|

Alex King Group |

Certaines informations ont été traduites automatiquement.

| Prix | 22 257 862 € |

| Prix/m² | 11 311 € / m² |

| Condition de vente | Ventes de portefeuille |

| Taux de capitalisation | 6,57 % |

| Type de vente | Investissement triple net |

| Statut | Actif |

| Nb de biens | 4 |

| Individuellement en vente | 0 |

| Surface totale de l’immeuble | 1 968 m² |

| Surface totale du terrain | 2,43 ha |

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

| 645 Old San Carlos Blvd, Fort Myers, FL 33931 | Local commercial | 836 m² | 1980 | - |

|

Snug Harbor

645 Old San Carlos Blvd, Fort Myers Beach, FL 33931 |

Local commercial | 397 m² | 2002 | - |

|

Snug Harbor

441-445 Old San Carlos Blvd, Fort Myers, FL 33931 |

Terrain | 0,23 ha | - | - |

|

Nervous Nellies

1131 1st St, Fort Myers, FL 33931 |

Local commercial | 735 m² | 2003 | - |

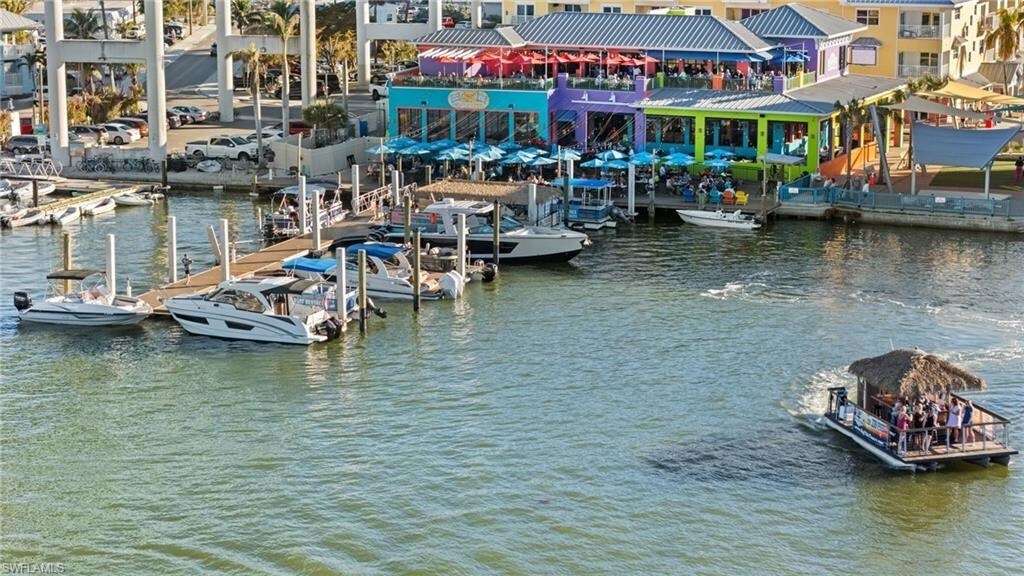

Nervous Nellies outdoor dining and docks

Nervous Nellies outdoor dining and docks

Nervous Nellies outdoor dining and docks

Nervous Nellies outdoor dining and docks

Nervous Nellies outdoor dining and docks

Nervous Nellies outdoor dining and docks

Nervous Nellies bar

Nervous Nellies bar

Nervous Nellies bar

Nervous Nellies bar

Outdoor dining at Nervous Nellies

Outdoor dining at Nervous Nellies

Outdoor dining at Nervous Nellies

Outdoor dining at Nervous Nellies

View of docks at Nervous Nellies

View of docks at Nervous Nellies

Bayside Park outdoor concert venue between Nervous Nellies and Snug Harbor!

Bayside Park outdoor concert venue between Nervous Nellies and Snug Harbor!

