Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

35-Yr Ground Lease | Generational Leased Fee 5783 Manatee Ave W Terrain 0,35 ha À vendre 1 341 215 € Bradenton, FL 34209

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Bradenton FL drive-thru asset with 35 years remaining on lease agreement

- Rare Leased Fee Interest in fully-leased Bradenton drive-thru asset anchored by top-performing Starbucks

- Bradenton FL— fast-growing market in the Tampa MSA with $111K avg. income (1-mi)

- Absolute NNN ‘Ground Lease’ with zero landlord duties

- Favorable rent bumps every 5 years—lesser of 15% or CPI—with next increase set by June 2025 CPI

- The leased fee rent is 30% of the total collected rent from the leasehold improvements highlighting a compelling value gap

RÉSUMÉ ANALYTIQUE

Faris Lee Investments is pleased to present the rare opportunity to acquire a long-term leased fee interest in a premier Starbucks-anchored, multi-tenant asset located in Bradenton, Florida—a high-growth market within the Tampa–Sarasota–North Port MSA. The leased fee interest is backed by a 35-year absolute NNN ground lease, with annual rent scheduled to increase to approximately $62,000 in July 2025. The lease also features rental escalations every five years based on the lesser of 15% or the cumulative increase in CPI, providing built-in income growth and inflation protection.

The leasehold improvements comprise a 6,752-square-foot, drive-thru-equipped multi-tenant retail building anchored by a top-performing Starbucks. The leasehold currently generates $205,000 in annual rental income, placing the leased fee rent at just 30% of total collected rent. This significant rent spread highlights a compelling value gap and signals long-term upside potential as the ground lease progresses toward maturity.

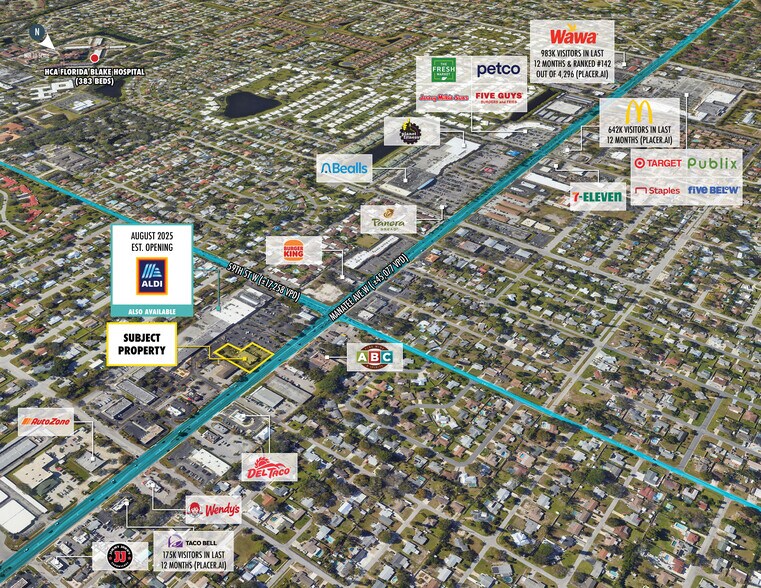

Strategically situated as an outparcel to a 120,000 SF shopping center anchored by a forthcoming 48,000 SF ALDI. The property sits at the intersection of Manatee Avenue West (FL-64, 45,000 VPD) and 59th Street West (17,258 VPD), with direct access and visibility from Manatee Avenue West that is the main artery through Bradenton, FL. The trade area is supported by major retailers including: Publix, Target, Planet Fitness, and Bealls. Bradenton continues to demonstrate dynamic growth, ranking 4th in U-Haul’s 2023 report of one-way moving destinations and 2nd in the U.S. for net population growth in 2021. With no state income tax, a dense trade area (148,000+ residents within five miles), and a household income exceeding $111,000 within a 1-mile radius, the area offers a compelling demographic profile.

This offering represents an extraordinary opportunity to acquire a long-term leased fee asset with generational-value located in a high-growth Florida market with zero management responsibility, and significant long-term value creation.

BILAN FINANCIER (RÉEL - 2025) |

ANNUEL | ANNUEL PAR ha |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

53 649 €

|

152 377,68 €

|

BILAN FINANCIER (RÉEL - 2025)

| Revenu de location brut | |

|---|---|

| Annuel | - |

| Annuel par ha | - |

| Autres revenus | |

|---|---|

| Annuel | - |

| Annuel par ha | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Annuel par ha | - |

| Revenu brut effectif | |

|---|---|

| Annuel | - |

| Annuel par ha | - |

| Résultat net d’exploitation | |

|---|---|

| Annuel | 53 649 € |

| Annuel par ha | 152 377,68 € |

INFORMATIONS SUR L’IMMEUBLE

1 LOT DISPONIBLE

Lot

| Prix | 1 341 215 € | Surface du lot | 0,35 ha |

| Prix par ha | 3 809 441,89 € |

| Prix | 1 341 215 € |

| Prix par ha | 3 809 441,89 € |

| Surface du lot | 0,35 ha |

DESCRIPTION

Faris Lee Investments is pleased to present the rare opportunity to acquire a long-term leased fee interest in a premier Starbucks-anchored, multi-tenant asset located in Bradenton, Florida—a high-growth market within the Tampa–Sarasota–North Port MSA. The leased fee interest is backed by a 35-year absolute NNN ground lease, with annual rent scheduled to increase to approximately $62,000 in July 2025. The lease also features rental escalations every five years based on the lesser of 15% or the cumulative increase in CPI, providing built-in income growth and inflation protection. The leasehold improvements comprise a 6,752-square-foot, drive-thru-equipped multi-tenant retail building anchored by a top-performing Starbucks. The leasehold currently generates $205,000 in annual rental income, placing the leased fee rent at just 30% of total collected rent. This significant rent spread highlights a compelling value gap and signals long-term upside potential as the ground lease progresses toward maturity. Strategically situated as an outparcel to a 120,000 SF shopping center anchored by a forthcoming 48,000 SF ALDI. The property sits at the intersection of Manatee Avenue West (FL-64, 45,000 VPD) and 59th Street West (17,258 VPD), with direct access and visibility from Manatee Avenue West that is the main artery through Bradenton, FL. The trade area is supported by major retailers including: Publix, Target, Planet Fitness, and Bealls. Bradenton continues to demonstrate dynamic growth, ranking 4th in U-Haul’s 2023 report of one-way moving destinations and 2nd in the U.S. for net population growth in 2021. With no state income tax, a dense trade area (148,000+ residents within five miles), and a household income exceeding $111,000 within a 1-mile radius, the area offers a compelling demographic profile. This offering represents an extraordinary opportunity to acquire a long-term leased fee asset with generational-value located in a high-growth Florida market with zero management responsibility, and significant long-term value creation.

TAXES FONCIÈRES

| Numéro de parcelle | 38016-1055-9 | Évaluation des aménagements | 493 363 € (2024) |

| Évaluation du terrain | 407 447 € (2024) | Évaluation totale | 900 810 € (2024) |

TAXES FONCIÈRES

Présenté par

35-Yr Ground Lease | Generational Leased Fee | 5783 Manatee Ave W

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.