Cardone Capital - Fractional Share Sale

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

Cardone Capital - Fractional Share Sale Portefeuille de immeuble residentiel à vendre 6 biens 1 217 974 € Localisations multiples

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- this portfolio has 8 funds and 18 class A multifamily properties. fractional share distributions. Seller is selling his equity shares.

- THE INVESTOR WILL BE RECEIVING ALL OF THEIR CAPITAL BACK PLUS AN ADDITIONAL ONE AND A HALF TIMES WITHIN 3 YEARS!

- fund has thrown off already $350k to current owner via monthly distribution

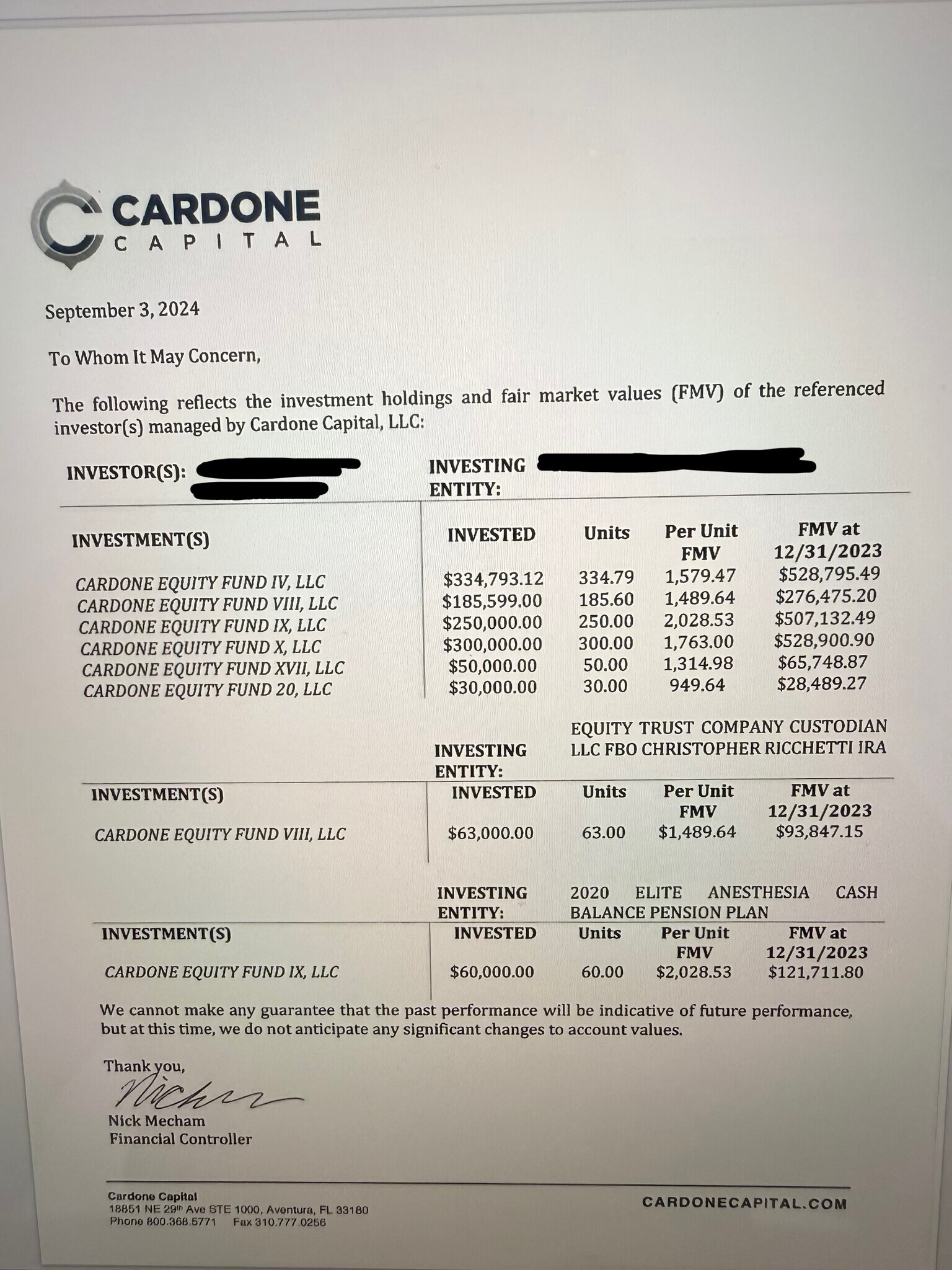

