CSL Plasma | Long Term NNN Lease 1971 Government St Local commercial 1 892 m² À vendre Mobile, AL 36606 2 254 225 € (1 191,47 €/m²) Taux de capitalisation 7 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

- CSL Plasma, a strong investment-grade tenant and subsidiary of $14.8B global biotech leader CSL, operates 350+ locations with 17,000+ employees.

- Triple net lease with CSL Plasma offers ease of management, tenant-covered expenses, and is ideal for passive investors and 1031 exchanges.

- Multi-tenant retail investment offers tax benefits through depreciation and cost segregation. Adjacent to 14,000-students University of South Alabama

- Long-term lease with over 9 years remaining and two 5-year renewal options offers up to 19 years of stable, secure income.

- Lease includes 10% rent increases every 5 years, offering growing income, increased cash flow, and inflation protection.

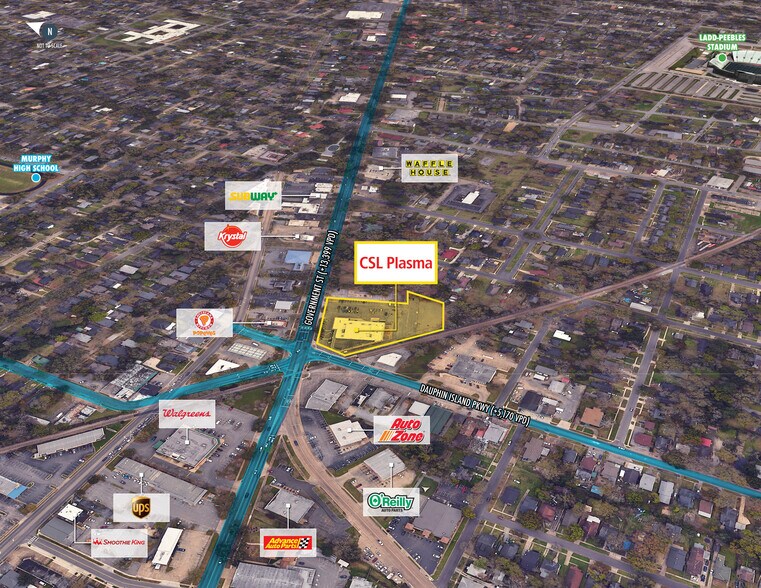

- Centrally located in Mobile, AL MSA, the site serves Southwest Alabama and Southeast Mississippi, with 112,000+ residents and 48,000+ household nearby

RÉSUMÉ ANALYTIQUE

ALABAMA BROKER OF RECORD.... SPENCER AKIN....License No. 000083270-0

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest in

a 2-Tenant retail building anchored by CSL Plasma. Located in the heart of Mobile, Alabama,

this investment offers stable cash flow, minimal landlord responsibilities, and strong real estate

fundamentals in a central, high-traffic location.

The property is anchored by CSL Plasma, a wholly owned subsidiary of CSL—a global biotechnology

leader with annual revenues exceeding $14.8 billion as of 2024. CSL Plasma is one of the world’s

largest collectors of human plasma, operating over 350 locations across the U.S. and Europe

with a workforce of more than 17,000 employees. As a mission-driven enterprise specializing in

life-saving therapies for immune diseases, vaccines, and iron deficiencies, CSL represents a highcredit,

investment-grade tenant ideal for long-term ownership.

CSL Plasma signed a 15-year lease commencing in 2019, with the current term running through

December 2034. The lease includes two (2), five (5)-year renewal options, offering up to 19 years

of total potential lease term. With 10% rental increases every five years, the lease structure

ensures a growing income stream, acts as a hedge against inflation, and supports long-term

value appreciation.

CSL Plamsa is structured as a Triple Net (NNN) lease, with the tenant responsible for property

taxes, liability insurance, and common area maintenance expenses including landscaping and

parking lot. The minimal landlord obligations make this asset ideal for passive investors or those

seeking a 1031 exchange.

The asset also presents strong tax advantages through enhanced property depreciation and

cost segregation analysis, further bolstering investment returns. As a multi-tenant retail asset,

it delivers additional flexibility and long-term utility.

