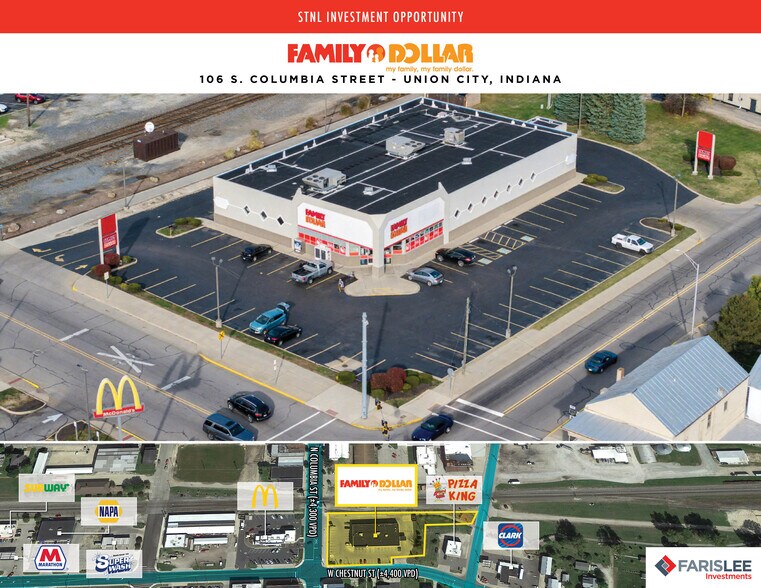

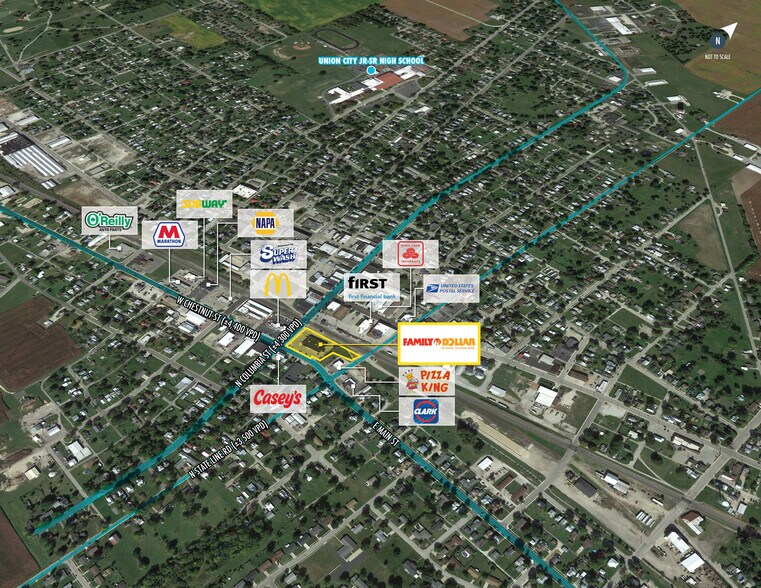

Faris Lee Investments is pleased to present the opportunity to acquire a single-tenant Family Dollar, strategically positioned at the signalized hard corner of Chestnut and Columbia Streets, at the busiest intersection in Union City. The property enjoys outstanding visibility, two monument signs, and access from both major retail corridors (Highways 32 and 28). Family Dollar benefits from strong national tenant synergy with McDonald’s, O’Reilly Auto Parts, Subway, and NAPA Auto Parts within the immediate trade area, along with its proximity to schools, banks, the U.S. Post Office, and surrounding residential neighborhoods.

The property features a single-tenant NNN lease, an ideal structure for investors seeking secure, passive income. Family Dollar is responsible for the property taxes, insurance, and CAM, offering true ease of ownership. The predictable income stream and corporate tenancy make this an exceptional opportunity for 1031 exchange buyers and investors looking for stable, long-term cash flow with minimal management.

Family Dollar is a nationally recognized discount retailer operating over 8,000 stores across 45 states with annual revenues exceeding $13.3 billion in 2024. For more than six decades, Family Dollar has built a strong reputation as a value-oriented, necessity-based retailer serving millions of loyal customers nationwide. Its proven business model and operational resilience make it one of America’s most dependable retail brands.

Ownership interest includes both the land and the building, providing long-term intrinsic value and significant tax advantages through cost segregation and depreciation. Priced well below replacement cost at just $129 per square foot, the investment offers strong cash-flow and future appreciation potential.

