TCU Student Rental Properties

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

merci

Votre e-mail a été envoyé !

TCU Student Rental Properties Portefeuille de immeuble residentiel à vendre 2 biens 6 223 424 € Localisations multiples

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- Grandfathered in TCU Overlay

- TCU Student body increasing

- Close to TCU Campus

RÉSUMÉ ANALYTIQUE

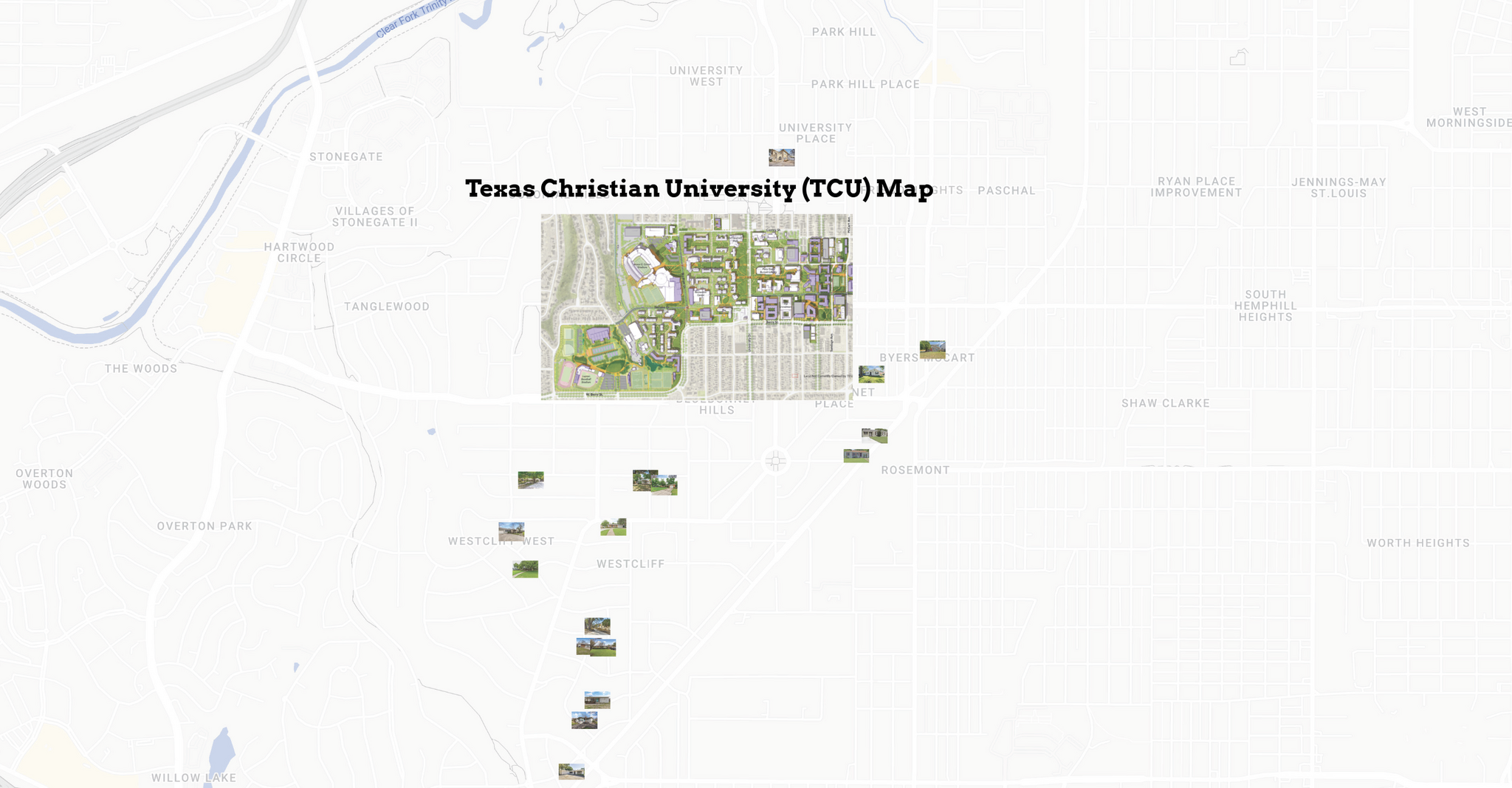

TCU Student Housing Portfolio Fort Worth, TX 76109

An exceptional opportunity to acquire a stabilized and strategically positioned student housing portfolio consisting of 12 single-family residential (SFR) assets in the highly sought-after 76109 zip code, adjacent to Texas Christian University (TCU). This submarket has demonstrated robust fundamentals, including a 92% increase in rental rates since 2021 and a 235% increase in price per square foot over the past decade.