Strategically located at 1971 Government Street, the property lies adjacent to the University

of South Alabama, the Gulf Coast’s flagship university with 14,000+ students and 5,500+

employees supporting two hospitals and a cancer research center. This prime location is central

to the Mobile MSA, which serves a broad trade area extending into Southwest Alabama and

Southeast Mississippi.

Mobile is the fourth-largest municipality in Alabama, home to the state’s only saltwater port and

a key logistics hub. The immediate area boasts 112,000+ residents and over 48,000 households

within a 5-mile radius, ensuring continued demand and relevance for CSL’s services in the local

and regional economy.

Faris Lee Investments is pleased to present the opportunity to acquire the fee simple interest in

a 2-Tenant retail building anchored by CSL Plasma. Located in the heart of Mobile, Alabama,

this investment offers stable cash flow, minimal landlord responsibilities, and strong real estate

fundamentals in a central, high-traffic location.

The property is anchored by CSL Plasma, a wholly owned subsidiary of CSL—a global biotechnology

leader with annual revenues exceeding $14.8 billion as of 2024. CSL Plasma is one of the world’s

largest collectors of human plasma, operating over 350 locations across the U.S. and Europe

with a workforce of more than 17,000 employees. As a mission-driven enterprise specializing in

life-saving therapies for immune diseases, vaccines, and iron deficiencies, CSL represents a highcredit,

investment-grade tenant ideal for long-term ownership.

CSL Plasma signed a 15-year lease commencing in 2019, with the current term running through

December 2034. The lease includes two (2), five (5)-year renewal options, offering up to 19 years

of total potential lease term. With 10% rental increases every five years, the lease structure

ensures a growing income stream, acts as a hedge against inflation, and supports long-term

value appreciation.

CSL Plamsa is structured as a Triple Net (NNN) lease, with the tenant responsible for property

taxes, liability insurance, and common area maintenance expenses including landscaping and

parking lot. The minimal landlord obligations make this asset ideal for passive investors or those

seeking a 1031 exchange.

The asset also presents strong tax advantages through enhanced property depreciation and

cost segregation analysis, further bolstering investment returns. As a multi-tenant retail asset,

it delivers additional flexibility and long-term utility.

Strategically located at 1971 Government Street, the property lies adjacent to the University

of South Alabama, the Gulf Coast’s flagship university with 14,000+ students and 5,500+

employees supporting two hospitals and a cancer research center. This prime location is central

to the Mobile MSA, which serves a broad trade area extending into Southwest Alabama and

Southeast Mississippi.

Mobile is the fourth-largest municipality in Alabama, home to the state’s only saltwater port and

a key logistics hub. The immediate area boasts 112,000+ residents and over 48,000 households

within a 5-mile radius, ensuring continued demand and relevance for CSL’s services in the local

and regional economy.

BILAN FINANCIER (RÉEL - 2025) Cliquez ici pour accéder à |

ANNUEL | ANNUEL PAR m² |

|---|---|---|

| Revenu de location brut |

-

|

-

|

| Autres revenus |

-

|

-

|

| Perte due à la vacance |

-

|

-

|

| Revenu brut effectif |

-

|

-

|

| Résultat net d’exploitation |

$99,999

|

$9.99

|

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

1 892 m²

Classe d’immeuble

B

Année de construction/rénovation

1992/2019

Prix

2 254 225 €

Prix par m²

1 191,47 €

Taux de capitalisation

7 %

RNE

157 808 €

Occupation

Mono

Hauteur de l’immeuble

1 Étage

Coefficient d’occupation des sols de l’immeuble

0,19

Surface du lot

1,01 ha

Stationnement

70 Espaces (37 places par 1 000 m² loué)

Façade

80 m le Government St

CARACTÉRISTIQUES

- Ligne d’autobus

- Intersection avec signalisation

- Service au volant

1 of 2

Walk Score®

Très praticable à pied (77)

PRINCIPAUX COMMERCES À PROXIMITÉ

TAXES FONCIÈRES

| N° de parcelle | Évaluation des aménagements | 322 889 € (2024) | |

| Évaluation du terrain | 67 898 € (2024) | Évaluation totale | 390 787 € (2024) |