This Family Dollar location demonstrates strong tenant performance and long-term commitment. Family Dollar relocated from a successful 6,800-square-foot site up the street in Union City to this existing location, a newly improved 11,868-square-foot facility, nearly doubling its size and volume. The tenant invested substantial capital in renovations and new HVAC systems in 2022, underscoring its confidence in the location. The lease has 7 years remaining on the initial 10-year term, with 3 (5 Year) renewal options, allowing for up to 22 years of total tenancy remaining.

The trade area offers an ideal demographic profile for Family Dollar’s core customer, with over 20,000 residents within a ten-mile radius and household incomes of over 76,000. The store receives more than 200,000 annual visits according to Placer.ai and is one of only three Family Dollar locations within a 20-mile radius, ensuring minimal competition and continued tenant success in a stable Midwestern market.

Faris Lee Investments is pleased to present the opportunity to acquire a single-tenant Family Dollar, strategically positioned at the signalized hard corner of Chestnut and Columbia Streets, at the busiest intersection in Union City. The property enjoys outstanding visibility, two monument signs, and access from both major retail corridors (Highways 32 and 28). Family Dollar benefits from strong national tenant synergy with McDonald’s, O’Reilly Auto Parts, Subway, and NAPA Auto Parts within the immediate trade area, along with its proximity to schools, banks, the U.S. Post Office, and surrounding residential neighborhoods.

The property features a single-tenant NNN lease, an ideal structure for investors seeking secure, passive income. Family Dollar is responsible for the property taxes, insurance, and CAM, offering true ease of ownership. The predictable income stream and corporate tenancy make this an exceptional opportunity for 1031 exchange buyers and investors looking for stable, long-term cash flow with minimal management.

Family Dollar is a nationally recognized discount retailer operating over 8,000 stores across 45 states with annual revenues exceeding $13.3 billion in 2024. For more than six decades, Family Dollar has built a strong reputation as a value-oriented, necessity-based retailer serving millions of loyal customers nationwide. Its proven business model and operational resilience make it one of America’s most dependable retail brands.

Ownership interest includes both the land and the building, providing long-term intrinsic value and significant tax advantages through cost segregation and depreciation. Priced well below replacement cost at just $129 per square foot, the investment offers strong cash-flow and future appreciation potential.

This Family Dollar location demonstrates strong tenant performance and long-term commitment. Family Dollar relocated from a successful 6,800-square-foot site up the street in Union City to this existing location, a newly improved 11,868-square-foot facility, nearly doubling its size and volume. The tenant invested substantial capital in renovations and new HVAC systems in 2022, underscoring its confidence in the location. The lease has 7 years remaining on the initial 10-year term, with 3 (5 Year) renewal options, allowing for up to 22 years of total tenancy remaining.

The trade area offers an ideal demographic profile for Family Dollar’s core customer, with over 20,000 residents within a ten-mile radius and household incomes of over 76,000. The store receives more than 200,000 annual visits according to Placer.ai and is one of only three Family Dollar locations within a 20-mile radius, ensuring minimal competition and continued tenant success in a stable Midwestern market.

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

10 393 m²

Classe d’immeuble

C

Année de construction/rénovation

1999/2022

Prix

1 299 084 €

Prix par m²

125,00 €

Taux de capitalisation

7 %

RNE

90 929 €

Occupation

Mono

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

1,78

Surface du lot

0,58 ha

Zone de développement économique [USA]

Oui

Zonage

C - Commercial

Stationnement

51 places (4,91 places par 1 000 m² loué)

Façade

1 1

PRINCIPAUX COMMERCES À PROXIMITÉ

TAXES FONCIÈRES

| Numéro de parcelle | 68-02-25-475-018.000-019 | Évaluation des aménagements | 522 613 € (2024) |

| Évaluation du terrain | 20 176 € (2024) | Évaluation totale | 542 789 € (2024) |

TAXES FONCIÈRES

Numéro de parcelle

68-02-25-475-018.000-019

Évaluation du terrain

20 176 € (2024)

Évaluation des aménagements

522 613 € (2024)

Évaluation totale

542 789 € (2024)

1 sur 7

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

Family Dollar/Hard Corner/Next to McDonalds | 106 S Columbia St

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.