|

|

Certaines informations ont été traduites automatiquement.

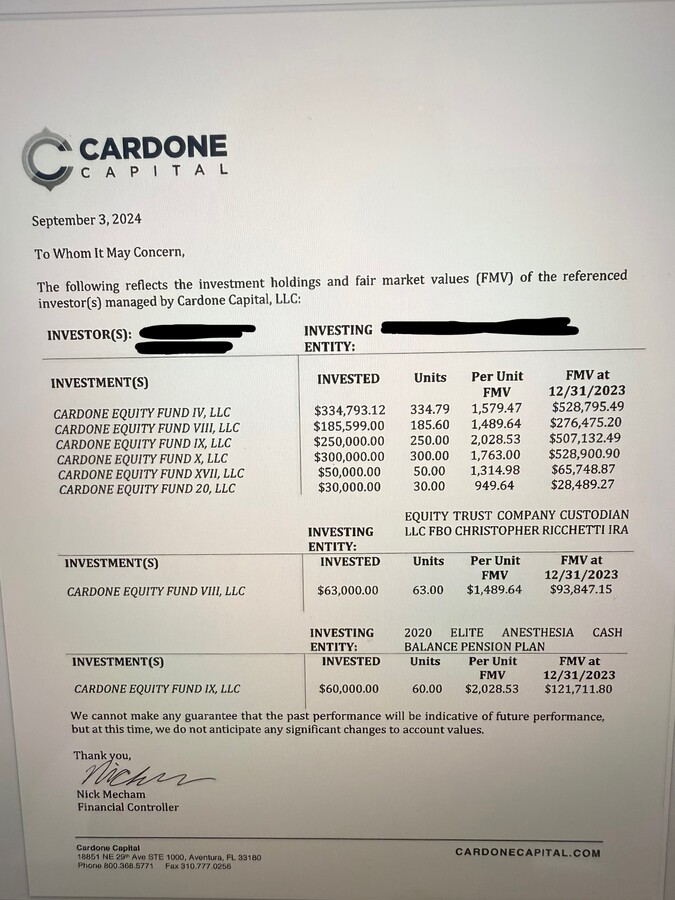

| Prix | 1 246 977 € |

| Prix/m² | 5,14 € / m² |

| Condition de vente | Ventes de portefeuille |

| Type de vente | Investissement |

| Statut | Actif |

| Nb de biens | 6 |

| Individuellement en vente | 0 |

| Surface totale de l’immeuble | 242 475 m² |

| Surface totale du terrain | 36,74 ha |

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

|