Several properties within the portfolio have undergone significant capital improvements, including major HVAC and plumbing upgrades—reducing near-term CapEx exposure. Two of the twelve homes sit on oversized lots (avg. 0.25 acres) and are well-positioned for potential redevelopment or density optimization under current zoning allowances.

Notably, these assets are grandfathered within the TCU Overlay District, a designation that permits leasing to more than three unrelated tenants per home a rarity in this submarket. Only 283 properties remain with this allowance. With average rent currently at approximately $1,000 per bed, this translates to up to 17 additional tenants across the portfolio compared to standard single-family rentals, driving enhanced income potential.

Operational efficiency has improved markedly, with a significant decline in maintenance requests since 2021. Seven of the twelve properties are pre leased for the 2025 to 2026 academic year, ensuring immediate continuity of cash flow. Additionally, two homes are duplex-style on a Multi Family Zone B lot, each capable of housing five tenants per side.

Ownership is distributed across four investor entities (1–4 properties per entity). The properties are treated as individual assets for accounting purposes, but the portfolio is being offered collectively. The seller, who also serves as the listing representative, has curated a comprehensive digital due diligence package (available via Google Drive) for immediate review.

Key Highlights:

12 SFR assets in high demand TCU market

92% rent growth since 2021

235% increase in PSF over 10 years

Grandfathered allows more than 3 unrelated tenants per home

$1,000 bed rental rate average with additional 17 beds vs. standard SFRs

Major CapEx items (HVAC, plumbing) completed on multiple properties

7 of 12 homes pre leased for the 2025 to 2026 academic year

Two lots suited for redevelopment or increased density

Buyer Representative commission is available for consideration

Investment Considerations:

Rare entitlement advantage in a constrained housing submarket

Strong historical appreciation and rental demand

Operational stability with declining maintenance burden

Seller facilitated due diligence process for efficient evaluation

An exceptional opportunity to acquire a stabilized and strategically positioned student housing portfolio consisting of 12 single-family residential (SFR) assets in the highly sought-after 76109 zip code, adjacent to Texas Christian University (TCU). This submarket has demonstrated robust fundamentals, including a 92% increase in rental rates since 2021 and a 235% increase in price per square foot over the past decade.

Several properties within the portfolio have undergone significant capital improvements, including major HVAC and plumbing upgrades—reducing near-term CapEx exposure. Two of the twelve homes sit on oversized lots (avg. 0.25 acres) and are well-positioned for potential redevelopment or density optimization under current zoning allowances.

Notably, these assets are grandfathered within the TCU Overlay District, a designation that permits leasing to more than three unrelated tenants per home a rarity in this submarket. Only 283 properties remain with this allowance. With average rent currently at approximately $1,000 per bed, this translates to up to 17 additional tenants across the portfolio compared to standard single-family rentals, driving enhanced income potential.

Operational efficiency has improved markedly, with a significant decline in maintenance requests since 2021. Seven of the twelve properties are pre leased for the 2025 to 2026 academic year, ensuring immediate continuity of cash flow. Additionally, two homes are duplex-style on a Multi Family Zone B lot, each capable of housing five tenants per side.

Ownership is distributed across four investor entities (1–4 properties per entity). The properties are treated as individual assets for accounting purposes, but the portfolio is being offered collectively. The seller, who also serves as the listing representative, has curated a comprehensive digital due diligence package (available via Google Drive) for immediate review.