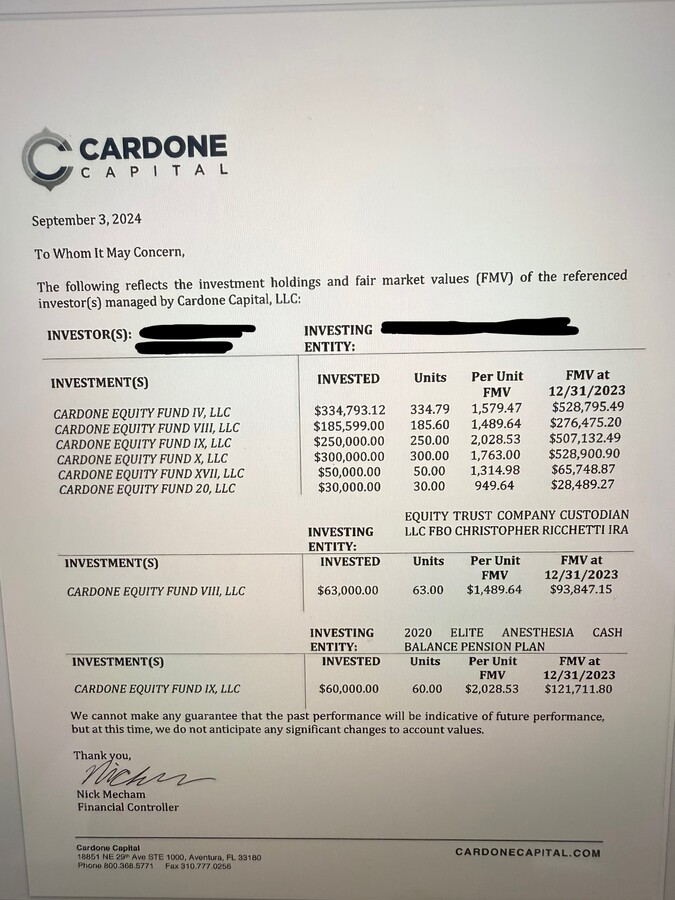

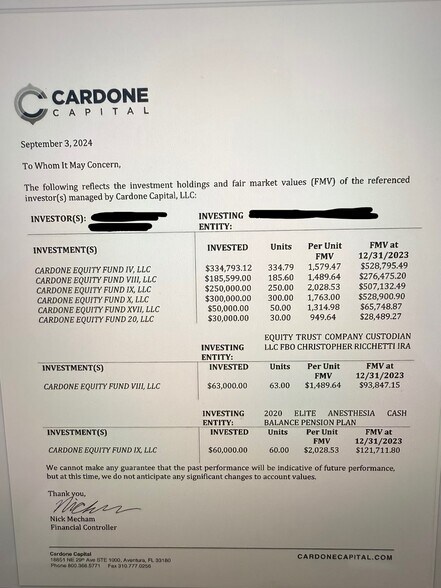

- The Seller is selling for a life event and is willing to walk away from the FMV upside to make a deal See attached FMV report.

- average price value of the portfolio of $2.3 million. Which is an Appreciation from the initial investment of $1,273,000. You get that appreciation

RÉSUMÉ ANALYTIQUE

this portfolio has 8 funds and 18 class A multifamily properties. fractional share distributions. All funds throw-off different amounts and they all have different cap rates. Please reach out for more details. We are selling our equity shares. Take advantage of an already proven and secure investment.