10X Retreat at PCB

90 Sandal Ln, Panama City Beach, FL 32413 |

Immeuble residentiel | 35 043 m² | 2008 | - |

|

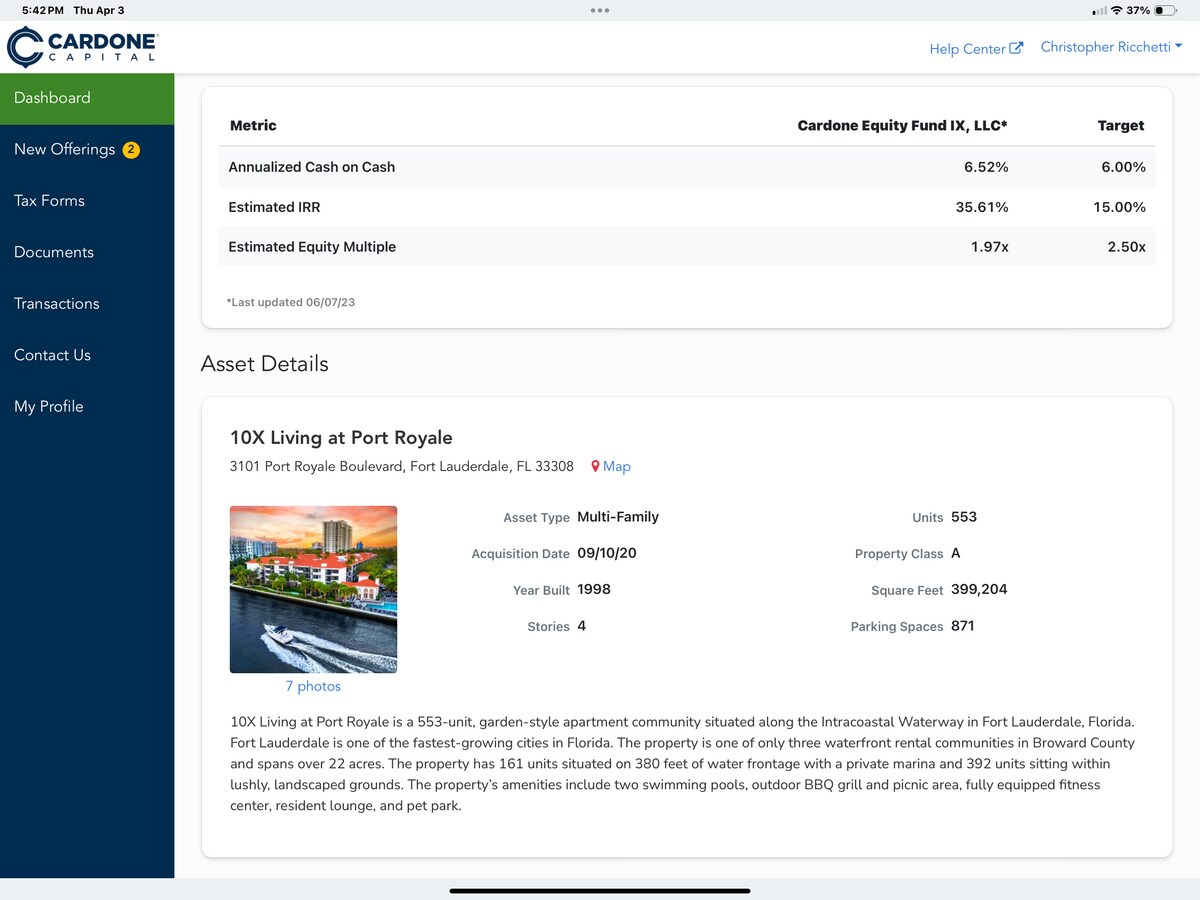

10x Port Royale

3101 Port Royale Blvd, Fort Lauderdale, FL 33308 |

Immeuble residentiel | 54 749 m² | 1988 | - |

|

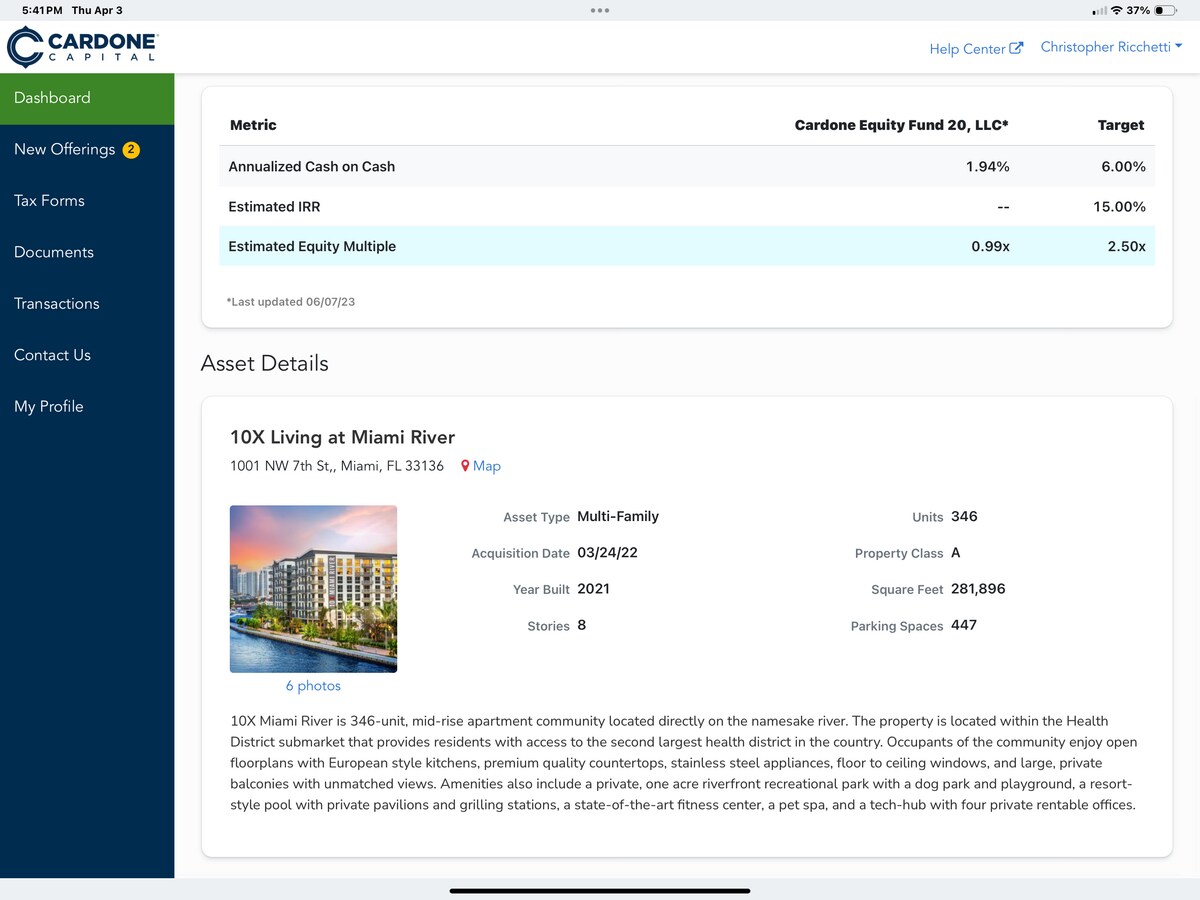

10X Miami River

1001 NW 7th St, Miami, FL 33136 |

Immeuble residentiel | 18 581 m² | 2020 | - |

|

10x Breakfast Point

9700 Panama City Beach Pky, Panama City Beach, FL 32407 |