Key Highlights:

12 SFR assets in high demand TCU market

92% rent growth since 2021

235% increase in PSF over 10 years

Grandfathered allows more than 3 unrelated tenants per home

$1,000 bed rental rate average with additional 17 beds vs. standard SFRs

Major CapEx items (HVAC, plumbing) completed on multiple properties

7 of 12 homes pre leased for the 2025 to 2026 academic year

Two lots suited for redevelopment or increased density

Buyer Representative commission is available for consideration

Investment Considerations:

Rare entitlement advantage in a constrained housing submarket

Strong historical appreciation and rental demand

Operational stability with declining maintenance burden

Seller facilitated due diligence process for efficient evaluation

TAXES ET FRAIS D’EXPLOITATION (RÉEL - 2024) |

ANNUEL |

|---|---|

| Revenu de location brut |

537 275 €

|

| Autres revenus |

-

|

| Perte due à la vacance |

-

|

| Revenu brut effectif |

537 275 €

|

| Résultat net d’exploitation |

-

|

TAXES ET FRAIS D’EXPLOITATION (RÉEL - 2024)

| Revenu de location brut | |

|---|---|

| Annuel | 537 275 € |

| Autres revenus | |

|---|---|

| Annuel | - |

| Perte due à la vacance | |

|---|---|

| Annuel | - |

| Revenu brut effectif | |

|---|---|

| Annuel | 537 275 € |

| Résultat net d’exploitation | |

|---|---|

| Annuel | - |

INFORMATIONS SUR L’IMMEUBLE

| Prix | 6 223 424 € | Statut | Actif |

| Prix/m² | 9 955 € / m² | Nb de biens | 2 |

| Condition de vente | Ventes de portefeuille | Individuellement en vente | 1 |

| Taux de capitalisation | 6,41 % | Surface totale de l’immeuble | 625 m² |

| Type de vente | Investissement ou propriétaire occupant |

| Prix | 6 223 424 € |

| Prix/m² | 9 955 € / m² |

| Condition de vente | Ventes de portefeuille |

| Taux de capitalisation | 6,41 % |

| Type de vente | Investissement ou propriétaire occupant |

| Statut | Actif |

| Nb de biens | 2 |

| Individuellement en vente | 1 |

| Surface totale de l’immeuble | 625 m² |

Biens

| NOM DU BIEN/ADRESSE | TYPE DE BIEN | SURFACE | ANNÉE DE CONSTRUCTION | PRIX INDIVIDUEL |

|---|---|---|---|---|

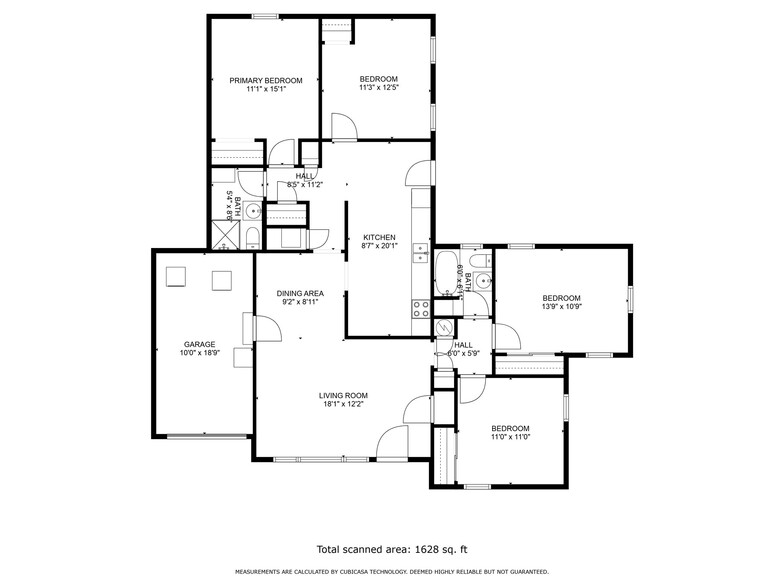

| 3201 Forest Park Blvd, Fort Worth, TX 76110 | Immeuble residentiel | 348 m² | 2016 | 6 223 424 € |

| 2701 S University Dr, Fort Worth, TX 76109 | Immeuble residentiel | 277 m² | 1927 | - |

1 of 1

1 de 19

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

TCU Student Rental Properties

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.