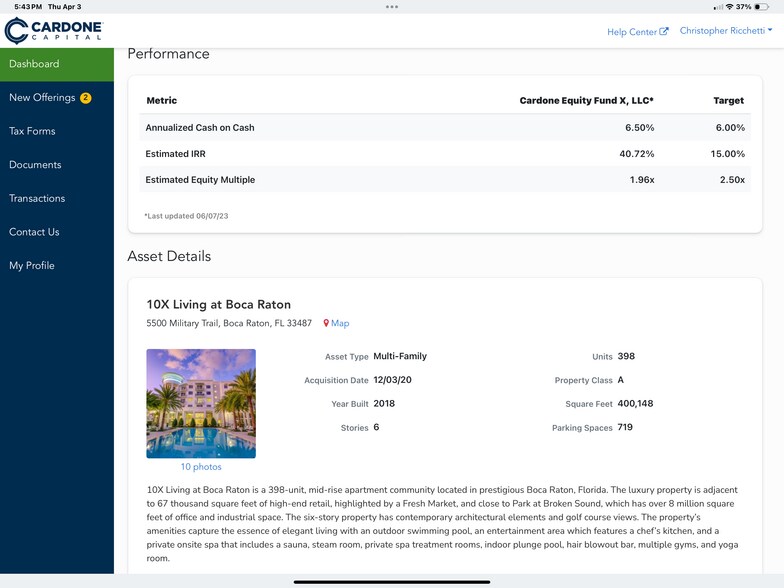

Cardone Equity Fund 20 was opened to accredited investors who seek to capitalize on strategic, undervalued, and/or value-add multifamily properties. In December 2021 the fund purchased the 10X Living at Miami River apartment community and raised $38.8M of equity. The fund co-invested in the property with Cardone REIT I.call for information on the rest of the properties and see attached photos with summaries. The big deal here is the monies have been invested on average 6-7 years ago before the boom and the latest FMV is attached. The Seller is selling for a life event and is willing to walk away from the FMV upside to make a deal. Call for more details. Here is a note from the owner of the funds.

— All investments in the funds that are owned have a target multiple of 2.5 or greater.

— Cardone Capital has a potential up to a 10 year Hold on each individual fund With the sweet spot of usually a 7-8 year sale possible.

— 94%, which is roughly $1.2 million the portfolio Has an acquisition date that is in or past that half point of the 10 year target hold. That means 94% or $1.2 million is at or past that five year mark already.

— Seller has received over $350,000 in distributions in the portfolio so far.

— You get paid every 15th of the month and not once was one payment ever late or missed not even during Covid.

— Here are 2 scenarios for the near future of Cardone Capital portfolio.

— Scenario A, If you simply go off the 7 to 8 year model Of which more than 94% or $1.2 million of my portfolio falls into a 1 to 3 year remaining time frame for a sale. When you take into Cardone Capitals Target Multiple of 2.5X This means that an individual acquiring my portfolio would receive a gross sum of

3,000,000 dollars Upon the sale of these properties.

$3,000,000 — $1,200,000 ( Return of investment) = $ 1,800,000 dollars PROFIT

THE INVESTOR WILL BE RECEIVING ALL OF THEIR CAPITAL BACK PLUS AN ADDITIONAL ONE AND A HALF TIMES WITHIN 3 YEARS!

— Scenario B, If you simply take the longer of the 9 to 10 year model 94% Or $1.2 million of my Cardone Capital portfolio still falls under that model of 9-10 years Because acquisition of those funds started back in 2019. Using the same target multiple of 2 1/2 times The individual investor would receive the gross amount of

$300,000,000 Dollars upon the sale of these Funds.

Same $3,000,000 — $1,200,000 (return of investment) = $1,800,000 dollars profit

Within a 4-5 year time frame.

The investor is getting the benefit of the five years plus that I have held Cardone Capital.

— As you know, I received two fair market value letters over the last few years with the main average price value of the portfolio of $2.3 million. Which is an Appreciation from the initial investment of $1,273,000.

— Cardone Capital also informed me that they’re looking to take their real estate empire public within the next 1-2 years. They informed me that when they will go, public shares would be able to be sold at whichever price they were set at if an individual wanted to liquidate out of Cardone Capital.

Cardone Equity Fund 20 was opened to accredited investors who seek to capitalize on strategic, undervalued, and/or value-add multifamily properties. In December 2021 the fund purchased the 10X Living at Miami River apartment community and raised $38.8M of equity. The fund co-invested in the property with Cardone REIT I.call for information on the rest of the properties and see attached photos with summaries. The big deal here is the monies have been invested on average 6-7 years ago before the boom and the latest FMV is attached. The Seller is selling for a life event and is willing to walk away from the FMV upside to make a deal. Call for more details. Here is a note from the owner of the funds.

— All investments in the funds that are owned have a target multiple of 2.5 or greater.

— Cardone Capital has a potential up to a 10 year Hold on each individual fund With the sweet spot of usually a 7-8 year sale possible.

— 94%, which is roughly $1.2 million the portfolio Has an acquisition date that is in or past that half point of the 10 year target hold. That means 94% or $1.2 million is at or past that five year mark already.

— Seller has received over $350,000 in distributions in the portfolio so far.

— You get paid every 15th of the month and not once was one payment ever late or missed not even during Covid.

— Here are 2 scenarios for the near future of Cardone Capital portfolio.

— Scenario A, If you simply go off the 7 to 8 year model Of which more than 94% or $1.2 million of my portfolio falls into a 1 to 3 year remaining time frame for a sale. When you take into Cardone Capitals Target Multiple of 2.5X This means that an individual acquiring my portfolio would receive a gross sum of

3,000,000 dollars Upon the sale of these properties.

