Alamitos Plaza Infill Long Beach Strip Center | 1002-1012 Alamitos Ave

Cette fonctionnalité n’est pas disponible pour le moment.

Nous sommes désolés, mais la fonctionnalité à laquelle vous essayez d’accéder n’est pas disponible actuellement. Nous sommes au courant du problème et notre équipe travaille activement pour le résoudre.

Veuillez vérifier de nouveau dans quelques minutes. Veuillez nous excuser pour ce désagrément.

– L’équipe LoopNet

Votre e-mail a été envoyé.

Alamitos Plaza Infill Long Beach Strip Center 1002-1012 Alamitos Ave Local commercial 492 m² 100 % Loué À vendre Long Beach, CA 90813 1 687 335 € (3 426,85 €/m²) Taux de capitalisation 6,88 %

Certaines informations ont été traduites automatiquement.

INFORMATIONS PRINCIPALES SUR L'INVESTISSEMENT

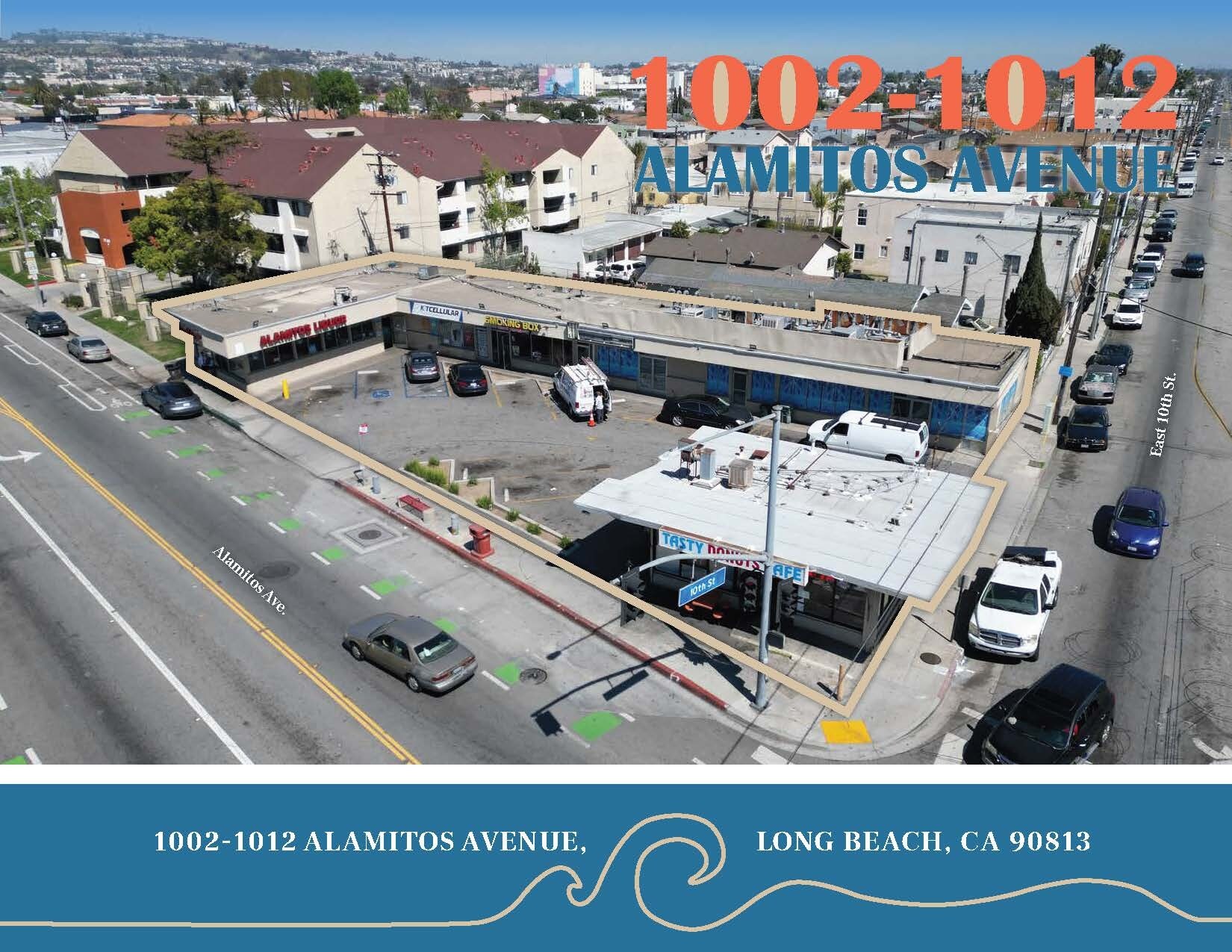

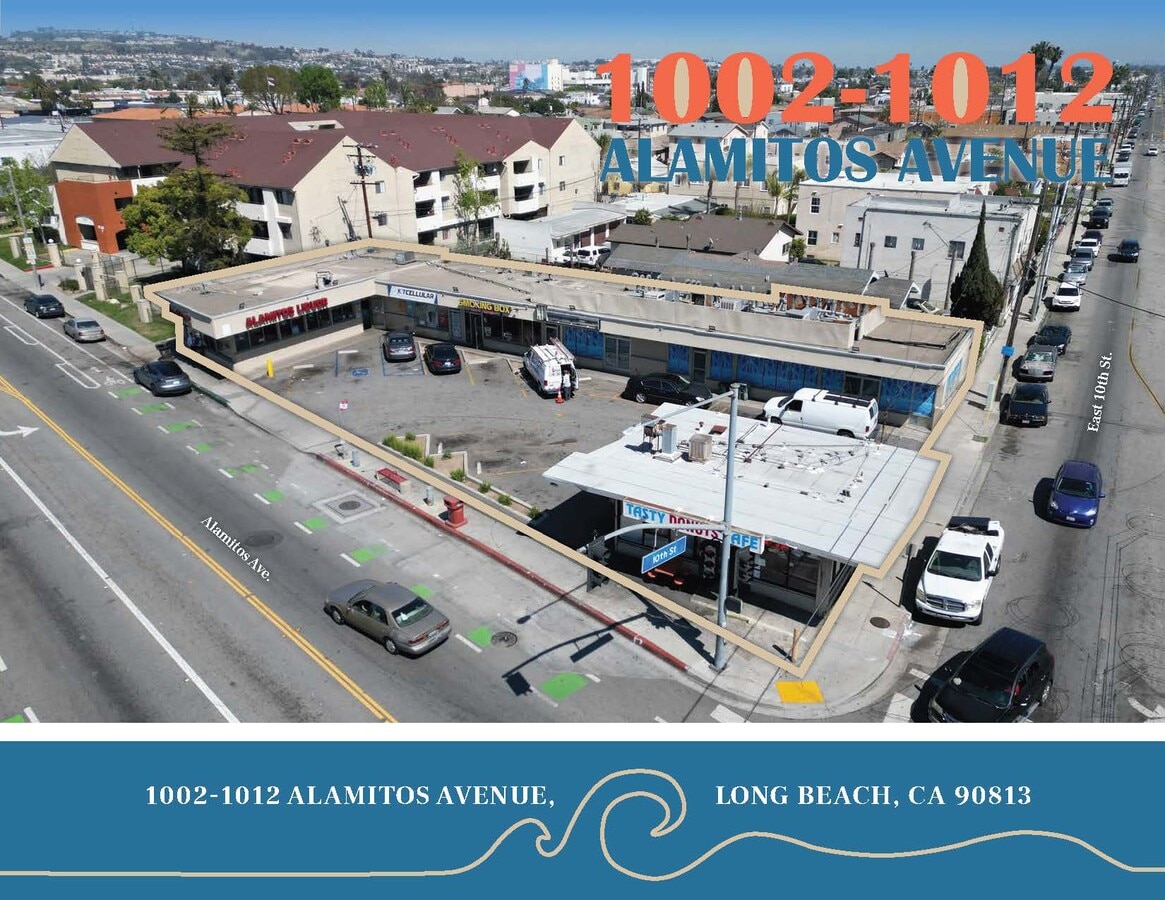

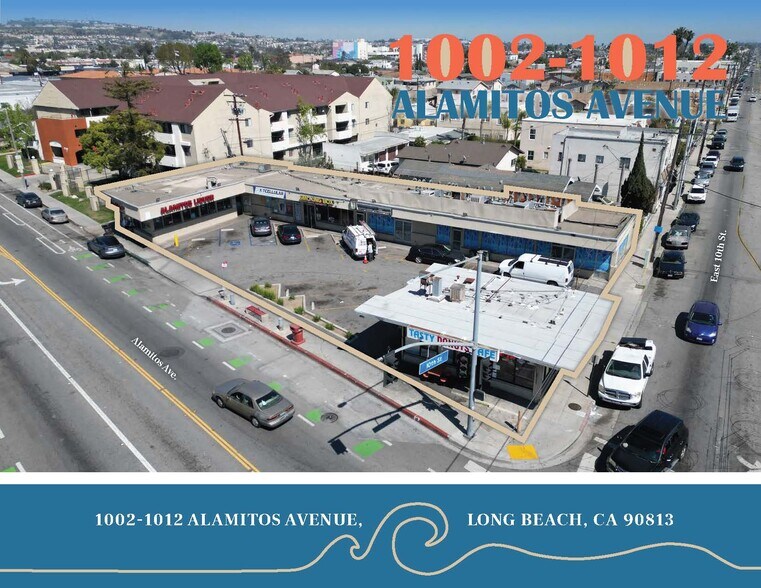

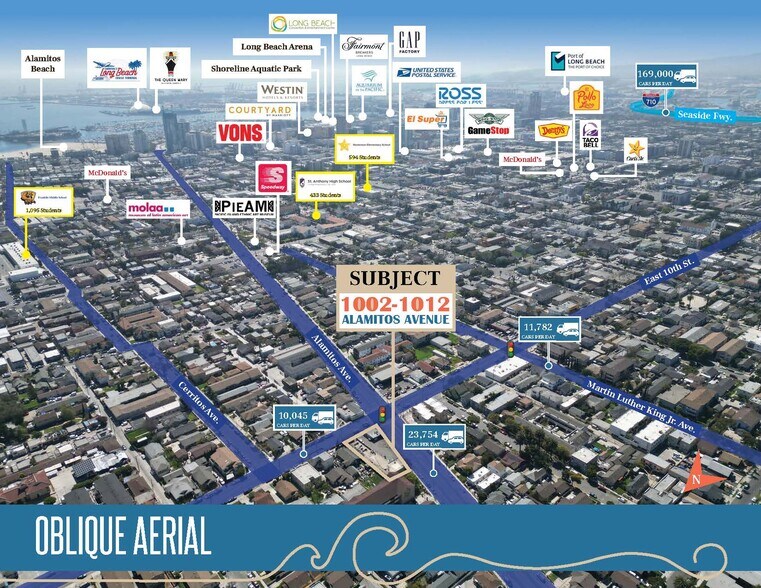

- Infill Long Beach strip center at a signalized hard corner with 27,000 VPD and strong street-front visibility.