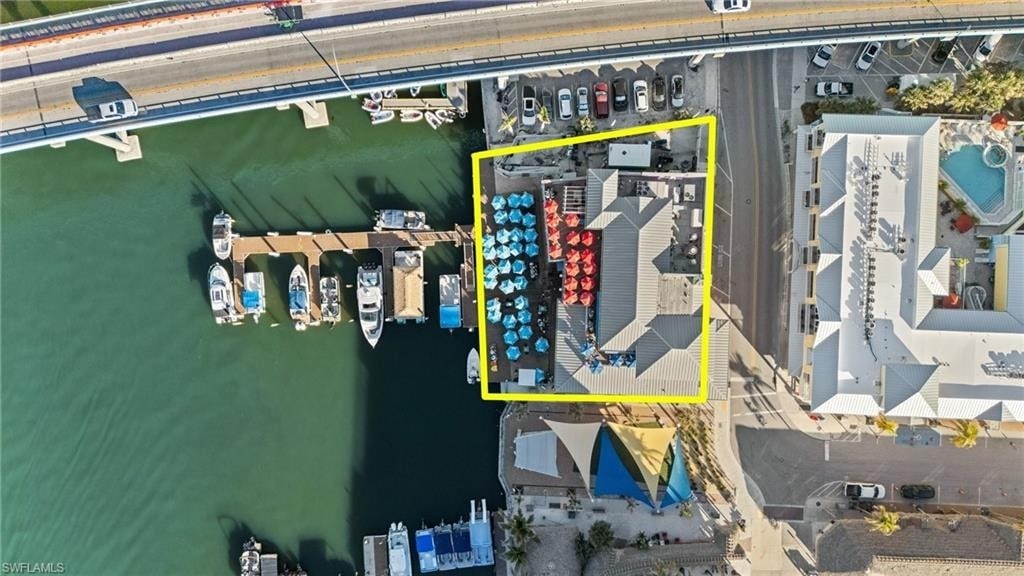

View of Nervous Nellies, Snug Harbor and docks

View of Nervous Nellies, Snug Harbor and docks

645 Old San Carlos Blvd

645 Old San Carlos Blvd

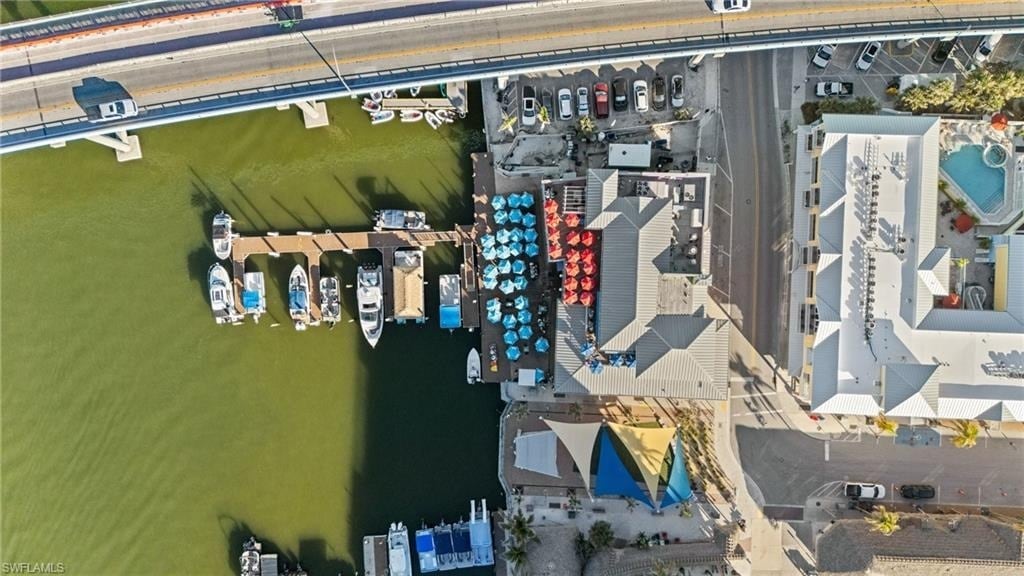

Snug Harbor and docks

Snug Harbor and docks

Tiki entrance to Snug Harbor

Tiki entrance to Snug Harbor

Snug Harbor outdoor dining over the water

Snug Harbor outdoor dining over the water

Snug Harbor inside bar area

Snug Harbor inside bar area

Snug Harbor inside bar area

Snug Harbor inside bar area

View of Snug Harbor outdoor covered dining area

View of Snug Harbor outdoor covered dining area

Snug Harbor outdoor open dining area over water

Snug Harbor outdoor open dining area over water

Snug Harbor waterfront terrace

Snug Harbor waterfront terrace

Snug Harbor dock

Snug Harbor dock

Overhead view of Snug Harbor

Overhead view of Snug Harbor

Entrance to Wahoo Willies

Entrance to Wahoo Willies

Live music at Wahoo Willies!

Live music at Wahoo Willies!

Retail store at Wahoo Willies

Retail store at Wahoo Willies

Wahoo Willies ding area view from sidewalk

Wahoo Willies ding area view from sidewalk

Wahoo Willies dining area

Wahoo Willies dining area

Wahoo Willies dining area

Wahoo Willies dining area

Wahoo Willies bar

Wahoo Willies bar

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

New modern kitchens in all restaurants!

One of the fun and exciting tour boats moored at Old Seaport Place!

One of the fun and exciting tour boats moored at Old Seaport Place!