Immeuble residentiel | 59 658 m² | 2007 | - |

|

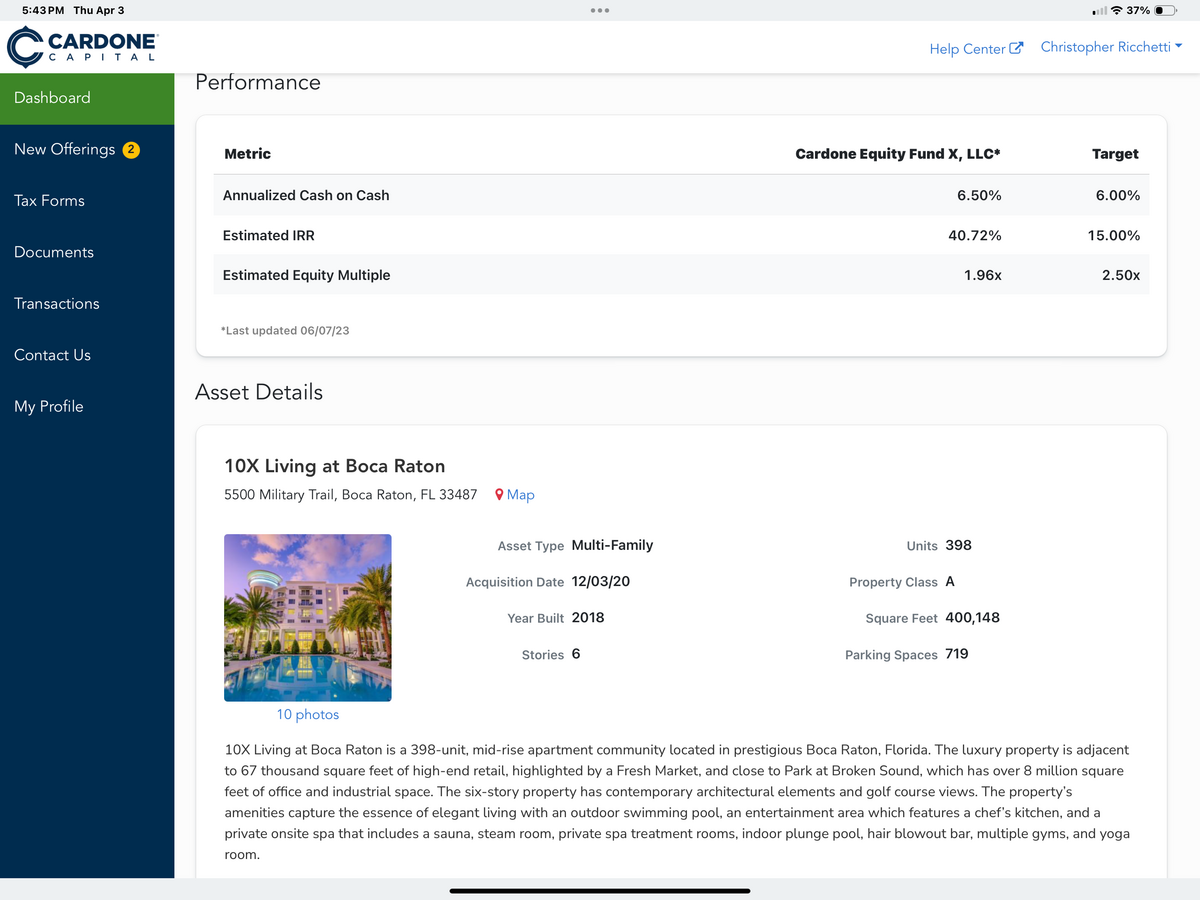

10X Boca

5500 N Military Trl, Boca Raton, FL 33496 |

Immeuble residentiel | 45 645 m² | 2017 | - |

|

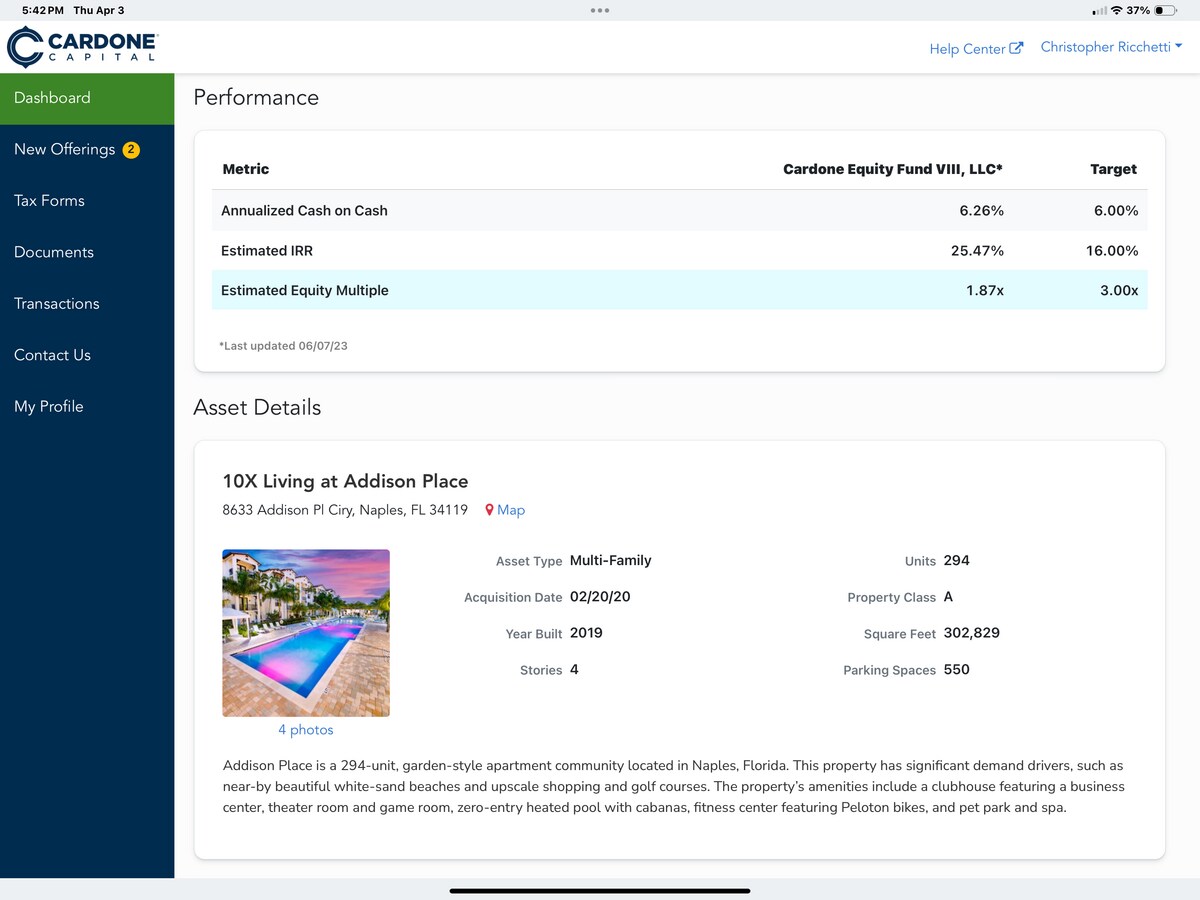

10X Addison Place

8633 Addison Place Cir, Naples, FL 34119 |

Immeuble residentiel | 28 800 m² | 2018 | - |

IMG_5790

IMG_5790

IMG_5789

IMG_5789

IMG_5788

IMG_5788

IMG_5787

IMG_5787

IMG_5786

IMG_5786

1001 NW 7th St

1001 NW 7th St

9700 Panama City Beach Pky

9700 Panama City Beach Pky

3101 Port Royale Blvd

3101 Port Royale Blvd

8633 Addison Place Cir

8633 Addison Place Cir

90 Sandal Ln

90 Sandal Ln

5500 N Military Trl

5500 N Military Trl

Le service LoopNet et les informations qu’il contient, bien que réputés exacts, sont fournis « en l’état ». LoopNet décline toute responsabilité, garantie expresse ou implicite de quelque nature que ce soit.