- 6.88% CAP rate with upside to 7.02% by 2027, backed by steady in-place cash flow.

- Daily needs tenant mix with strong occupancy, healthy rent levels, and efficient CAM recovery.

- Ideal entry-point for private investors with attractive pricing and manageable building size.

- NNN leases with 4-year WALT and 3% annual bumps on most leases provide built-in rent growth.

- 416K+ residents within 5 miles; $107K avg. income and $239K+ annual retail spend per household.

RÉSUMÉ ANALYTIQUE

The Ovaness-Rostamian Group of Marcus & Millichap is pleased to present the opportunity to acquire a well-located infill retail center in the heart of Long Beach, California. Strategically positioned at a signalized hard corner with visibility to over 27,000 vehicles per day, the property offers excellent frontage, strong accessibility, and consistent foot and vehicular traffic.

The asset is anchored by a complementary mix of daily needs tenants, providing a reliable income stream with a favorable rent and CAM ratio. In-place rents average $2.45/SF/Month, reflecting healthy and sustainable levels that are considered easily replaceable in today's leasing environment. Additionally, most leases feature annual rent increases, ensuring built-in income growth over the hold period. With a weighted average lease term (WALT) of four years, investors benefit from immediate cash flow at 6.88% going-in cap rate, with upside to a 7.02% cap rate by 2027. through modest rent growth and tenant rollover.

Located in a dense, mature trade area, the center is supported by over 416,000 residents within a five-mile radius and boasts an average household income of $107,210. Additionally, average household retail expenditure within this radius reaches $239,585 annually, highlighting strong consumer spending and demand for essential retail services.

This offering presents an exceptional opportunity for private investors to acquire a stable, cash-flowing retail asset in a supply-constrained coastal submarket with long-term growth potential.