$3,000,000 — $1,200,000 ( Return of investment) = $ 1,800,000 dollars PROFIT

THE INVESTOR WILL BE RECEIVING ALL OF THEIR CAPITAL BACK PLUS AN ADDITIONAL ONE AND A HALF TIMES WITHIN 3 YEARS!

— Scenario B, If you simply take the longer of the 9 to 10 year model 94% Or $1.2 million of my Cardone Capital portfolio still falls under that model of 9-10 years Because acquisition of those funds started back in 2019. Using the same target multiple of 2 1/2 times The individual investor would receive the gross amount of

$300,000,000 Dollars upon the sale of these Funds.

Same $3,000,000 — $1,200,000 (return of investment) = $1,800,000 dollars profit

Within a 4-5 year time frame.

The investor is getting the benefit of the five years plus that I have held Cardone Capital.

— As you know, I received two fair market value letters over the last few years with the main average price value of the portfolio of $2.3 million. Which is an Appreciation from the initial investment of $1,273,000.

— Cardone Capital also informed me that they’re looking to take their real estate empire public within the next 1-2 years. They informed me that when they will go, public shares would be able to be sold at whichever price they were set at if an individual wanted to liquidate out of Cardone Capital.

INFORMATIONS SUR L’IMMEUBLE

| Prix | 1 217 974 € | Nb de biens | 6 |

| Prix/m² | 5,02 € / m² | Individuellement en vente | 0 |

| Condition de vente | Ventes de portefeuille | Surface totale de l’immeuble | 242 475 m² |

| Type de vente | Investissement | Surface totale du terrain | 36,74 ha |

| Statut | Actif |

| Prix | 1 217 974 € |

| Prix/m² | 5,02 € / m² |

| Condition de vente | Ventes de portefeuille |

| Type de vente | Investissement |

| Statut | Actif |

| Nb de biens | 6 |

| Individuellement en vente | 0 |

| Surface totale de l’immeuble | 242 475 m² |

| Surface totale du terrain | 36,74 ha |

Biens

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

|

10x Breakfast Point

9700 Panama City Beach Pky, Panama City Beach, FL 32407 |

Immeuble residentiel | 59 658 m² | 2007 | - |

|

10x Port Royale

3101 Port Royale Blvd, Fort Lauderdale, FL 33308 |

Immeuble residentiel | 54 749 m² | 1988 | - |

|

10X Retreat at PCB

90 Sandal Ln, Panama City Beach, FL 32413 |

Immeuble residentiel | 35 043 m² | 2008 | - |

|

10X Boca

5500 N Military Trl, Boca Raton, FL 33496 |

Immeuble residentiel | 45 645 m² | 2017 | - |

|

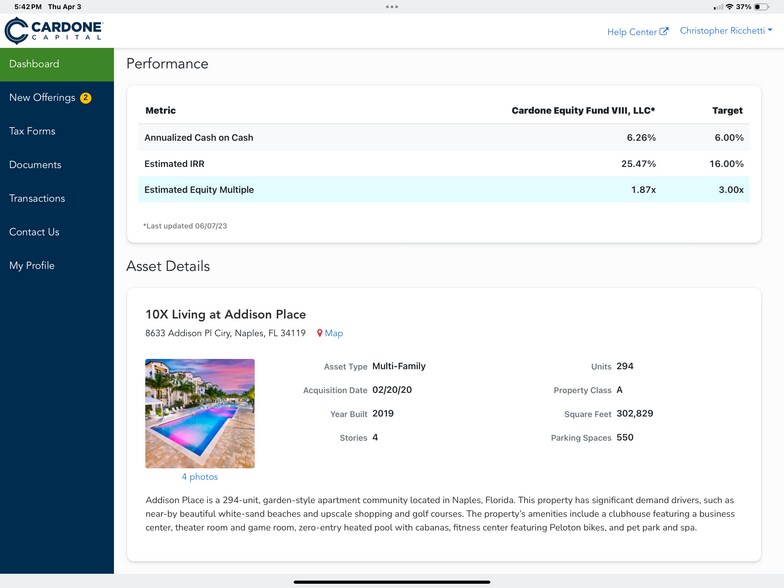

10X Addison Place

8633 Addison Place Cir, Naples, FL 34119 |

Immeuble residentiel | 28 800 m² | 2018 | - |

|

10X Miami River

1001 NW 7th St, Miami, FL 33136 |

Immeuble residentiel | 18 581 m² | 2020 | - |

1 of 1

1 de 13

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

Cardone Capital - Fractional Share Sale

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.