View of dock featuring a water view

View of dock featuring a water view

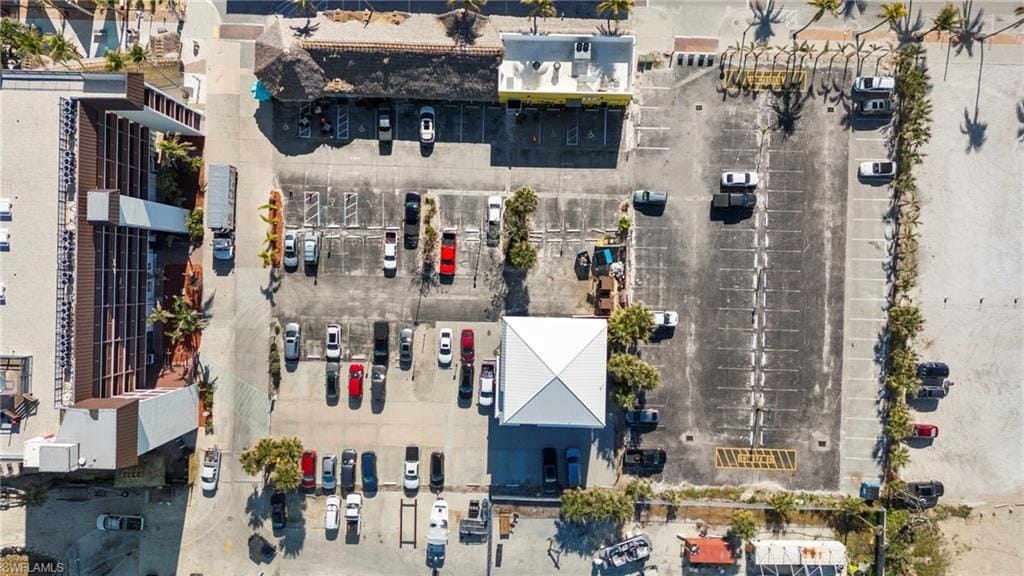

122 Space parking lot

122 Space parking lot

122 Space parking lot

122 Space parking lot

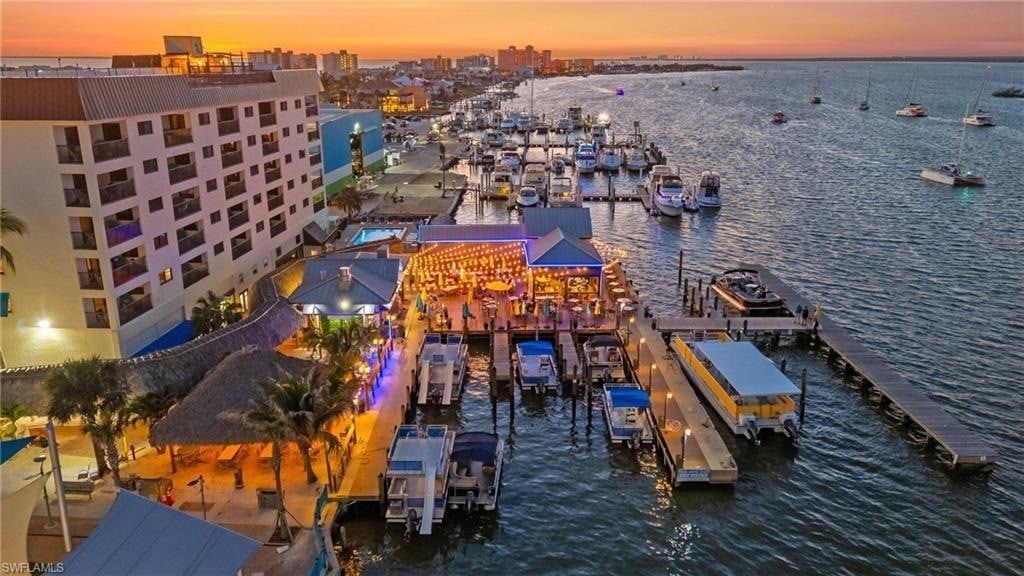

Snug Harbor docks

Snug Harbor docks

Nervous Nellies docks!

Nervous Nellies docks!

Front of parking lot and access to restaurants

Front of parking lot and access to restaurants

Rear of parking lot.

Rear of parking lot.

Location of 3-950+ sq. ft. ground floor units

Location of 3-950+ sq. ft. ground floor units

Location of Nervous Nellies

Location of Nervous Nellies

Docks at Snug Harbor

Docks at Snug Harbor

Docks at Snug Harbor

Docks at Snug Harbor

Nighttime view of Nervous Nellies

Nighttime view of Nervous Nellies

Le service LoopNet et les informations qu’il contient, bien que réputés exacts, sont fournis « en l’état ». LoopNet décline toute responsabilité, garantie expresse ou implicite de quelque nature que ce soit.