Connectez-vous/S’inscrire

Votre e-mail a été envoyé.

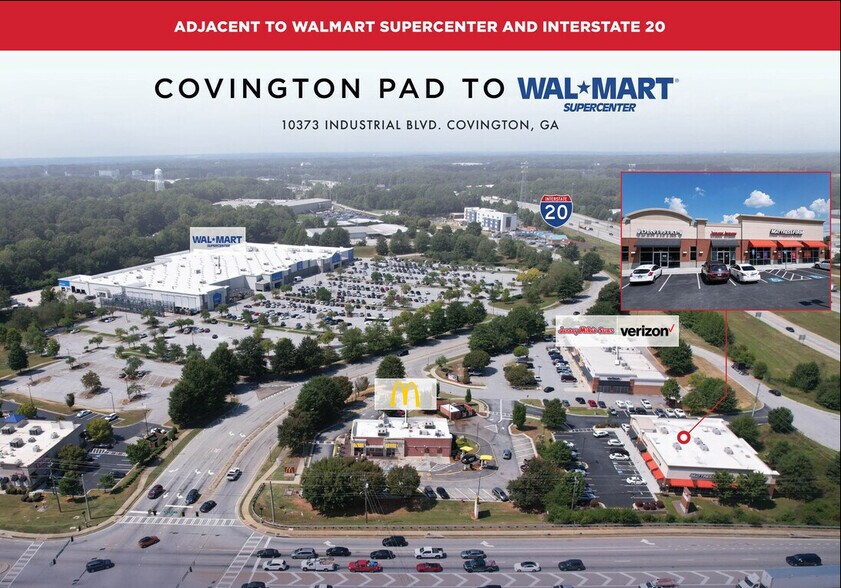

Outparcel Pad to Walmart SuperCenter 10373 Industrial Blvd NE Local commercial 790 m² 100 % Loué À vendre Covington, GA 30014 3 190 628 € (4 040,43 €/m²) Taux de capitalisation 6,30 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- MATTRESS FIRM (NYSE: SGI) | 2,300+ LOCATIONS | NATIONAL BRAND

- STRONG CONSUMER DRAW FROM ADJACENT WALMART SUPERCENTER AND HOME DEPOT

- ORIGINAL TENANTS | RECENT LEASE RENEWALS | 10 YEAR HISTORICAL OCCUPANCY

- 100% LEASED 3 TENANT PAD BUILDING | PART OF THE DOMINANT TRADE CENTER IN AREA

- KNOWN AS “HOLLYWOOD OF THE SOUTH” | HOME TO MAJOR ENTERTAINMENT STUDIOS

- TOP 6 AND 15 PERCENTILE STORE VISITS FOR WALMART AND HOME DEPOT RESPECTIVELY

RÉSUMÉ ANALYTIQUE

6.65% Cap in Sept 2028 | Annual Rent Increases in 2 of 3 leases | 3 Tenant Pad | All Original Tenants Having Recent Lease Renewals

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest (land & building) in a multi-tenant pad building in Covington, GA, a growing suburb 35 miles east of Atlanta. The offering is anchored by Mattress Firm (NYSE:SGI) (2,300+ locations in 49 states). All tenants are original, have occupied the property for 10 years, and have recently renewed their lease. The Property boasts minimal maintenance and expenses obligations with the tenants operating under NNN leases, providing an investor ease of management with the tenants being responsible for taxes, insurance and common area maintenance expenses. More than one-half of the leasable square footage contains annual rent increases while Mattress Firm has their next rent increase in February 2028.

The offering is strategically positioned as an outparcel pad to a successful Walmart Supercenter which per Placer.ai ranks in the top 6 percentile for customer visits of all Walmart stores in Georgia. The drawing power of the Walmart Supercenter combined with visibility and convenient access to Interstate 20 enables the Property to out-position and outperform other multi-tenant properties in the under-supplied Covington retail market. As with most suburbs of Atlanta, Covington is anticipated to continue its strong population growth over the next 10 years. In addition to being home to Cinelease Studios, one of the largest film studios in the country, other major employers include General Mills, Bridgestone Golf, and Bard Medical.

This offering checks all the major boxes for an investor by having long term historical occupancies and a stabilized income stream. The location is strategically positioned to benefit from cross over shopping opportunities created by the adjacent top tier performing Walmart Supercenter while the growing population base will continue to support the tenants and help create appreciating real estate values in the immediate area.

BROKER OF RECORD.... NOVAK & ASSOCIATES, INC....License No. 6506

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest (land & building) in a multi-tenant pad building in Covington, GA, a growing suburb 35 miles east of Atlanta. The offering is anchored by Mattress Firm (NYSE:SGI) (2,300+ locations in 49 states). All tenants are original, have occupied the property for 10 years, and have recently renewed their lease. The Property boasts minimal maintenance and expenses obligations with the tenants operating under NNN leases, providing an investor ease of management with the tenants being responsible for taxes, insurance and common area maintenance expenses. More than one-half of the leasable square footage contains annual rent increases while Mattress Firm has their next rent increase in February 2028.

The offering is strategically positioned as an outparcel pad to a successful Walmart Supercenter which per Placer.ai ranks in the top 6 percentile for customer visits of all Walmart stores in Georgia. The drawing power of the Walmart Supercenter combined with visibility and convenient access to Interstate 20 enables the Property to out-position and outperform other multi-tenant properties in the under-supplied Covington retail market. As with most suburbs of Atlanta, Covington is anticipated to continue its strong population growth over the next 10 years. In addition to being home to Cinelease Studios, one of the largest film studios in the country, other major employers include General Mills, Bridgestone Golf, and Bard Medical.

This offering checks all the major boxes for an investor by having long term historical occupancies and a stabilized income stream. The location is strategically positioned to benefit from cross over shopping opportunities created by the adjacent top tier performing Walmart Supercenter while the growing population base will continue to support the tenants and help create appreciating real estate values in the immediate area.

BROKER OF RECORD.... NOVAK & ASSOCIATES, INC....License No. 6506

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à

| Revenu de location brut | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Revenu brut effectif | |

|---|---|

| Annuel | - |

| Annuel par m² | - |

| Résultat net d’exploitation | |

|---|---|

| Annuel | $99,999 |

| Annuel par m² | $9.99 |

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

790 m²

Classe d’immeuble

B

Année de construction

2014

Prix

3 190 628 €

Prix par m²

4 040,43 €

Taux de capitalisation

6,30 %

RNE

200 980 €

Pourcentage loué

100 %

Occupation

Multi

Hauteur du bâtiment

1 étage

Coefficient d’occupation des sols de l’immeuble

0,21

Surface du lot

0,37 ha

CARACTÉRISTIQUES

- Visibilité de l’autoroute

- Signalisation

- Panneau monumental

1 1

PRINCIPAUX COMMERCES À PROXIMITÉ

TAXES FONCIÈRES

| Numéro de parcelle | C081000000088000 | Évaluation des aménagements | 205 631 € (2024) |

| Évaluation du terrain | 152 946 € (2024) | Évaluation totale | 358 577 € (2024) |

TAXES FONCIÈRES

Numéro de parcelle

C081000000088000

Évaluation du terrain

152 946 € (2024)

Évaluation des aménagements

205 631 € (2024)

Évaluation totale

358 577 € (2024)

1 sur 22

VIDÉOS

VISITE EXTÉRIEURE 3D MATTERPORT

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 sur 1

Présenté par

Outparcel Pad to Walmart SuperCenter | 10373 Industrial Blvd NE

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.