The asset is anchored by a complementary mix of daily needs tenants, providing a reliable income stream with a favorable rent and CAM ratio. In-place rents average $2.45/SF/Month, reflecting healthy and sustainable levels that are considered easily replaceable in today's leasing environment. Additionally, most leases feature annual rent increases, ensuring built-in income growth over the hold period. With a weighted average lease term (WALT) of four years, investors benefit from immediate cash flow at 6.88% going-in cap rate, with upside to a 7.02% cap rate by 2027. through modest rent growth and tenant rollover.

Located in a dense, mature trade area, the center is supported by over 416,000 residents within a five-mile radius and boasts an average household income of $107,210. Additionally, average household retail expenditure within this radius reaches $239,585 annually, highlighting strong consumer spending and demand for essential retail services.

This offering presents an exceptional opportunity for private investors to acquire a stable, cash-flowing retail asset in a supply-constrained coastal submarket with long-term growth potential.

INFORMATIONS SUR L’IMMEUBLE

Type de vente

Investissement

Condition de vente

1031 Exchange

Type de bien

Local commercial

Sous-type de bien

Surface de l’immeuble

492 m²

Classe d’immeuble

C

Année de construction/rénovation

1958/2007

Prix

1 687 335 €

Prix par m²

3 426,85 €

Taux de capitalisation

6,88 %

RNE

116 042 €

Pourcentage loué

100 %

Occupation

Multi

Hauteur de l’immeuble

1 Étage

Coefficient d’occupation des sols de l’immeuble

0,45

Surface du lot

0,11 ha

Zone de développement économique [USA]

Oui

Zonage

C - Commercial

Stationnement

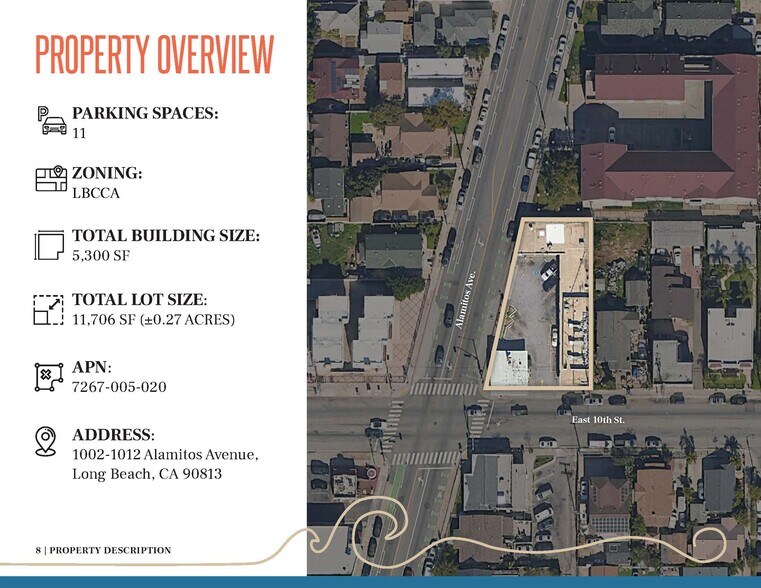

11 Espaces (22,34 places par 1 000 m² loué)

Façade

56 m le Alamitos Ave.

1 of 1

Walk Score®

Idéal pour les promeneurs (92)

Bike Score®

Très praticable en vélo (82)

PRINCIPAUX COMMERCES À PROXIMITÉ

TAXES FONCIÈRES

| Numéro de parcelle | 7267-005-020 | Évaluation des aménagements | 801 005 € |

| Évaluation du terrain | 833 250 € | Évaluation totale | 1 634 255 € |

TAXES FONCIÈRES

Numéro de parcelle

7267-005-020

Évaluation du terrain

833 250 €

Évaluation des aménagements

801 005 €

Évaluation totale

1 634 255 €

1 de 7

VIDÉOS

VISITE 3D

PHOTOS

STREET VIEW

RUE

CARTE

1 of 1

Présenté par

Alamitos Plaza Infill Long Beach Strip Center | 1002-1012 Alamitos Ave

Vous êtes déjà membre ? Connectez-vous

Hum, une erreur s’est produite lors de l’envoi de votre message. Veuillez réessayer.

Merci ! Votre message a été envoyé.